Who doesn’t love a discount? Shopping for high quality for a low value is without doubt one of the thrills of the market system – and that applies to inventory markets as nicely. The trick is realizing which rock-bottom shares are the suitable ones to purchase.

Loads of shares are priced low, and bargain-hunting buyers want to search out those whose fundamentals are sound. The sheer quantity of shares, and the reams of information they produce, makes that tough – however Wall Avenue analysts make their dwelling by taking deep dives behind the scenes of the inventory market, and their suggestions are all the time value a learn.

Utilizing the analyst critiques as a information and backing them up with the newest knowledge from TipRanks, we’ve picked out two shares that ought to entice the curiosity of bargain-minded buyers. Each shares maintain ‘Sturdy Purchase’ scores from the analysts, and each are displaying important losses over the previous yr, on the order of fifty% or extra. Let’s take a more in-depth look.

ADTRAN, Inc. (ADTN)

Let’s begin with ADTRAN, an organization primarily based in Alabama that provides ‘open, disaggregated networking and communications options’ on a worldwide scale. ADTRAN’s product vary encompasses voice, knowledge, video, and web communications options, all adaptable to current community infrastructures. Collaborating with service suppliers worldwide, the corporate facilitates scalable administration of providers, linking people, areas, and gadgets.

ADTRAN maintains workplaces within the UK, Europe, the Center East, and Australia, catering to tens of millions of shoppers in governmental and personal sectors. The corporate’s portfolio covers community infrastructure, fiber entry, aggregation, open optical networking, residential and enterprise options, cloud software program, in addition to providers and help.

Shares in ADTRAN are down 59% up to now this yr, with a sequence of disappointing earnings outcomes not serving to its case, as occurred within the lately launched Q2 print. The 2Q23 numbers confirmed a high line of $327.4 million, for a 90% y/y improve – however lacking the forecast by $2.3 million. Trying forward, ADTRAN anticipates 3Q23 income to vary between $275 million and $305 million, which lags behind the consensus estimate of $352.5 million.

This world telecom agency has caught the eye of Rosenblatt’s 5-star analyst Mike Genovese, who defends the corporate, and factors out in his latest be aware a number of the explanation why buyers ought to contemplate proudly owning the inventory. Laying out the case, Genovese writes: “1) The inventory is cheap at below 0.5x EV-to-2024 gross sales. 2) The corporate has received extra Huawei substitute enterprise than every other (six EMEA Tier 1 wins) and the income development from these wins remains to be forward. 3) We count on 2024 to be a superb yr, and suppose Adtran will possible develop revenues by double-digits. 4) Trade comps, and stock correction pressures, ought to turn out to be a lot simpler in 4Q23, in comparison with 3Q23, and proceed to enhance in early 2024. In different phrases, we expect 3Q23 is the underside for the trade.”

Monitoring ahead from these feedback, Genovese charges ADTN shares as a Purchase, and his value goal, of $11, implies a one-year upside potential of ~44%. (To look at Genovese’s monitor document, click on right here)

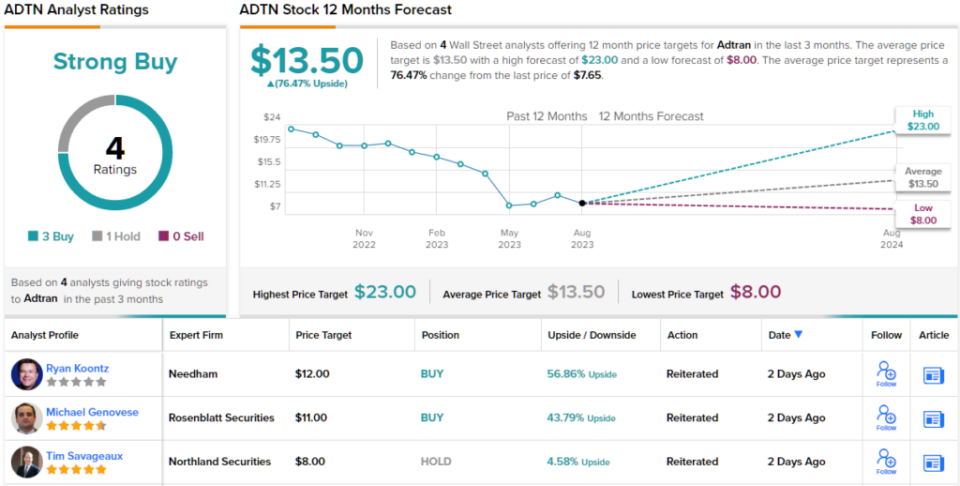

Total, there are 4 latest analyst critiques on ADTN shares, breaking down 3 to 1 favoring Buys over Holds, to make the Sturdy Purchase consensus score. The shares have a present buying and selling value of $7.65, and the $13.50 common value goal suggests the inventory will acquire ~76% within the subsequent 12 months. As an added bonus, ADTRAN pays a ahead annual dividend yield of 4.7%. (See ADTRAN inventory forecast)

IGM Biosciences (IGMS)

The second beaten-down inventory we’re taking a look at is a biomedical analysis agency, IGM Biosciences. This firm is working within the subject of antibody medicines, utilizing IgM antibodies as the start line in its improvement therapeutic brokers designed to surpass the shortcomings of current IgG antibody medicines. The corporate has used IgM know-how to create a number of ‘tremendous antibodies,’ that are forming the bottom of a brand new class of superior drug candidates.

