To this point, 2024 has carried over comparable themes that have been in style final 12 months. Megacap corporations proceed to drive the S&P 500 and Nasdaq Composite to new heights.

After being the best-performing inventory within the S&P 500 in 2023, Nvidia has staged an encore not like every other with a greater than 120% year-to-date acquire — pole-vaulting it to the third-most precious firm on the earth and inside placing distance of surpassing Apple and Microsoft.

However long-term buyers know that drifting too far into the highlight can distract from higher alternatives. These Motley Idiot contributors are significantly enthusiastic about SoundHound AI (NASDAQ: SOUN), Adobe (NASDAQ: ADBE), Vertex Prescribed drugs (NASDAQ: VRTX), Residence Depot (NYSE: HD), and Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP).

This is why all 5 corporations have what it takes to be stable long-term investments and are value shopping for in June.

Why SoundHound is a brilliant guess on the AI alternative

Anders Bylund (SoundHound AI): SoundHound AI transforms your voice into a robust instrument, letting you effortlessly search, uncover, and work together with the world round you. Its Houndify voice evaluation software program has been round for twenty years, and is now present in locations like Stellantis vehicles, the automated drive-thru home windows of Chipotle Mexican Grill, and customer support cellphone menus for dozens of family names.

Powered by a number of layers of synthetic intelligence (AI) analytics, SoundHound’s voice controls supply excessive accuracy in noisy environments. Then, it passes a cleaned-up command on to machine studying processes for a deep evaluation of the speaker’s meant that means. It is a distinctive and closely patent-protected strategy.

This little firm goes locations in the long term. Lengthy-term voice management contracts with a number of giant automakers will begin producing income over the following couple of years. On the similar time, SoundHound AI retains including marquee names to its roster of restaurant shoppers. A deep partnership with fellow high-growth phenom Toast ought to give each companies a major enhance.

SoundHound AI’s inventory is not low-cost at this time, buying and selling at 32 occasions gross sales. Earnings and money flows are destructive, pushing worth buyers even additional away. However the firm runs a basic high-octane progress technique proper now, funneling its modest income and sturdy money reserves right into a beneficiant advertising and marketing funds and even richer analysis and improvement bills.

And the growth-oriented techniques are working. SoundHound AI’s first-quarter gross sales rose 73% 12 months over 12 months. Hold scaling up these income streams, and the bottom-line income ought to observe finally. Its providers faucet into the AI increase, addressing the necessity for correct voice instructions throughout a number of trillion-dollar markets.

As SoundHound AI continues to execute its aggressive progress plans, the rewards could possibly be substantial for these prepared to trip out the early volatility. Skimming only a small income slice off the highest of world automotive gross sales and restaurant operations may simply raise SoundHound AI’s annual gross sales into billion-dollar territory over time.

By then, you will want you had picked up a few shares in 2024 whereas they have been nonetheless low-cost.

Adobe is simply too low-cost to disregard

Daniel Foelber (Adobe): Salesforce inventory fell a staggering 19.7% on Might 30 — sending out ripple results that slammed different cloud computing shares from Adobe to Snowflake, Atlassian, Workday, and others. Including insult to harm is the truth that many of those shares had already fallen as a result of their very own slowing progress. Adobe is now down practically 22% since reporting fiscal 2024 first-quarter outcomes. That is a giant transfer for one of many 5 largest U.S.-based software program corporations.

To save lots of you the difficulty of combing by way of the earnings reviews and transcripts of Adobe and its friends, the straightforward takeaway is that progress is slowing, and these corporations have largely missed out on the AI-induced progress wave. For those who take a step again and take into consideration their enterprise fashions, it is simple to see why.

Nvidia is the poster baby of AI progress, and for good motive. It offers the processing spine to run complicated AI fashions by way of its knowledge middle enterprise. The factor is, Nvidia would not essentially care if these fashions are helpful as long as they demand extra computational energy.

Many software program corporations are investing in AI to enhance their services. Adobe is one among them, and it deserves credit score for unveiling some wonderful enhancements and new instruments in a comparatively quick period of time. The issue is that Adobe in the end must earn money on these investments to justify the elevated bills.

In different phrases, AI should generate a robust return on invested capital. And for essentially the most half, that return has but to materialize within the software program area, which is a core driver of the broad-based sell-off that was amplified by Salesforce’s weak steering.

Admittedly, it is a bit of an unfair setup for software program corporations within the quick time period. Investments take time to repay. Value-cutting efforts have been a preferred development regardless of the sector, which results in slower progress and a possible lag issue for implementing AI-based product enhancements.

