The markets have skilled a interval of volatility over the previous month, elevating questions on the place they could be heading subsequent. Has the yr’s robust rally hit a brick wall, or is it only a pause earlier than the following leg up?

It’s a query that has been fielded to Goldman Sachs’ chief U.S. fairness strategist David Kostin. The excellent news for traders is that going by the course the broader financial system is taking, Kostin makes some reassuring noises on the matter.

Decelerating inflation knowledge presents affirmation that “disinflation is properly below manner,” whereas traders now see much less of a threat for a recession given financial development knowledge has “remained sturdy.”

These optimistic developments level towards an consequence desired by inventory market contributors. “Because the US financial system nears a gentle touchdown,” Kostin says, “traders have room to additional enhance their publicity to equities.”

If it’s time to increase publicity to equities, the following query naturally is: which equities precisely?

The analysts at Goldman have an thought about that too. They’ve pinpointed a chance in two names, and it appears like the remainder of the Avenue is onside as properly. In response to the TipRanks database, each are rated as Sturdy Buys by the analyst consensus. Let’s discover out why they’re getting the thumbs up on Wall Avenue proper now.

Sagimet Biosciences (SGMT)

The primary Goldman choose we’ll take a look at is Sagimet Biosciences, a clinical-stage biotech agency, engaged on novel therapeutics known as fatty acid synthase (FASN) inhibitors. These are meant as remedies for illnesses similar to non-alcoholic steatohepatitis (NASH), pimples and completely different cancers. Sagimet has solely been a public entity for a bit of over a month, having held its IPO in mid-July.

Sagimet has one drug candidate, denifanstat – an oral, once-daily capsule in growth for the remedy of nonalcoholic steatohepatitis (NASH). In collaboration with its Chinese language associate Ascletis, the drug can be being developed as a possible remedy for pimples and most cancers.

But it surely’s the NASH alternative that’s most below the microscope proper now. There are at the moment no permitted drugs to deal with the situation, and it’s estimated that by 2030 it might characterize a worldwide market value roughly $108 billion. In reality, the US Nationwide Institutes of Well being reckons that, within the US, as many as 24% have NAFLD (non-alcoholic fatty liver illness), NASH’s precursor, with round 1.5% to six.5% inflicted with NASH.

Sagimet not too long ago offered deliberate interim knowledge from the FASCINATE-2 Section 2b medical research for denifanstat that demonstrated it was well-tolerated and met the liver fats response endpoint. Biopsy outcomes are anticipated to be launched in 1Q24.

Goldman Sachs analyst Andrea Tan has excessive hopes for the drug. She writes, “With 26-week interim Ph2b FASCINATE-2 knowledge confirming denifanstat’s sturdy profit on lowering liver fats content material, irritation, and fibrosis per biomarkers coupled with rising proof on the correlation between liver fats discount per MRI-PDFF and NASH decision per histology, we’re optimistic into the upcoming biopsy knowledge in 1Q24, the totality of which ought to assist development to a pivotal program.”

“Whereas we acknowledge the aggressive panorama, denifanstat’s differentiated mechanism of motion, alongside a predictive biomarker panel, might assist a best-in-class profile and seize a blockbuster alternative in F2/F3 NASH sufferers (GSe peak international gross sales of $3.7bn in 2037),” Tan went on so as to add.

