Synthetic intelligence (AI) has the potential to be one of many largest revolutionary developments in know-how that the world has ever seen. Corporations are simply beginning to embrace the know-how and what it may possibly do. Nevertheless, the early outcomes are very promising, permitting organizations to develop into extra environment friendly and higher serve their clients.

However make no mistake, synthetic intelligence continues to be in its early days, and there are numerous alternatives for buyers to revenue from corporations serving to paved the way with AI. Let us take a look at among the finest shares to play the AI bull run.

Nvidia

No firm is benefiting extra from AI for the time being than Nvidia (NASDAQ: NVDA). The maker of graphics processing unit (GPUs) has develop into the spine of the infrastructure wanted to energy AI functions in information facilities. GPU chips are capable of do technical calculations quicker and with much less power than central processing models (CPUs), which makes them ultimate to be used in AI coaching and inference.

Nvidia’s GPUs, in the meantime, have develop into the trade gold normal as a result of its CUDA software program platform, which permits its chips to be programmed instantly, saving clients money and time.

Nvidia will proceed to be the go-to firm for constructing out the extra highly effective information facilities wanted to energy AI functions. In the meantime, Nvidia is not a one-trick pony, and its networking enterprise can be tremendously benefiting from AI.

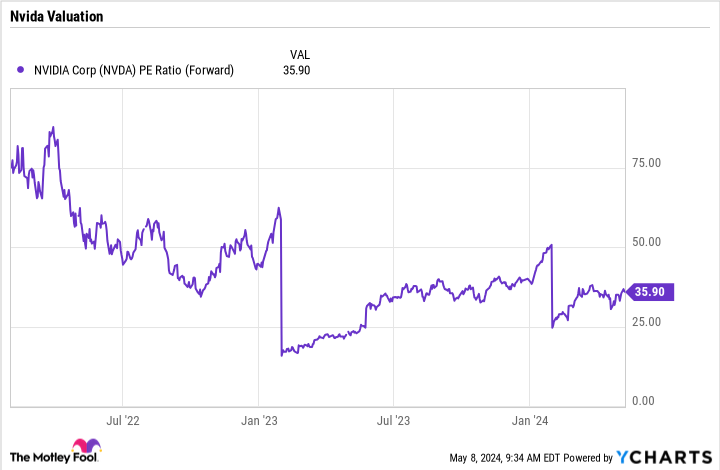

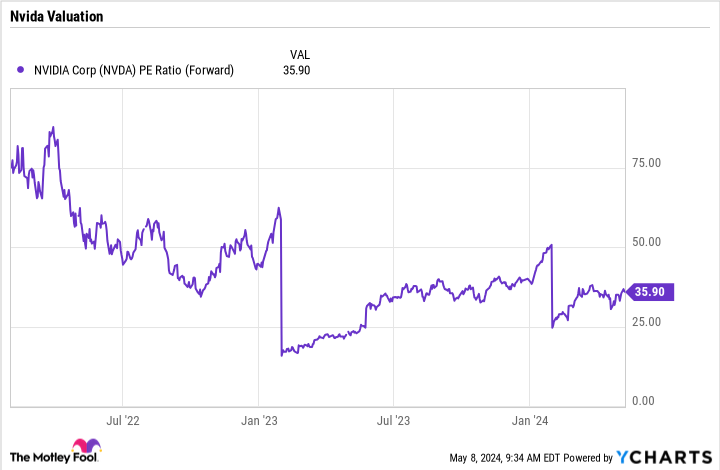

Nvidia has been placing up unbelievable progress, together with a greater than tripling of its income throughout its most up-to-date quarter. Regardless of that, the inventory is attractively valued at solely a 36 ahead P/E, setting it up for a bull run because the enterprise grows and buyers push up the inventory value.

Amazon

In the case of AI, Amazon (NASDAQ: AMZN) will not be the primary inventory that involves thoughts. Nevertheless, the e-commerce big has been closely investing within the know-how.

The corporate owns the biggest cloud enterprise, Amazon Internet Companies or AWS, which is benefiting from the proliferation of AI. It has additionally developed two chips, Trainium and Inferentia, for use particularly for AI functions.

On the software program aspect, the corporate has developed platforms to assist clients construct their very own AI fashions and functions. Its SageMaker platform helps clients construct, practice, and deploy machine studying fashions, whereas its Bedrock platform provides clients high-performing fashions from Amazon and different main AI corporations by a single API to assist them construct AI functions.

Amazon has additionally constructed out its personal AI-powered assistant for software program builders, Amazon Q. The AI assistant can write, check, and debug code. It could actually additionally reply questions on firm insurance policies, merchandise, and different matters.

