On Feb. 9, the S&P 500 closed above 5,000 for the primary time ever. Optimism round synthetic intelligence (AI) has been a big catalyst, with shares like Nvidia main the market increased. However Nvidia is not your solely possibility. Listed here are three different AI shares value contemplating proper now.

1. Microsoft

My first choose is the most important firm on the earth by market cap: Microsoft (NASDAQ: MSFT).

What makes Microsoft stand out within the AI crowd proper now could be how rapidly the corporate is bringing AI developments to market. Because of its long-standing partnership with OpenAI, the corporate built-in ChatGPT options into its Bing search engine and Edge web browser greater than a yr in the past.

And whereas some folks would possibly dismiss the corporate’s search and associated advert enterprise, that is a mistake, as a result of by any regular enterprise measure, Microsoft’s search enterprise is gigantic.

For instance, in its newest quarter (the three months ending Dec. 31), Microsoft generated $3.2 billion from search and its information feed’s promoting enterprise. That is about the identical because the quarterly income of Domino’s Pizza, Pinterest, CrowdStrike Holdings (NASDAQ: CRWD), and DraftKings mixed.

And search is only one space the place Microsoft is incorporating new AI options. The corporate has additionally debuted its new AI-powered Copilot “on a regular basis AI companion.” By buying a subscription, customers can entry generative AI options to assist enhance and streamline duties like summarizing and replying to electronic mail and constructing charts and graphs.

Briefly, Microsoft might be doing greater than some other firm to convey AI to the general public, creating one more aggressive benefit for the world’s most respected firm.

2. CrowdStrike Holdings

Subsequent up is CrowdStrike Holdings, the corporate behind some of the fashionable AI-powered cybersecurity platforms.

CrowdStrike’s signature providing is the Falcon platform, a scalable, dynamic endpoint safety answer. Organizations should buy a number of safety modules relying on their wants and funds.

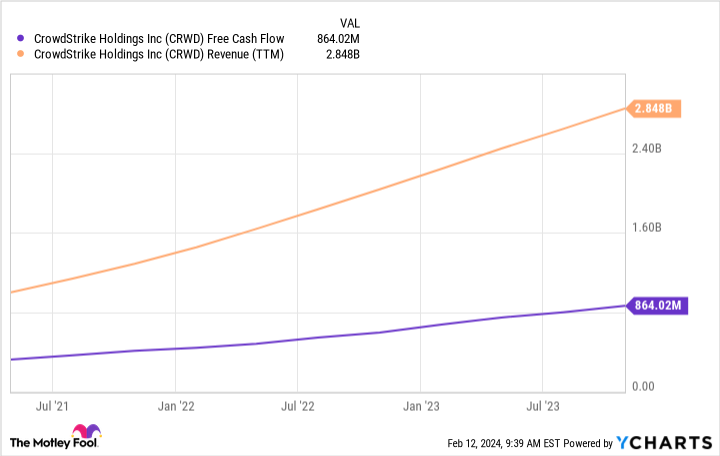

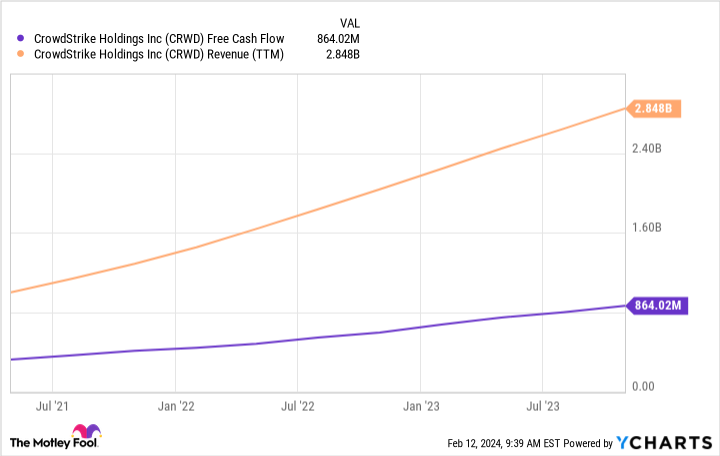

Financially, CrowdStrike is correct the place a younger firm early in its life cycle ought to be. It’s rising quick and producing ample free money movement.

