Synthetic intelligence (AI) is a transformational know-how. Due to AI, some established companies will develop extra sources of income, and others will battle to discover a place within the new enterprise and tech surroundings.

Nonetheless, different firms, typically not considered AI shares, might expertise speedy progress and presumably emerge out of nowhere to develop to a market cap of $1 trillion and past. Though it is troublesome to precisely predict which progress shares will obtain such a milestone, three Motley Idiot contributors have concepts on which of those much less apparent AI shares can develop their market cap past $1 trillion.

An old-school tech inventory income from the AI revolution

Jake Lerch (Oracle): My decide is Oracle (NYSE: ORCL), due to its resurgent cloud enterprise that is being fueled by skyrocketing demand for synthetic intelligence information servers.

On the corporate’s most up-to-date earnings name (for the three months ending on Feb. 29), Oracle chairman Larry Ellison was very easy in admitting that Microsoft‘s explosive cloud progress is driving knock-on success for Microsoft’s suppliers, together with Oracle. “We’re constructing 20 information facilities [for] Microsoft and Azure. They only ordered three extra information facilities this quarter,” Ellison mentioned.

In flip, Oracle’s general income rose 7% yr over yr in its most up-to-date quarter to $13.3 billion. Higher but, administration gave upbeat steerage, indicating that future gross sales objectives could also be met sooner than anticipated, as the corporate’s cloud providers phase is rising at a 25% year-over-year fee.

As for the corporate’s inventory, it is perhaps a shock that Oracle is already America’s Twentieth-largest firm with a market cap of $345 billion, making it greater than twice the scale of iconic firms like Verizon, Caterpillar, and American Categorical.

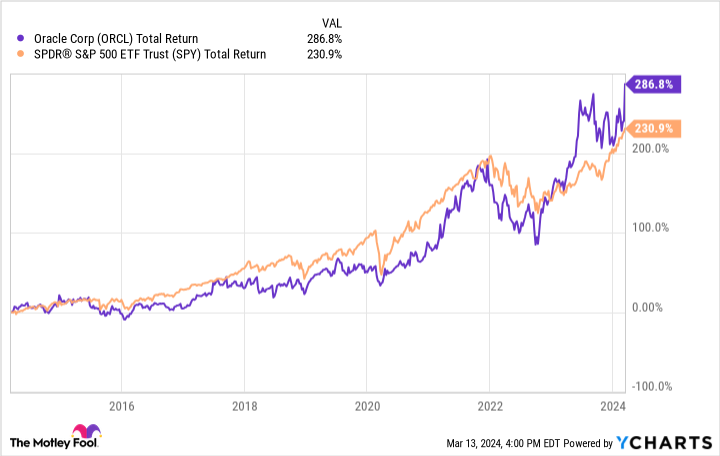

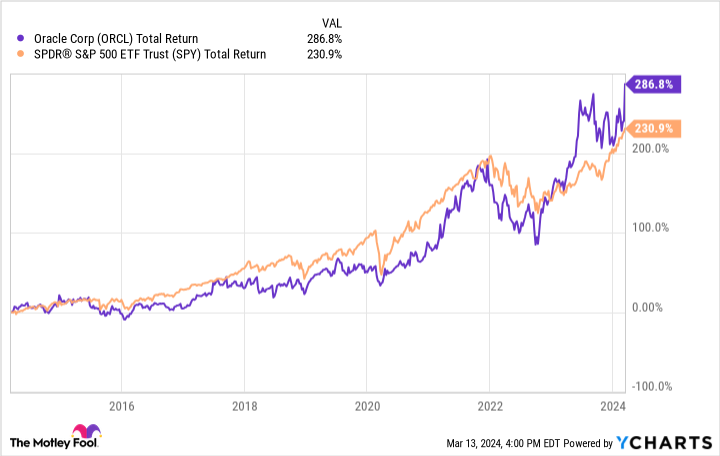

What is probably extra surprising, significantly to these of us who lived by the inventory’s utter collapse within the wake of the dot-com bubble, Oracle has really been a stable funding for greater than a decade. Actually, Oracle’s shares have outperformed the S&P 500 over the past decade.

So, it is perhaps time for buyers to provide Oracle one other look. Because of its red-hot cloud enterprise, this Net 1.0 title could possibly be on the quick observe to a $1 trillion market cap.

