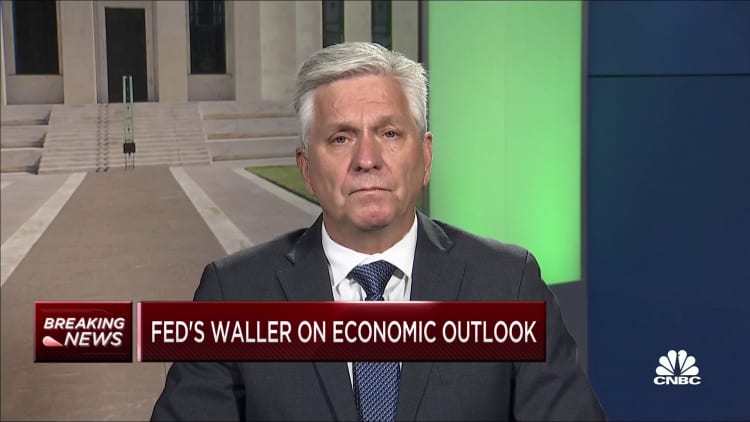

Federal Reserve Governor Christopher Waller stated Tuesday that the current spherical of robust financial knowledge will purchase the central financial institution a while because it decides whether or not further rate of interest hikes are wanted to regulate inflation.

“That was a hell of week of information we received final week, and the important thing factor out whether it is it will permit us to proceed fastidiously,” Waller instructed CNBC’s Steve Liesman throughout a “Squawk Field” interview. “We are able to simply sit there, watch for the info, see if issues proceed.”

Highlighting these knowledge factors was Friday’s nonfarm payrolls report, which confirmed better-than-expected progress of 187,000 jobs in August whereas common hourly earnings rose simply 0.2% for the month, decrease than forecast.

Earlier within the week, different studies confirmed that the Fed’s most well-liked inflation gauge rose simply 0.2% in July, and that job openings, a key measure of labor market tightness, fell to their lowest degree since March 2021.

“The largest factor is simply inflation,” Waller stated. “We received two good studies in a row.” The important thing now’s to “see whether or not this low inflation is a development or if it was simply an outlier or a fluke.”

Waller is mostly thought of one of many extra hawkish members of the rate-setting Federal Open Market Committee, that means he has favored tighter financial coverage and better rates of interest because the central financial institution battles inflation that in the summertime of 2022 was operating at its highest price in additional than 40 years.

Whereas he was inspired by the current studies on the place costs are trending, he stated in addition they point out that the Fed can afford to carry charges increased till it’s positive inflation is on the run.

“That relies on the info,” Waller stated when requested whether or not the speed will increase can cease. “We now have to attend and see if this inflation development is continuous. We have been burned twice earlier than. In 2021, we noticed it coming down after which it shot up. The tip of 2022, we noticed it coming down, then all of it received revised away.”

“So, I wish to be very cautious about saying we have form of carried out the job on inflation till we see a few months persevering with alongside this trajectory earlier than I say we’re carried out doing something,” he added.

Markets are assigning a near-certainty to the possibilities that the Fed skips a hike at its Sept. 19-20 assembly. Nonetheless, there is a 43.5% chance of a rise on the Oct.31-Nov. 1 session, in line with CME Group monitoring of futures pricing, indicating some uncertainty. Goldman Sachs this week stated it expects the Fed is completed.

“I do not suppose another hike would essentially throw the economic system into recession if we did really feel that we wanted to do one,” Waller stated. “It is not apparent that we’re in actual hazard of doing numerous injury to the job market, even when we increase charges another time.”

Waller’s remarks come lower than two weeks after Fed Chair Jerome Powell stated inflation continues to be too excessive and will require extra price hikes, although he famous policymakers will “proceed fastidiously” earlier than shifting.