Income in its most up-to-date quarter (ending on Oct. 31, 2023), jumped 35% to $786 million. Free money movement during the last 12 months has elevated to $864 million. And the corporate’s buyer rely has grown 35% yr over yr.

Granted, CrowdStrike’s lofty price-to-sales a number of of 28 makes it an costly inventory. But for long-term, growth-oriented buyers, it is a identify to recollect.

3. Tremendous Micro Pc

Lastly, let’s discuss one of many hottest shares on Wall Avenue: Tremendous Micro Pc (NASDAQ: SMCI).

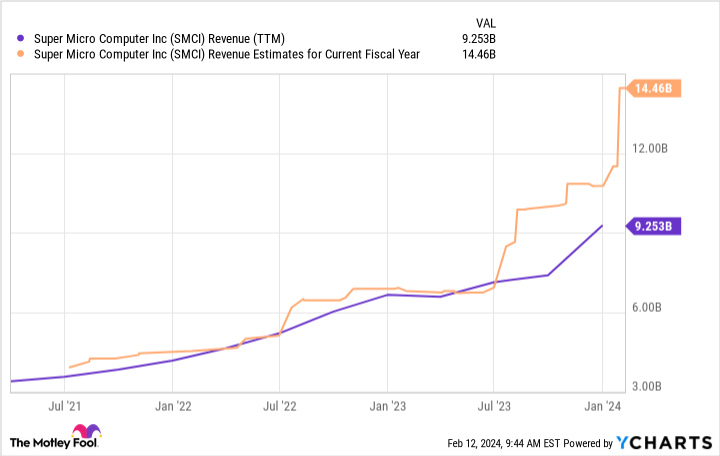

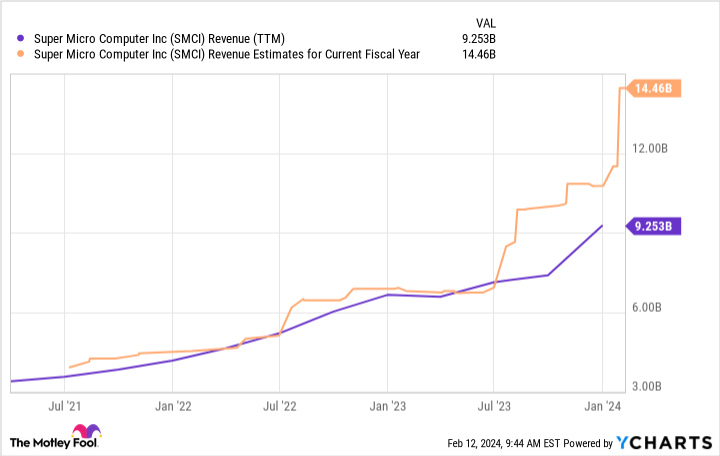

Up 171% yr thus far as of this writing, Tremendous Micro Pc is firing on all cylinders because of the AI revolution.

The reason being that the corporate makes server racks, the bodily {hardware} utilized in knowledge facilities to carry, cool, and retailer the cutting-edge AI chips made by Nvidia, AMD, and others.

Since cloud giants like Microsoft, Alphabet, and Amazon are shopping for AI chips at lightning velocity, the demand for server racks can be via the roof. The truth is, analysts estimate that the corporate’s gross sales will greater than double in 2024 to $14.5 billion, with a 34% leap anticipated in 2025.

Nonetheless, this is not a inventory for everybody. Given how rapidly shares have skyrocketed, the inventory’s valuation — a price-to-earnings a number of of 58 — places it effectively out of consideration for worth buyers.

Nevertheless, for these searching for an organization that may profit from the expansion of bodily AI infrastructure and knowledge facilities, Tremendous Micro Pc is a inventory to contemplate.

Must you make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Tremendous Micro Pc wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, CrowdStrike, Domino’s Pizza, Microsoft, Nvidia, and Pinterest. The Motley Idiot recommends Tremendous Micro Pc and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 High Synthetic Intelligence Shares to Purchase Proper Now was initially revealed by The Motley Idiot