TSMC would not get the credit score it deserves

Justin Pope (Taiwan Semiconductor Manufacturing): Semiconductors have change into the constructing blocks of AI; the chips energy the large computer systems wanted to crunch the info to coach AI fashions. Nvidia, the present king of AI chips with many of the market share, is doing simply over $60 billion in companywide gross sales yearly. CEO Lisa Su of Superior Micro Units, Nvidia’s rival, believes the AI chip market will develop as massive as $400 billion over the approaching years.

Regardless of being well-known chip giants, neither Nvidia nor AMD really manufacture their chips. That job belongs to manufacturing specialists like Taiwan Semiconductor Manufacturing (NYSE: TSM). TSMC is the world’s largest semiconductor producer, with an estimated 56% share of the world’s chip manufacturing. Because the market chief, you possibly can make sure that TSMC is the go-to for these new, extremely superior chips powering the most recent improvements like AI.

The market is not precisely sleeping on TSMC inventory. In spite of everything, the corporate is value over $600 billion at the moment. Nonetheless, it is nonetheless fairly priced at 23 instances analysts’ estimated 2024 earnings of $6.17 per share.

Give it some thought. If semiconductor demand pushes the AI chip market to such large progress (a number of instances its present dimension if Lisa Su is appropriate), a lot of that enterprise will trickle right down to TSMC. It is not a stretch to see the corporate’s earnings doubling over the following decade, which might be greater than sufficient to push TSMC previous a trillion-dollar market cap.

The longer term appears shiny for the world’s main chip fab, and a trillion-dollar valuation appears extra like a matter of when not if.

This journey inventory ought to proceed to e-book AI-driven positive factors

Will Healy (Airbnb): Most shoppers see Airbnb (NASDAQ: ABNB) as a tourism firm, and understandably so. It has turned the holiday rental business on its head, altering any residence into a possible trip property. Furthermore, it has strengthened this popularity by providing actions which may attraction to vacationers.

Nonetheless, it could seemingly shock many purchasers and even some buyers to know that Airbnb in all probability owes its success to AI. For one, it is not a primary mover on this house. That declare belongs to Expedia‘s Vrbo. Moreover, not like a lodge chain like Hilton, it would not personal the properties it helps lease.

In actuality, Airbnb is little greater than an internet site for listings with a excessive degree of title recognition. The corporate fosters its aggressive benefits by AI. The know-how helps with challenges akin to figuring out correct pricing ranges in a given space or estimating the reputations of potential tenants.

Airbnb has additionally discovered uncommon functions for AI. The know-how performs a task in implementing vacation exercise restrictions and estimating the probability a tenant would possibly violate such guidelines.

Additionally, Airbnb has begun testing its AI chatbot to deal with many buyer help inquiries. To this finish, it just lately purchased GamePlanner, an organization that may presumably make AI experiences on Airbnb appear extra human.

Furthermore, the corporate is perhaps nearer to a $1 trillion market cap than some would possibly assume. Because of its 7.7 million listings and 448 million nights and experiences booked in simply the fourth quarter of 2023 alone, the inventory has already grown to a market cap of $105 billion — which means it has to double roughly 3.2 instances to take the market cap to $1 trillion.

Admittedly, such a feat will seemingly take a number of years for the reason that market cap will nonetheless should develop by virtually ninefold to attain that milestone. Additionally, Airbnb’s P/E ratio of 23 was skewed decrease by a one-time earnings tax profit, making its true earnings-based valuation greater than it’d seem.

Nonetheless, its price-to-sales ratio of 11 is just not removed from document lows, an element that ought to function a catalyst as income and earnings rise additional. With AI persevering with to extend the corporate’s productiveness, the $1 trillion market cap ought to finally be inside attain.

Do you have to make investments $1,000 in Oracle proper now?

Before you purchase inventory in Oracle, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Oracle wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

American Categorical is an promoting accomplice of The Ascent, a Motley Idiot firm. Jake Lerch has positions in Airbnb, Caterpillar, and Nvidia. Justin Pope has no place in any of the shares talked about. Will Healy has positions in Superior Micro Units. The Motley Idiot has positions in and recommends Superior Micro Units, Airbnb, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Verizon Communications and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Shock AI Shares Headed for a $1 Trillion Market Cap was initially revealed by The Motley Idiot