Tech shares have a protracted status for offering constant and vital beneficial properties over the long run, confirmed by the Nasdaq-100 Know-how Sector’s 395% rise over the past 10 years.

The business’s ever-expanding nature is pushed by dependable demand for upgrades to varied {hardware} and software program merchandise. So, it is unsurprising that investing mogul Warren Buffett’s holdings firm, Berkshire Hathaway, has devoted greater than 40% of its portfolio to tech shares. In the meantime, Berkshire’s holdings posted a compound annual achieve of almost 20% between 1965 and 2023.

In consequence, it might be price following swimsuit and making a large long-term funding within the high-growth sector. So, listed below are three shares to take a position $30,000 in proper now — $10,000 for every.

1. Superior Micro Units

Superior Micro Units (NASDAQ: AMD) enterprise has exploded over the past decade, taking over a number one position within the chip market.

A decade in the past, the corporate was on the point of chapter, bleeding cash alongside mounting debt. Then, in 2014, Lisa Su grew to become AMD’s CEO, triggering some of the spectacular turnarounds within the tech market’s historical past.

The launch of its Ryzen line of central processing models (CPUs) in 2017 has been a serious development catalyst, with AMD’s CPU market share rising from 18% within the first quarter of 2017 to 33% in 2024. The corporate has progressively chipped away Intel‘s share, which fell from 82% to 64% in the identical interval.

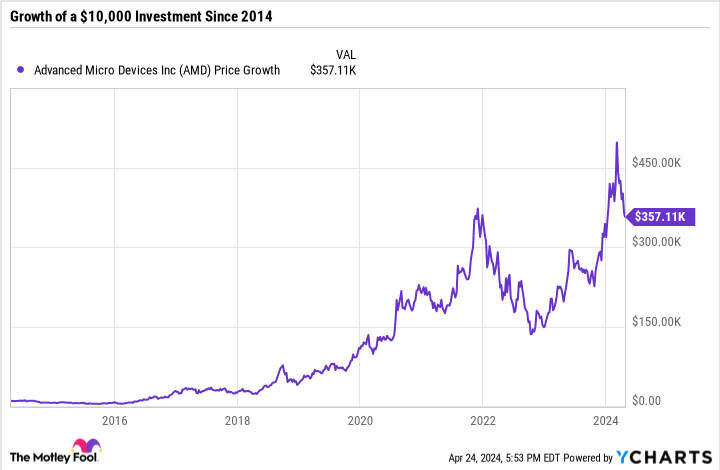

Shares in AMD have soared 3,500% over the past 10 years. In consequence, an funding of $10,000 in AMD’s inventory in 2014 could be price greater than $357 billion immediately.

In fact, previous development would not at all times point out what’s to return. Nonetheless, the corporate has an thrilling outlook that would ship main beneficial properties over the following 10 years. AMD is investing closely in synthetic intelligence (AI), launching new AI graphics processing models (GPUs) this 12 months and investing in AI private computer systems.

The AI market hit almost $200 billion final 12 months and is projected to achieve almost $2 trillion by 2030. Alongside positions in different areas of tech, equivalent to cloud computing, video video games, and client PCs, AMD will possible proceed benefiting from the tailwinds of tech for years.

Consequently, an funding of $10,000 in AMD’s inventory over the following decade might ship vital beneficial properties.

2. Amazon

It is not possible to disclaim Amazon‘s (NASDAQ: AMZN) potent position in tech. Because of its widespread e-commerce web site, the corporate has constructed up immense model loyalty worldwide. Amazon’s retail web site is on the market in over 20 international locations and ships to greater than 100 nations.

The success of Amazon’s e-commerce enterprise has seen annual income climb 546% since 2014, with working revenue skyrocketing by greater than 20,000%.

Amazon’s meteoric rise is primarily owed to its profitable Prime membership. Its subscription-based mannequin bundles a number of providers, together with free expedited transport on its retail web site, video streaming, music, gaming, and extra. Together with a number of providers makes customers much less more likely to unsubscribe, resulting in a worldwide subscriber depend above 230 million.

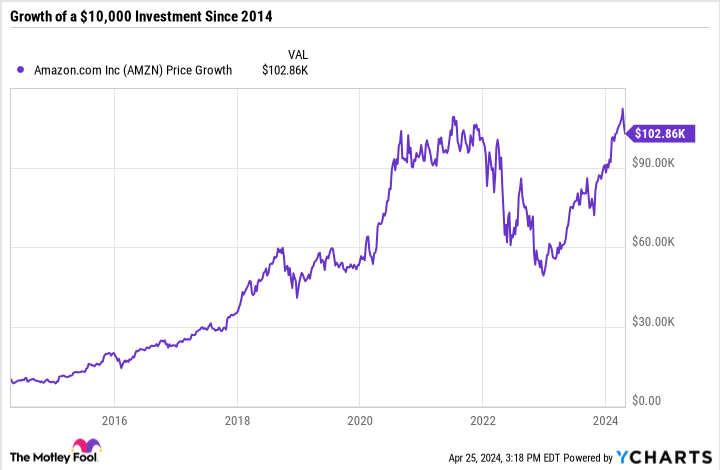

Shares in Amazon have risen 926% since 2014, which means an funding of $10,000 again then could be price over $102,000 immediately. And the corporate might probably beat that development over the following 10 years.

