The tech-heavy Nasdaq 100’s (NDX) sturdy begin to the 12 months (up 21% year-to-date) has been led by the AI tech excessive flyers. Except you’re overconcentrated within the main semiconductor companies, although, your portfolio might be falling effectively shy of the Nasdaq 100. Certainly, it’s robust to beat the market. In any case, there’s no must chase semiconductor shares after a euphoric surge — not whereas there are Sturdy-Purchase-rated, modestly-priced software program shares which have the means to warmth up.

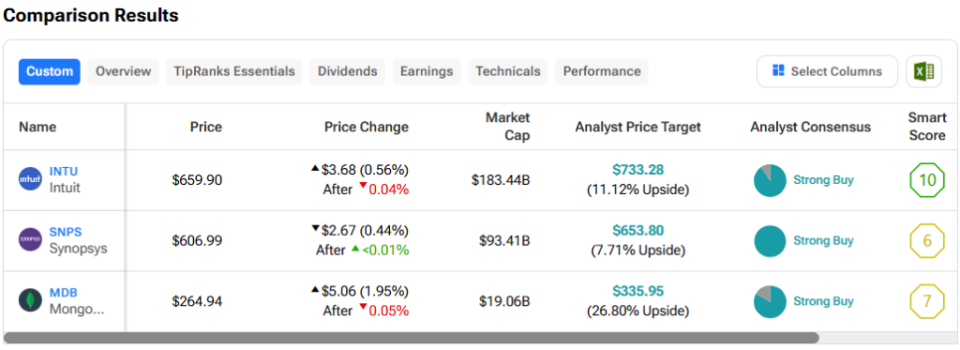

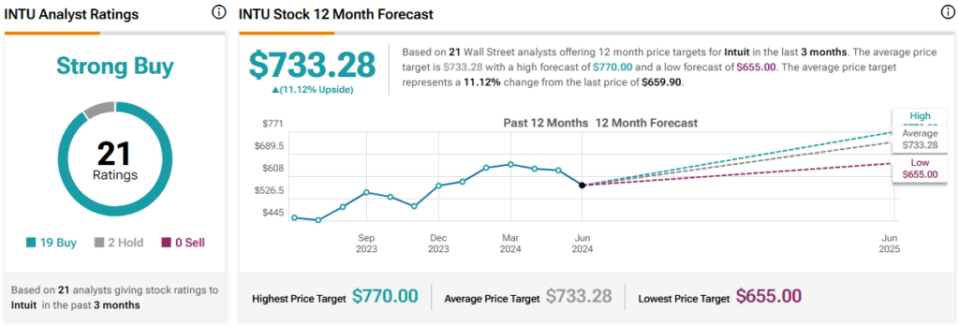

Thus, let’s use TipRanks’ Comparability Instrument to gauge three Sturdy Purchase-rated software program names—INTU, SNPS, MDB—which will nonetheless be missed.

Intuit (NASDAQ:INTU)

It didn’t take very lengthy for shares of monetary software program agency Intuit to get well from its fast correction in Could. Over the previous month alone, INTU inventory has gained greater than 14% as traders piled again into a reputation which will have the chance to boost costs by providing extra worth. Certainly, bookkeeping and accounting appear to be a job match for synthetic intelligence (AI). And as Intuit refines its AI arsenal, it’s onerous to be something lower than bullish.

Final month, Intuit acquired some applied sciences and property from insurance coverage know-how firm Zendrive. Certainly, Intuit is probably greatest identified for its QuickBooks and Turbotax software program, not insurance coverage. Nonetheless, what you could not know is that Credit score Karma (owned by Intuit) has gotten into the auto insurance coverage enterprise by way of Karma Drive.

With Zendrive’s tech and expertise aboard, maybe Karma Drive has what it takes to take its insurance coverage foray to the subsequent degree because it embraces worth from telematics and knowledge analytics. Come for the credit score rating, keep for the good quote on a bank card, loans, and, now, automobile insurance coverage. Traders appear to have seen the Zendrive deal positively, with shares now flirting with 52-week highs once more.

As Intuit turns into extra of a data- and AI-driven firm assured sufficient to increase into new markets (like insurance coverage) versus a mere monetary software program developer, maybe the 60.3 instances trailing price-to-earnings (P/E) a number of is warranted.

