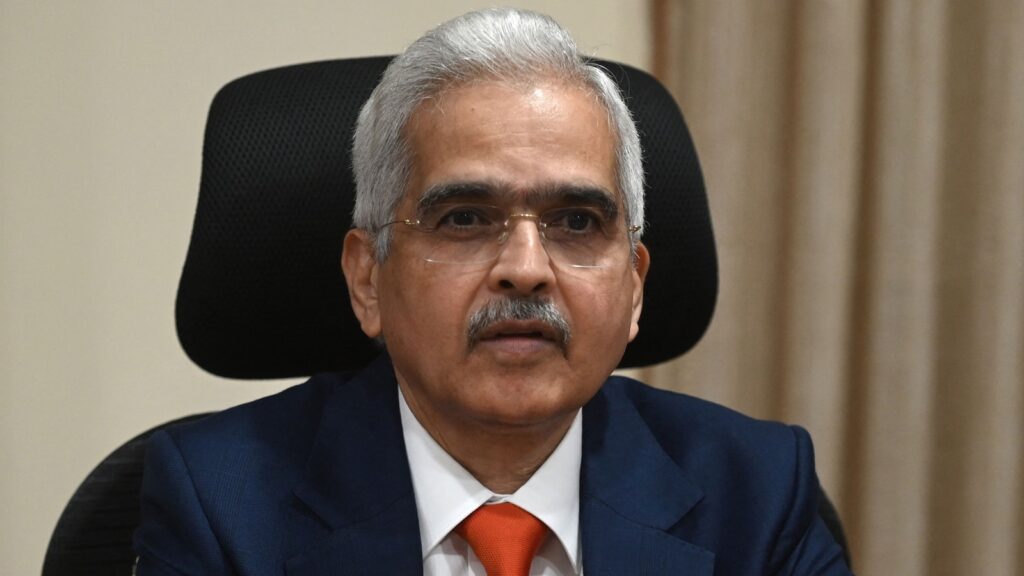

With Prime Minister Narendra Modi dedicating 75 digital banking items (DBUs) to the nation, Reserve Financial institution of India (RBI) Governor Shaktikanta Das stated on Sunday that these items had been arrange in a document time of six months in 75 districts. “Seventy-five DBUs had been arrange in a document six months in 75 districts unfold throughout the nation to commemorate 75 years of independence,” the RBI governor stated in a digital tackle. The institution of the DBUs, Das stated, is a step ahead to enhance the digital infrastructure within the nation.

“The DBUs are yet one more important within the ongoing marketing campaign to simplify the lives of widespread individuals. It’s a particular banking facility that’ll present most companies by minimal digital infrastructure,” he stated, including that these banking items “will present companies associated to figuring out authorities schemes”.

The RBI governor additionally highlighted throughout Sunday’s occasion that lately, digital banking has emerged as a most well-liked channel for delivering banking companies throughout India and the central financial institution has been taking progressive measures to enhance the provision of digital infrastructure from banking companies.

Prime Minister Modi, in the meantime, stated on Sunday underlined: “These companies will probably be freed from paperwork and different hassles. These could have services in addition to sturdy digital banking safety.”

What are DBUs?

In response to a assertion issued by the Prime Minister’s Workplace (PMO) just a few days again, DBUs will probably be brick-and-mortar retailers which is able to present quite a lot of digital banking services to individuals together with the opening of financial savings accounts, balance-check, print passbooks, switch of funds, funding in fastened deposits, mortgage functions, making use of for credit score and debit playing cards, paying taxes and payments and so on.

The DBUs will allow individuals to “have cost-effective, handy entry and enhanced digital expertise of banking services” all yr spherical, the assertion stated.

“Additionally, there shall be satisfactory digital mechanisms to supply real-time help and redress buyer grievances arising from enterprise and companies supplied by the DBUs instantly or by enterprise facilitators/ correspondents,” the assertion added.