-

Traders ought to make the most of the latest rally in shares and put together for losses by shopping for insurance coverage, in response to Goldman Sachs.

-

The financial institution stated the slender management from mega-cap tech shares means the draw back threat is elevated.

-

These are the 5 explanation why Goldman Sachs says now’s the time to hedge your portfolio.

Shares have been on a tear for the reason that S&P 500 bottomed in mid-October, leaping greater than 25%, however Goldman Sachs believes now’s an opportune time for buyers to hedge their portfolio towards future losses.

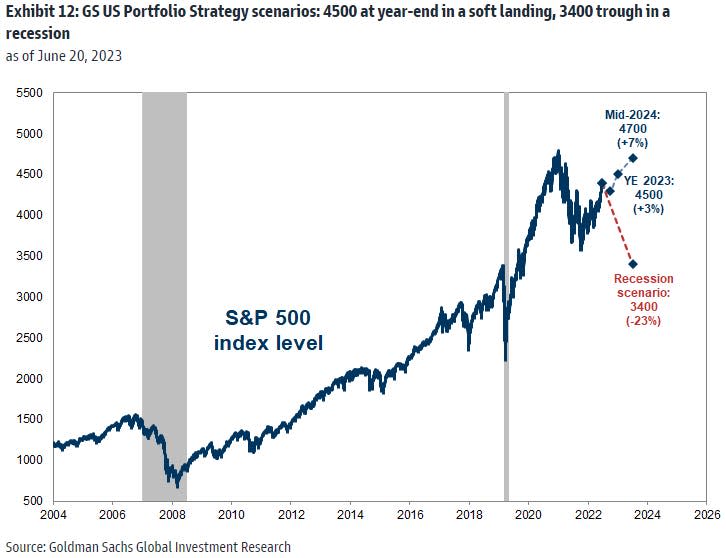

The financial institution really useful buyers put together for a inventory market sell-off of as a lot as 20% throughout the subsequent few months due to a possible recession.

“Some portfolio managers anticipate a recession to start throughout the subsequent 12 months, a view that’s in step with most financial forecasters. In that state of affairs… the index might fall by 23% to three,400,” Goldman Sachs’ David Kostin stated in a June 20 notice.

Given the sturdy inventory market rally, mixed with a possible recession throughout the subsequent 12 months, Kostin highlighted 5 explanation why buyers can buy insurance coverage for his or her portfolio now.

1. “Draw back safety is attractively priced.”

“Whereas buyers had been nicely hedged from March to Might, buyers began paying increased costs for single inventory calls in late-Might and index name patrons joined in beginning on June 2nd. We discover these measures of put-call skew are contrarian indicators for ahead market efficiency, and so they clearly present buyers have purchased upside asymmetry in shares and indexes. With buyers already bullishly positioned, it might be tougher for the market to rally farther from right here.”

2. Slim market rally suggests drawdown threat is elevated.

“Traditionally, sharp declines in market breadth have usually been related to massive drawdowns in subsequent months. Considered one of our market breadth indicators compares the gap from the 52-week excessive for the combination index vs. the median inventory. Market breadth has lately narrowed by essentially the most for the reason that Tech Bubble on this measure.”

3. Valuations are excessive in absolute and relative phrases.

“The S&P 500 trades on an NTM P/E of 19x, which represents the 88th percentile since 1976. Traditionally, when the index has traded at this stage or above, the S&P 500 has skilled a median drawdown of 14% over the subsequent 12 months as in contrast with a 5% drawdown over a typical 12-month interval.”

4. Equities already worth an optimistic outlook.

“Our economists anticipate US GDP progress will common 1.0% throughout 2H 2023. Nevertheless, as measured by the efficiency of cyclical shares relative to defensive shares, the fairness market implies a tempo of financial progress of roughly 2%.”

5. Positioning is now not a tailwind to equities.

“As 2023 has progressed, buyers have elevated their fairness publicity. Hedge funds elevated internet leverage, mutual funds lower money balances, and overseas buyers have been internet patrons of equities. On the newest studying, the SI registered a 114-week excessive of +1.2, suggesting that gentle positioning ought to now not be a tailwind for the fairness market. There are numerous affordable alternate options to equities right this moment, indicating that the stream of funds is unlikely to be a tailwind for shares this 12 months. “

Kostin’s view on sentiment and investor positioning was strengthened Wednesday by market veteran Ed Yardeni, who highlighted in a notice that there may be “too many bulls.”

“The bull/bear ratio compiled by Traders Intelligence jumped to three.00 through the July 4 week, up from 2.69 the earlier week. It’s the highest studying for the reason that bull run from March 23, 2020 by means of January 3, 2022,” he stated. “Excessive bullish sentiment generally is a warning flag.”

Learn the unique article on Enterprise Insider