Along with constant retail development, Amazon is quickly increasing in AI and cloud computing. On April 25, the corporate introduced plans to take a position $11 billion to construct information facilities in Indiana to develop Amazon Net Companies (AWS).

The corporate is on a promising development path, and when you’ve got the means, it might be price an funding of $10,000 this month. Nonetheless, a smaller funding continues to be price contemplating.

3. Apple

Apple (NASDAQ: AAPL) is well some of the profitable corporations in tech historical past. Its market cap of $2.6 billion makes it the world’s second-most-valuable firm (solely after Microsoft). In the meantime, Apple’s huge and constant person base has allowed it to realize main market shares in a number of product classes.

Nonetheless, the corporate has stumbled over the past 12 months. Macroeconomic headwinds led to repeated quarters of income declines in 2023. Apple’s Q1 2024 appeared to interrupt the streak, with income rising 2% 12 months over 12 months.

In the meantime, the tech big’s free money stream hit $107 billion, considerably greater than Microsoft, Amazon, or Alphabet. The appreciable distinction might counsel Apple is greatest outfitted to maintain investing in its enterprise and are available again sturdy within the coming years.

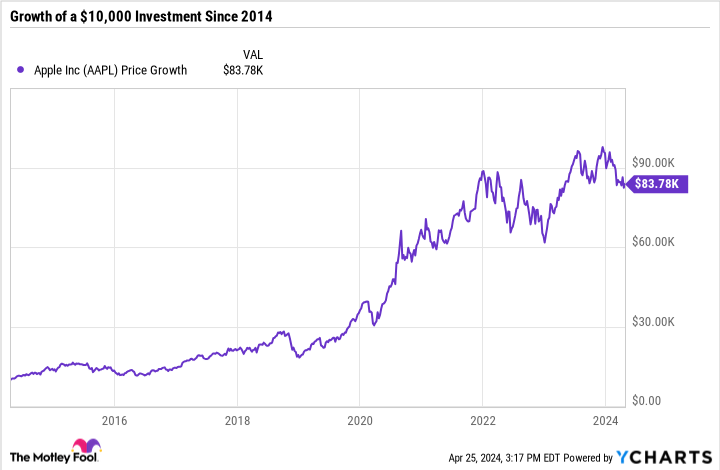

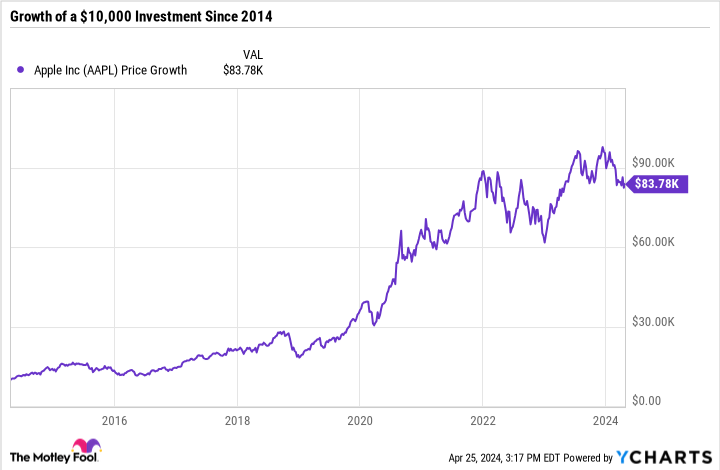

Apple’s inventory has elevated by 738% over the past decade. Consequently, a $10,000 funding in its shares 10 years in the past could be price almost $84,000 immediately.

Furthermore, like AMD and Amazon, Apple is taking over AI head-on. Over the past 12 months, the corporate has progressively added AI-driven options throughout its product vary, with plans to overtake its MacBook lineup to concentrate on AI. The corporate additionally just lately acquired French AI firm Datakalab, which makes a speciality of on-device processing.

Apple’s dominating position in tech and thrilling outlook might make it price investing $10,000 in its inventory, with plans to carry for a minimum of a decade.

Must you make investments $1,000 in Superior Micro Units proper now?

Before you purchase inventory in Superior Micro Units, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Superior Micro Units wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $537,557!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 22, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, and Microsoft. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, brief January 2026 $405 calls on Microsoft, and brief Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

3 Shares to Make investments $30,000 in Proper Now was initially revealed by The Motley Idiot