IGM has put collectively a proprietary pipeline with seven energetic analysis tracks. Of those, one remains to be in preclinical improvement, however the different six have moved to Part 1 scientific trials. These pipeline analysis tracks embrace each monotherapy and mixture remedy applications, and goal a wide range of cancers. The main drug candidate, aplitabart, is the topic of three trials, together with different anti-cancer medicine, in opposition to colorectal most cancers, acute myeloid leukemia, and strong tumors.

IGM reported a number of constructive steps in its pipeline applications. Distinguished amongst these was the rehash of constructive scientific knowledge from the Part 1 trial of aplitabart + Folfiri within the therapy of colorectal most cancers. The corporate reported that 51 sufferers on the drug mixture confirmed ‘promising exercise by way of progression-free survival.’

Moreover, the corporate’s drug candidate imvotamab, a possible therapy for autoimmune ailments, obtained FDA clearance for 2 Part 1b scientific trials. The primary will goal extreme systemic lupus erythematosus (SLE) whereas the second will deal with extreme rheumatoid arthritis (RA). Each trials are anticipated to provoke throughout 3Q23.

Nonetheless, regardless of all this exercise, shares in IGMS are down 54% up to now this yr. That brings the value down, and Stifel analyst Stephen Willey sees that as a shopping for alternative. In his feedback, the 5-star analyst notes the continuing progress of aplitabart, earlier than coming to a bullish conclusion:

“We proceed to imagine the biology of concurrently modulating extrinsic/intrinsic apoptosis signaling pathways has much-broader purposes past mCRC and Aplitabart stays the centerpiece of our longer-term estimates/valuation… We imagine administration’s disclosure of incremental affected person efficacy/security knowledge from the single-arm, dose-expansion cohorts evaluating the mixture of Aplitabart 3mg/kg + FOLFIRI ± bevacizumab (Bev) in largely 3L+ mCRC sufferers is directionally-positive and further-confirms our confidence within the underlying organic speculation (simultaneous extrinsic/intrinsic apoptosis pathway modulation) and longer-term path ahead.”

“A number of extra disclosures/updates anticipated from this improvement program by YE23 now present necessary near-term catalysts for what we imagine stays an undervalued/underappreciated inventory,” Willey summed up.

To this finish, Willey charges IGMS shares as a Purchase, and his goal value of $26 exhibits his confidence in a sturdy 230% acquire within the coming yr. (To look at Willey’s monitor document, click on right here)

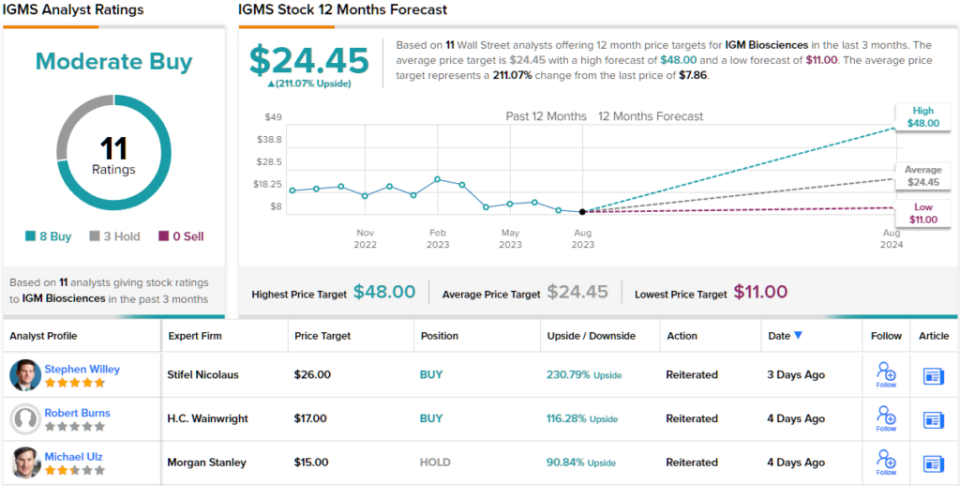

Total, IGM’s 11 latest analyst critiques, together with 8 Buys to three Holds, help the inventory’s Purchase score, whereas the typical value goal of $24.45 and buying and selling value of $7.86 mix to recommend a 211% upside potential on the one-year horizon. (See IGM inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.