As Salesforce Chief Working Officer Brian Millham stated on the corporate’s latest earnings name: “We proceed to see the measured shopping for habits just like what we skilled over the previous two years and except This autumn the place we noticed stronger bookings, the momentum we noticed on This autumn moderated in Q1. And we noticed elongated deal cycles, deal compression, and excessive ranges of funds scrutiny.”

Given all of the unhealthy information, it’s possible you’ll marvel why Adobe stands out as a very good software program inventory to purchase in June. The first motive is Adobe has a multi-decade runway with AI and is making extra strides than Wall Road is giving it credit score for. The second motive is that Adobe has a wonderful valuation — buying and selling at a ahead price-to-earnings ratio of below 25. Granted, Adobe’s precise earnings may disappoint and result in revisions in earnings forecasts.

However all advised, buyers are getting the possibility to purchase a confirmed industry-leading progress inventory for an awesome value. Adobe is my high choose within the area due to its aggressive benefits and engaging valuation.

A number of causes to be captivated with Vertex

Keith Speights (Vertex Prescribed drugs): With all due respect to Larry David, I can not curb my enthusiasm about Vertex Prescribed drugs. This large biotech has a lot going for it that I practically do not know the place to begin.

Since I want to start someplace, I am going to first be aware that Vertex instructions a monopoly in treating the underlying reason for the uncommon genetic illness cystic fibrosis (CF). Thanks primarily to its CF remedy Trikafta, the corporate generated income of $2.69 billion and a revenue of practically $1.1 billion within the first quarter of 2024.

Vertex awaits U.S. and European approvals of a triple-drug mixture remedy function, vanzacaftor. I search for this combo to be the corporate’s most profitable and worthwhile CF remedy but.

Transferring past CF, Vertex has already launched what’s prone to be its subsequent blockbuster drug — Casgevy. The gene-editing remedy is a one-time treatment for the uncommon blood problems sickle cell illness and transfusion-dependent beta thalassemia.

The large biotech ought to have an enormous industrial alternative for suzetrigine (VX-548), a non-opioid ache drug, if it is accepted. Vertex expects to wrap up its rolling U.S. regulatory submission for the drug this quarter.

It has a extremely promising late-stage candidate with inaxaplin. This experimental drug targets APOL1-mediated kidney illness (AMKD). There aren’t any accepted remedies for the underlying reason for AMKD. The illness impacts extra sufferers worldwide than CF.

Vertex’s pending acquisition of Alpine Immune Sciences will give it one other late-stage kidney illness program. Alpine’s povetacicept targets IgA nephropathy, a severe autoimmune kidney illness.

Need extra? Vertex can also be creating a possible treatment for kind 1 diabetes. The corporate is already evaluating two experimental therapies in section 1/2 research that use islet cells to revive insulin manufacturing.

Curb my enthusiasm about this biotech inventory? No manner.

Enhance your portfolio

Demitri Kalogeropoulos (Residence Depot): Do not let Residence Depot’s sluggish gross sales progress preserve you away from this stellar inventory in June and past. Positive, the house enchancment retailer has posted uncharacteristically weak outcomes in the course of the newest {industry} stoop. Excessive rates of interest have soaked up plenty of the surplus money many individuals had been directing into dwelling initiatives, resulting in a 3% drop in comparable-store gross sales in the latest quarter.

Look nearer, and you may see indicators of stabilization, although. The chain’s buyer visitors fell simply 1% final quarter in comparison with a 3% decline within the prior quarter. Residence Depot achieved a better gross revenue margin, as nicely, and working revenue is powerful at practically 14% of gross sales. All of this occurred regardless of a delayed begin to the crucial spring buying season.

“The workforce executed at a excessive stage within the quarter, and we continued to develop market share,” CEO Ted Decker advised buyers in mid-Might.

Residence Depot will share the detailed outcomes of its spring kick-off in its subsequent earnings report in August. However buyers do not have to attend till then to purchase the inventory. Shares look engaging at this time at 2.2 occasions income (down from 2.5 occasions income a number of months in the past).

And, whereas there could be extra bumps within the highway forward for the house enchancment market, shareholders can really feel assured that the {industry} chief will ship above-average returns, simply because it has by way of earlier cyclical upturns and downturns during the last a number of a long time.

A rock-solid dividend progress inventory to personal

Neha Chamaria (Brookfield Infrastructure): Shares of Brookfield Infrastructure — each items of the partnership and company shares — are within the crimson thus far this 12 months regardless of all-time highs reached by the S&P 500 index. The infrastructure large, nevertheless, is on stable footing, and its newest numbers ought to encourage buyers to scoop up some shares now.

Brookfield acquires and operates infrastructure belongings globally, specializing in sectors and industries like utilities, transportation similar to rail and toll roads, midstream power, and knowledge infrastructure, all of that are regulated and generate money flows below long-term contracts. Contracted belongings imply the corporate can generate regular money flows even throughout difficult occasions to put money into progress and pay dividends to its shareholders.