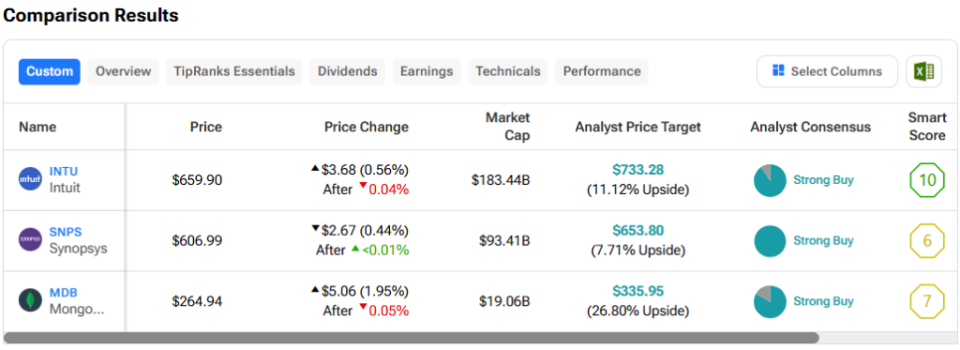

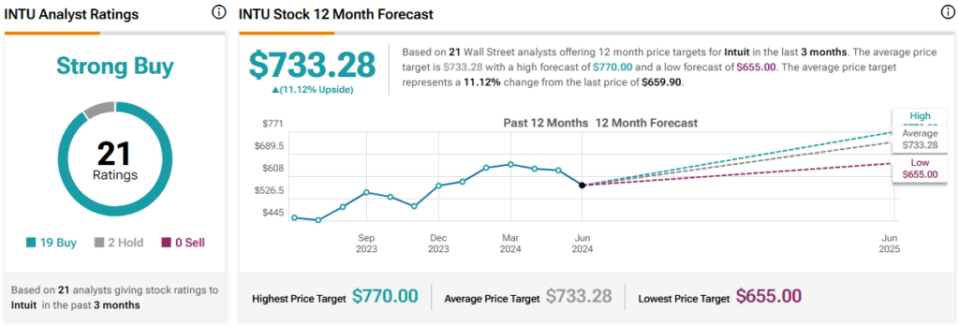

What Is the Value Goal of INTU Inventory?

INTU inventory is a Sturdy Purchase, in line with analysts, with 19 Buys and two Holds assigned prior to now three months. The common INTU inventory value goal of $733.28 implies 11.1% upside potential.

Synopsys (NASDAQ:SNPS)

Shares of chip design software program maker Synopsys are closing in on new highs once more after a 20% surge since their April 2024 lows. All it took was a robust second-quarter earnings beat for the bulls to return to a reputation that stands to profit significantly from the AI-driven semiconductor surge. Regardless of the loftier a number of, I’m inclined to remain bullish on SNPS inventory, provided that its progress prospects appear to have gotten an entire lot higher following its newest acquisition.

Trying forward, Synopsys goals to shut its $35 billion acquisition of engineering simulation software program developer Ansys within the first half of subsequent 12 months. This transfer will bolster the agency’s silicon-to-system design resolution and assist Synopsys develop into a extra influential enabler of rising technological improvements. Certainly, having simulations and chip designs underneath the identical hood may assist companies in the reduction of on prices and dangers concerned with tackling advanced, forward-thinking engineering initiatives.

The deal isn’t a positive factor, although, not after Chinese language anti-trust authorities look into the implications of a Synopsys-Ansys deal. Shares of Ansys (NASDAQ:ANSS) have fallen round 10% for the reason that deal was introduced again in December 2023 as a consequence of uncertainties about whether or not the deal will fall by means of.

Both means, Synopsys is already enjoying chess whereas others are enjoying checkers. With a powerful Synopsys.ai suite of instruments and analytics options that harness the complete energy of knowledge, maybe the hefty 65.8 instances trailing P/E (far more than the Infrastructure Software program business common of 42.2 instances) is value paying up for.

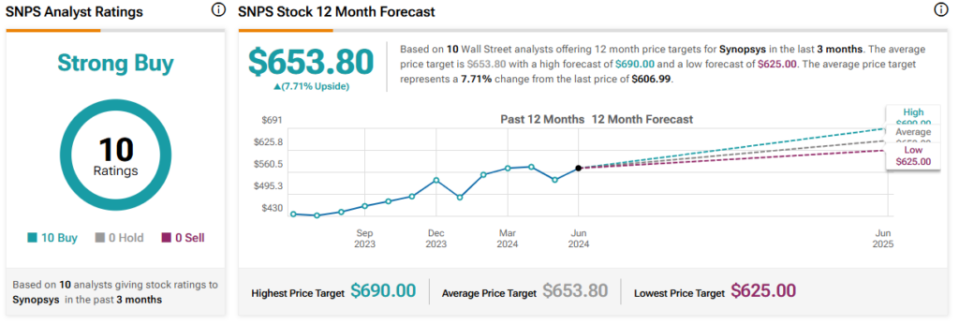

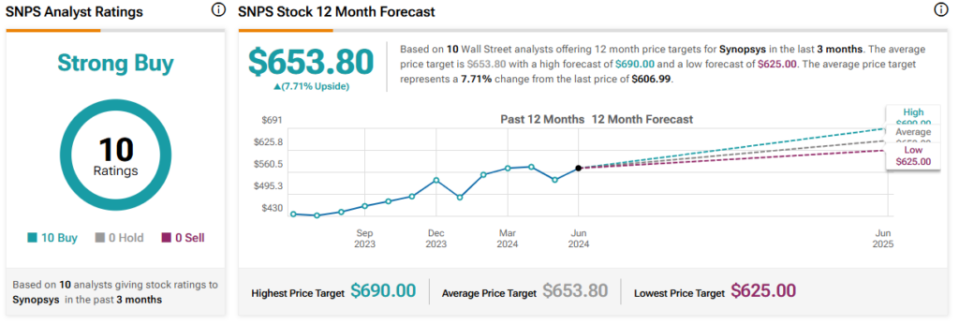

What Is the Value Goal of SNPS Inventory?

