The second half of the yr is now properly underway and comes off the again of a surprisingly sturdy first 6 months for the inventory market. The primary half was outlined by a banking meltdown adopted by a debt ceiling disaster that was narrowly averted. All of the whereas, discuss of an imminent recession buzzed within the background.

But, regardless of these issues, the markets rallied. As inflation continued to indicate indicators of being on the backfoot, many financial specialists started touting the concept that if a recession does come into play, will probably be a comparatively tame one.

Though August has skilled some market weak spot, if historical past is something to go by, J.P. Morgan’s U.S. Head of Funding Technique Jacob Manoukian thinks that the remainder of the yr seems extremely promising.

“A powerful first half of the yr usually begets a robust second half,” Manoukian not too long ago stated. “Since 1950, when the S&P 500 has been up over 10% within the first half of the yr, the median achieve for the index within the second half of the yr has been one other 10%. Second-half returns after a robust first half have been even higher when the prior yr was unfavorable.”

So, with that constructive outlook in tow, the query is, which equities ought to traders be loading up on at current? The JPMorgan analysts have been busy searching for out these names and have homed in on two they suppose make good additions to a portfolio on this setting. And they don’t seem to be alone, in response to TipRanks’ database, each are additionally rated as ‘Robust Purchase’s by the analyst consensus. Let’s see why they’re drawing plaudits throughout the board.

Procore Applied sciences (PCOR)

It’s no secret, the yr’s rally has been pushed by the tech sector, and that’s the place our first JPMorgan-backed identify resides. Procore Applied sciences is a software program firm with a singular promoting level. It focuses on the development business, providing development administration software program that revolutionizes the best way development professionals collaborate, talk, and handle tasks.

Procore’s complete platform gives a variety of instruments and options, together with challenge administration, doc management, monetary administration, high quality and security administration, and useful resource planning, all built-in right into a single cloud-based resolution.

The development business is a latecomer to the digital revolution and ripe for disruption. Procore has taken benefit of this and has elevated its income constantly over the previous few years. That was the case once more within the not too long ago reported Q2 print.

The corporate generated income of $228.5 million, representing a 32.7% year-over-year uptick and beating the forecast by $10.52 million. Adj. EPS of $0.02 got here in properly above the -$0.09 anticipated by the analysts. As for the outlook, Q3 income is anticipated to hit the vary between $232 million and $234 million, above consensus at $231.79 million, amounting to a y/y enhance between 24% to 26%.

JPMorgan analyst Alexei Gogolev thinks there may be a lot to admire right here. He writes, “We proceed to love Procore because it falls right into a cohort inside our vertical software program protection, which is ready to keep comparatively insulated from weaknesses within the underlying market they serve… Procore is well-positioned as a result of it’s automating among the many least digitalized industries within the international financial system. On the periphery, alternatives — resembling emphasizing funds and insurance coverage options — are set to supply aggressive providers that are to develop into extra merchandise to cross-sell and up-sell to shoppers…”

“With almost c.50% of gross sales spent on Gross sales and Advertising and marketing, Procore stays vehement that there’s extra market to grab and therefore seems disinterested from turning EBIT constructive within the close to time period,” Gogolev additional stated.

These feedback underpin Gogolev’s Obese (i.e. Purchase) score whereas his $85 worth goal implies one-year share appreciation of 27%. (To observe Gogolev’s observe file, click on right here)

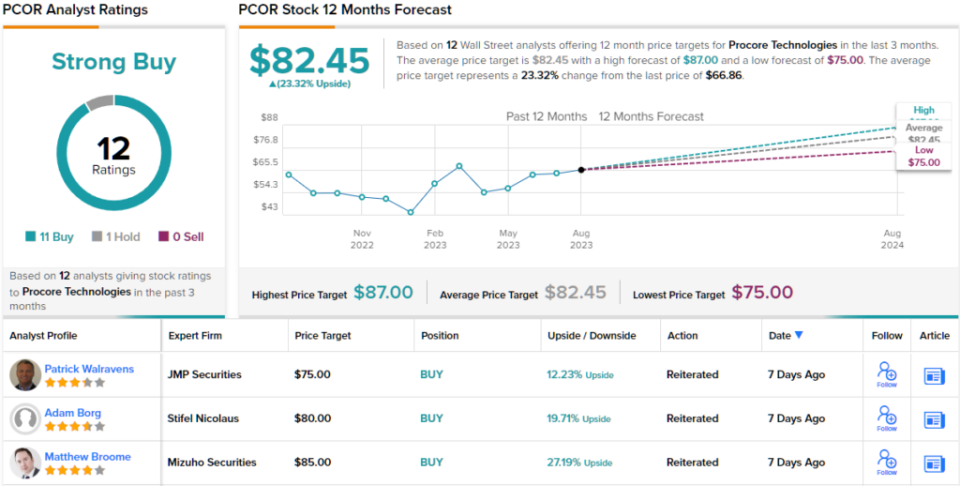

Total, the Robust Purchase consensus score exhibits that Wall Road usually agrees with the JPMorgan take right here. PCOR has 12 analyst critiques on file, together with 11 Buys and 1 Maintain. At $82.45, the typical suggests shares will climb 23% larger over the approaching months. (See PCOR inventory forecast)

Scorpio Tankers (STNG)

Let’s now flip from development software program to the marine transportation enterprise. Scorpio Tankers is a number one transport firm that focuses on transporting refined petroleum merchandise and bulk commodities. The Monaco-based agency is a big participant within the international transport business with a fleet comprising trendy vessels, together with eco-friendly carriers designed to satisfy environmental requirements. The corporate serves a clientele mixture of oil majors, merchants, and authorities entities throughout the globe, and thru strategic fleet enlargement and technological developments, has managed to remain aggressive and supply dependable transport options.

Volatility is a trademark of the worldwide oil transport business, with frequent price and income fluctuations on account of shifts in oil provide and demand, geopolitical occasions, and financial circumstances. These points affected the efficiency of the corporate in Q2.

Income fell by 18.7% year-over-year to $329 million, on the similar time lacking the consensus estimate by $14.83 million. And whereas the corporate has proven the flexibility to navigate a posh panorama and generate earnings, adj. EPS of $2.41 fell shy of Road expectations by $0.08.

Nevertheless, regardless of the misses, traders reacted positively to the outcomes. This isn’t a lot of a shock to JPMorgan analyst Sam Bland, who, going by administration’s commentary, thinks the outlook seems favorable to Scorpio.

“Seasonally August is often a weak month. Nevertheless, we observe alerts that charges are starting to enhance, with STNG now indicating the LR2 charges are above $40,000 / day, and MRs above $30,000. To some extent, this enchancment appears to be sentiment-driven, round improved macro outlook views, versus any precise demand / provide enchancment,” Bland defined. “These charges examine to a mean booked in Q3 to this point of $27,000. Whereas it is probably not linear, we anticipate a common upwards motion in charges over the approaching months, pushed by seasonality and anticipated will increase in demand. Provide / demand seems possible to enhance additional in 2024, and probably additionally in 2025.”

Accordingly, Bland has an Obese (i.e., Purchase) score on Scorpio Tankers shares to go alongside an $85 worth goal. The implication for traders? Upside of 69% from present ranges. (To observe Bland’s observe file, click on right here)

Total, 3 different analysts be part of Bland within the bull camp and the addition of 1 fencesitter can’t detract from a Robust Purchase consensus score. The forecast requires 12-month returns of 36%, contemplating the typical goal stands at $68.40. (See STNG inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.