The corporate has already began 2024 on a robust be aware, having grown its funds from operations (FFO) by 11% 12 months over 12 months within the first quarter. It seems the corporate is on monitor to ship a a lot stronger 12 months in comparison with 2023 as administration projected earlier.

Make no mistake although: 2023 was additionally a stable 12 months, with Brookfield Infrastructure’s FFO rising 10% to $2.3 billion, together with natural progress of 8%. Its robust first-quarter numbers, although, are only one motive why you’d need to purchase Brookfield Infrastructure inventory now.

Brookfield periodically sells mature belongings, and it has lined up belongings value practically $2 billion on the market this 12 months. It already has some acquisitions within the pipeline, together with an enormous community of telecom towers in India. Pushed by new investments and common capital recycling, the infrastructure large expects to develop its FFO per unit by no less than 10% and annual dividend by 5% to 9% within the coming years.

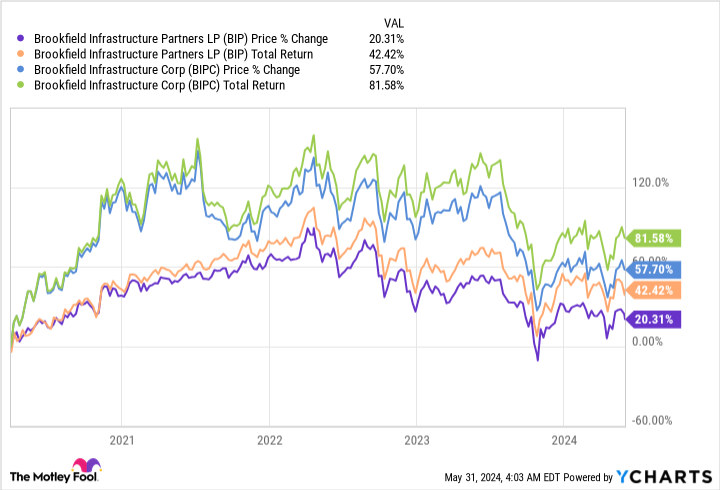

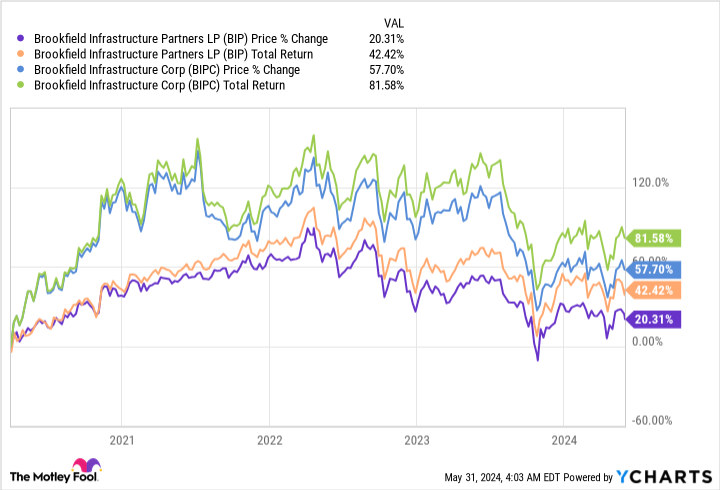

The inventory has elevated its dividend yearly for the previous 15 consecutive years, and that dividend progress has massively contributed to shareholders’ returns. For perspective, here is a chart exhibiting the inventory’s complete returns from 2019 when Brookfield Infrastructure Company was fashioned.

With a ahead dividend yield of 4.7% for shares of the company and 5.6% for items of the partnership (shopping for company shares has some tax benefits), Brookfield Infrastructure is a high dividend inventory to double up on proper now.

Must you make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and SoundHound AI wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $671,728!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 28, 2024

Anders Bylund has positions in Nvidia, SoundHound AI, and Toast. Daniel Foelber has no place in any of the shares talked about. Demitri Kalogeropoulos has positions in Apple, Chipotle Mexican Grill, and Residence Depot. Keith Speights has positions in Apple, Brookfield Infrastructure Company, Brookfield Infrastructure Companions, Microsoft, and Vertex Prescribed drugs. Neha Chamaria has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Adobe, Apple, Atlassian, Chipotle Mexican Grill, Residence Depot, Microsoft, Nvidia, Salesforce, Snowflake, Toast, Vertex Prescribed drugs, and Workday. The Motley Idiot recommends Brookfield Infrastructure Companions and Stellantis and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

5 Prime Shares to Purchase in June was initially revealed by The Motley Idiot