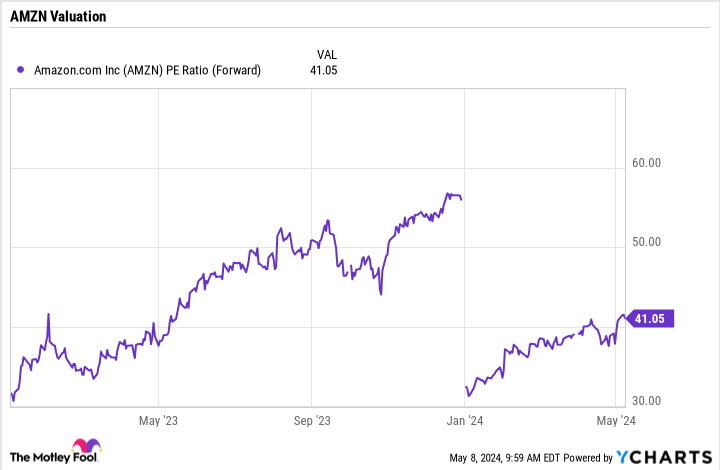

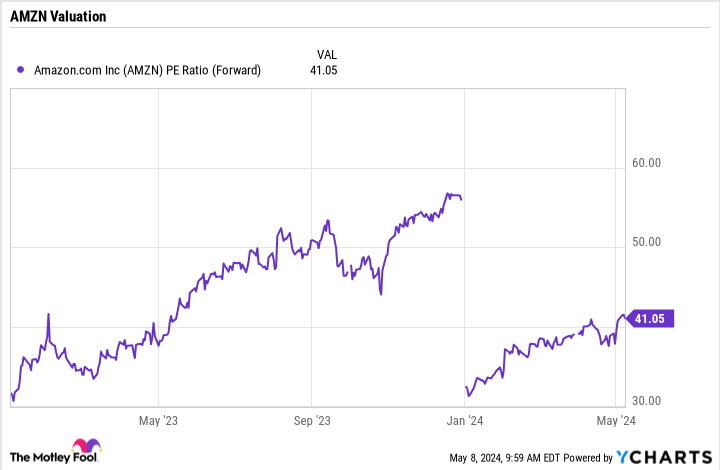

Amazon has proven previously that it’s prepared to spend massive to in the end win massive, and AI seems to be no exception. Buying and selling at a ahead P/E of round 41, the inventory has room to run given the AI progress alternatives in entrance of the corporate.

SoundHound AI

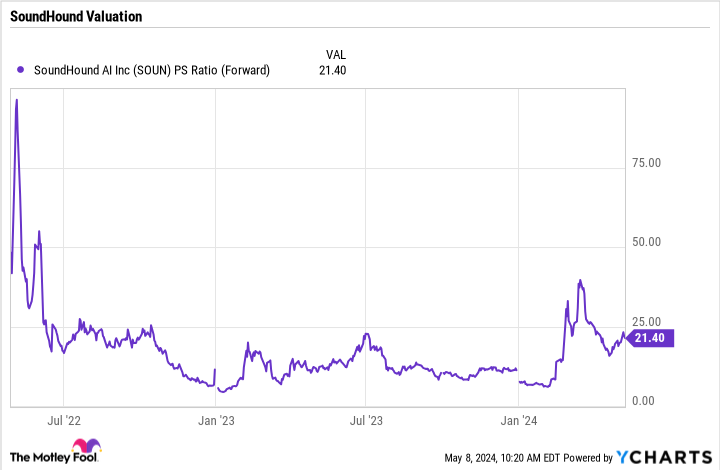

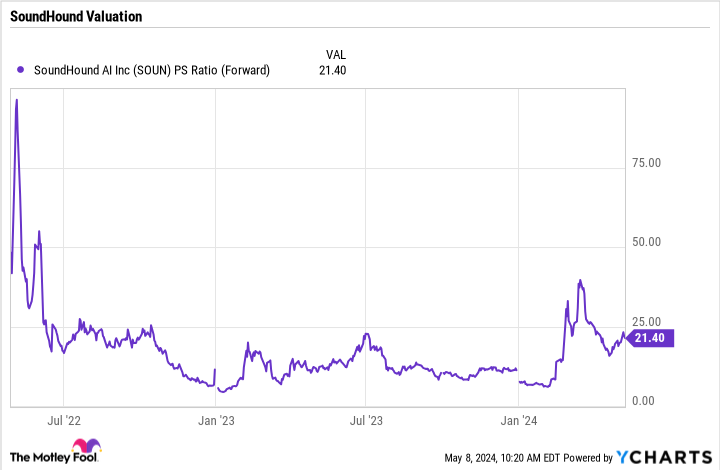

Shares of SoundHound AI (NASDAQ: SOUN) skyrocketed earlier this 12 months on information that Nvidia had made an funding within the AI-powered voice assistant firm. Nevertheless, extra not too long ago, the inventory has come again all the way down to a extra affordable stage.

Soundhound’s know-how helps voice assistants and people work together extra naturally, permitting customers to ask extra complicated questions whereas getting higher solutions. The corporate has made robust inroads within the car trade and is making good progress within the restaurant house as properly. Nevertheless, the functions of its know-how ought to increase far past these two trade verticals.

The corporate has a beautiful recurring income enterprise mannequin whereby it will get royalty funds based mostly on quantity, utilization, or the lifetime of the product. For functions the place no product is concerned, corresponding to with its restaurant providing, it makes use of a subscription mannequin.

SoundHound continues to be comparatively small, producing solely $46 million in income final 12 months. Nevertheless, it has a big reserving backlog of $661 million, which if honored will flip into income over the following a number of years. The weighted common size of its contracts is about six and a half years, with extra income backend loaded. A lot of the corporate’s backlog comes from its relationships with about 20 auto manufacturers and having its know-how constructed into new fashions of their autos.

Buying and selling at over 21 instances ahead gross sales, SoundHound inventory shouldn’t be low-cost. Nevertheless, its valuation has come down rather a lot in latest months, and it has numerous potential to develop if it may possibly proceed to maneuver its know-how into extra merchandise. Moving into smartphones, for instance, can be a recreation changer for the corporate and the inventory.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $550,688!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 6, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a disclosure coverage.

3 Prime AI Shares Prepared for a Bull Run was initially revealed by The Motley Idiot