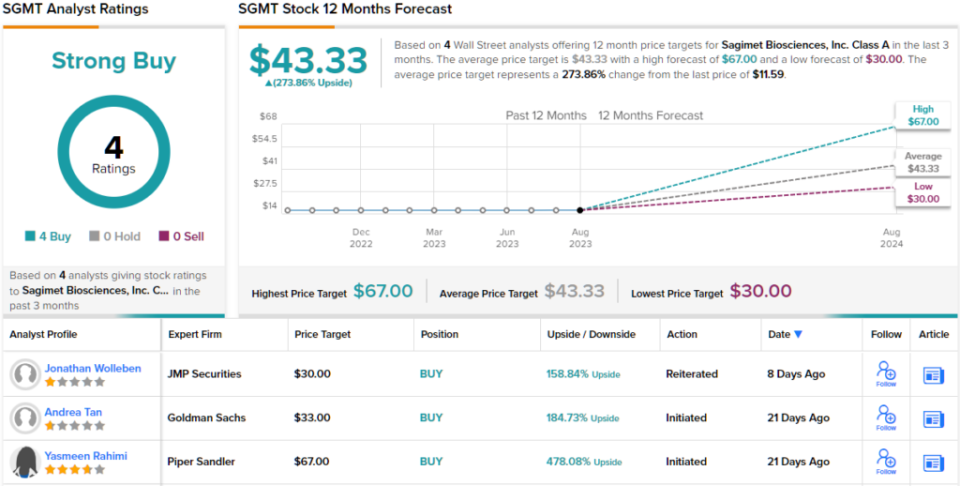

Conveying her confidence, together with a Purchase score, Tan provides SGMT a $33 value goal, suggesting ~185% upside potential over the following 12 months. (To look at Tan’s monitor report, click on right here)

In its brief time on the markets, SGMT has obtained 4 analyst opinions, and all are optimistic, making the consensus view right here a Sturdy Purchase. The common goal is much more bullish than Tan will permit; at $43.33, the determine makes room for 12-month returns of ~274%. (See SGMT inventory forecast)

Xenon Prescribed drugs (XENE)

The subsequent Goldman choose we’re is Xenon Prescribed drugs, a biotech firm centered on remedies for sufferers affected by neurological issues. Particularly, the corporate is concentrating on areas the place there’s a excessive unmet want.

Main the pipeline growth, the corporate is engaged on a number of analysis packages for XEN1101, a differentiated Kv7 potassium channel opener. It’s being developed as a remedy for epilepsy and different neurological circumstances, together with main depressive dysfunction (MDD).

Milestones inform the funding path for biotechs as they act as catalysts for inventory motion. And right here, Xenon has an enormous one arising.

With sufferers now totally enrolled within the XEN1101 Section 2 X-NOVA research of MDD, the corporate anticipates having a top-line knowledge readout round late November/mid-December. Previous to that, the corporate will maintain a webinar subsequent month during which it is going to talk about the MDD program and panorama.

Elsewhere within the pipeline, the corporate can be progressing its XEN1101 Section 3 epilepsy program, which incorporates two equivalent Section 3 medical trials (X-TOLE2 and X-TOLE3), and the Section 3 (ACKT) research of XEN1101 in major generalized tonic-clonic seizures (PGTCS).

These research inform Goldman Sachs analyst Paul Choi’s optimistic thesis for Xenon, who notes traders specific give attention to the MDD alternative.

“Our current investor dialog suggests important curiosity within the upcoming X-NOVA MDD research, which might characterize one other vital leg of development for XEN1101, in our view,” Choi mentioned. “Additional, given the potential learn by means of from the prior optimistic ezogabine knowledge, the Kv7 agonism mechanism of motion that was evaluated in a proof-of-concept randomized placebo managed medical trial (n=45), together with the pre-clinical knowledge profile of XEN1101, which we predict might assist the speculation that XEN1101 could have an affordable probability of succeeding in MDD… Moreover, XENE plans to share further knowledge from X-TOLE OLE research on XEN1101’s impacts on high quality of life and long-term use at two upcoming medical conferences.”

“General, we predict these vital medical catalysts within the second half 2023 might probably validate the corporate’s main place in neurology and we glance subsequent to the KOL dialogue on MDD in mid-September,” the analyst summed up.

What does this all imply for traders? Choi charges XENE shares as a Purchase, backed by a $60 value goal, implying the inventory stands to achieve ~56% over the one-year timeframe. (To look at Choi’s monitor report, click on right here)

General, 5 different analysts have not too long ago waded in with XENE opinions and all are optimistic, offering the inventory with a Sturdy Purchase consensus score. At $55.17, the common goal makes room for development of 43% within the months forward. (See XENE inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.