SNPS inventory is a Sturdy Purchase, in line with analysts, with 10 Buys assigned prior to now three months. The common SNPS inventory value goal of $651.70 implies 7.7% upside potential.

MongoDB (NASDAQ:MDB)

Shares of database software program agency MongoDB have been underneath severe strain this 12 months, now down 47% from 52-week highs and off round 35% year-to-date. In any case, some big-name analysts see worth within the title after the newest plunge. Regardless of the robust quarters and decrease steerage contributing to MDB inventory’s slide, I stay bullish on MDB inventory.

MongoDB isn’t the one enterprise software program agency sagging decrease, even because the Nasdaq 100 surges to new heights. Nonetheless, it might be one of many first to make up for misplaced time as business circumstances normalize.

Final week, analysts over at Citi (NYSE:C) praised MDB inventory as one in all their prime two picks within the enterprise software program scene. Citi highlighted a number of catalysts that might assist MongoDB and different ailing enterprise software program companies rise out of its funk. Most notably, Citi views recovering IT spending, decrease charges, and seasonal components as causes to get behind MDB inventory proper right here.

Certainly, company funds cuts from 2022 have weighed closely. Extra not too long ago, maybe enterprises are prioritizing AI {hardware} spending over software program spending. Nonetheless, as soon as the {hardware} is in place, it might be time to begin spending on software program once more to utilize these shiny, new AI accelerators.

Particularly, MongoDB’s AI Purposes Program (MAAP) stands out as an intriguing generative AI-enabling platform for the enterprise. With the backing of massive names in AI, like Anthropic, and among the Magnificent Seven public cloud giants, maybe traders are underestimating the agency’s potential to profit from the catalysts Citi outlined.

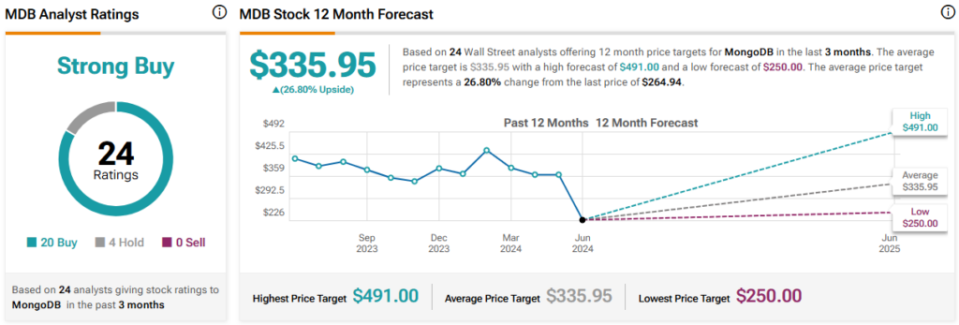

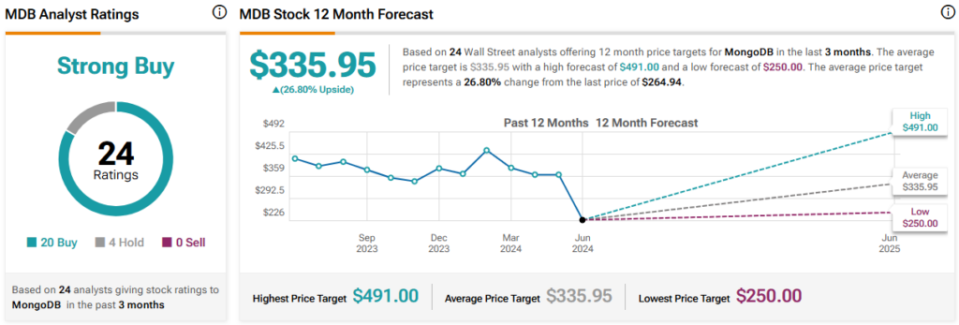

What Is the Value Goal of MDB Inventory?

MDB inventory is a Sturdy Purchase, in line with analysts, with 20 Buys and 4 Holds assigned prior to now three months. The common MDB inventory value goal of $335.95 implies 26.8% upside potential.

Conclusion

AI-enabling software program firms could also be standing within the shadows of semiconductor companies proper now. Solely time will inform if the euphoric good points will shift into the software program house within the second half of the 12 months. Regardless, Wall Avenue’s enthusiasm for every inventory is hard to disregard. Of the three names, Wall Avenue sees probably the most upside potential (26.8%) in MDB inventory.

Disclosure