With the third quarter winding down, and the ultimate quarter of the yr nearly upon us, it’s time to take inventory of inventory markets. The place are we prone to go within the subsequent few months, and what are the possible forces to influence buying and selling? In some current feedback on CNBC, Citi strategist Scott Chronert lays out his personal perception that we’re prone to see some additional positive factors.

Chronert first factors out that fears of a tough recession have light, or as he places it, “We’ve been pricing in a comfortable touchdown because the first a part of June.” Backing this, Chronert states that the Fed’s fee cycle is close to its peak, and that company earnings are prone to stay resilient. At his backside line, Chronert provides, “I believe all advised the steadiness remains to be to the upside into the top of the yr, and we’re going to fall again on our ongoing view that the basic underpinning for the S&P stays fairly constructive at this level.”

Operating with this constructive sentiment, the analysts at Citi pinpointed three names that they see as poised to ship over 40% positive factors. We ran this trio of Citi-recommended names by the TipRanks database to seek out out what the remainder of the Road has to say about them. It seems that each one three are rated as Buys by the analyst consensus. Let’s discover out why.

Tenting World Holdings (CWH)

We’ll begin within the leisure sector, with Tenting World Holdings, one of many largest corporations within the outside recreation area of interest. Tenting World is principally a supplier in new and used leisure automobiles, in addition to RV leases, however the firm additionally offers in RV equipment, for each inside and outdoors the automobiles, in boats and different watercraft, in moveable mills, and in tenting tools and equipment.

The corporate is a holding agency and operates primarily by two manufacturers: its eponymous Tenting World and the Good Sam model. By way of these subsidiaries, Tenting World Holdings has develop into the US leisure market’s largest RV supplier and a pacesetter in associated outside and tenting merchandise. The agency makes some extent of figuring out its clients and adjusting product strains to satisfy their preferences. It has been in enterprise since 1966.

Turning to firm outcomes, we discover that CWH reported record-level gross sales of used car models in 2Q23, the latest quarter reported. Nonetheless, the corporate’s top-line income of $1.9 billion fell greater than 13% year-over-year and missed the forecast by $70 million. On the backside line, Tenting World Holdings had a non-GAAP EPS of 73 cents per share, 3 cents beneath expectations.

Tenting World Holdings presents traders common share dividends and has a historical past of adjusting the fee to adapt to present situations. The latest declaration for 3Q23 set the frequent share fee at $0.125 per share or 50 cents annualized, giving a 2.3% yield. The fee is scheduled for September 29. The present dividend represents an 80% discount from the earlier quarter.

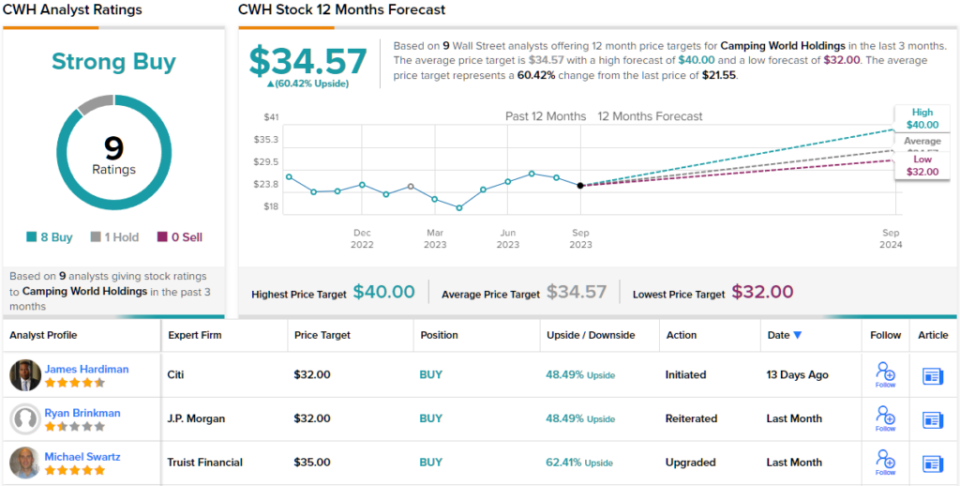

Shares on this veteran leisure firm tumbled after the earnings launch and dividend minimize. The inventory is down 31% from pre-release ranges. For Citi 5-star analyst, James Hardiman, nevertheless, this discount in share value marks a possibility for traders to purchase in.

“CWH is our High Choose within the RV area and we consider it’s the easiest way to play an RV business restoration, every time it arrives, as the corporate has a long-term macro-independent market share story pushed by M&A and scale in a fragmented business. The RV business is displaying preliminary indicators of stabilization and restoration that we consider will start to play out over the course of 2024 and past. We anticipate pricing/margin to stay below stress for RV producers in 2024, which may assist spur demand for RV sellers. In the meantime, shares have offered off just lately, offering what we consider is a sexy entry level from a valuation perspective,” Hardiman opined.

Based mostly on that bullish stance, Hardiman charges CWH inventory a Purchase and provides it a $32 value goal, implying a one-year upside potential of ~48%. (To look at Hardiman’s monitor report, click on right here)

General, the Road stays bullish on CWH. The inventory’s 9 current analyst critiques break down 8 to 1 favoring Buys over Holds, for a Sturdy Purchase consensus score, and the $34.57 common value goal suggests a 60% one-year acquire from the present buying and selling value of $21.55. (See CWH inventory forecast)

Sociedad Quimica Y Minera de Chile (SQM)

Subsequent below the Citi microscope is SQM, a Chilean mining agency with a strong presence within the lithium business. SQM is the world’s single largest producer of lithium and can be identified for its work within the chemical business, the place it produces iodine and potassium utilized in plant fertilizers and industrial chemical compounds. The corporate has famous that lithium gross sales volumes are at report ranges, pushed by elevated demand – significantly within the electrical car market.

Along with manufacturing work, SQM additionally distributes lithium. This yr, the corporate has entered into new agreements with Ford Motor Firm and LG Vitality Options for the long-term provide of lithium, a transfer that guarantees to maintain the corporate’s gross sales at excessive ranges. Decrease spot costs within the Chinese language lithium markets, nevertheless, are having a miserable impact on SQM’s backside line.

That is mirrored in misses in each revenues and earnings within the firm’s final reported outcomes. Particularly, SQM’s second-quarter topline of $2.05 billion was down 21% year-over-year and missed the estimates by $74.5 million. On earnings, the Q2 EPS of $2.03 was 61 cents beneath expectations.

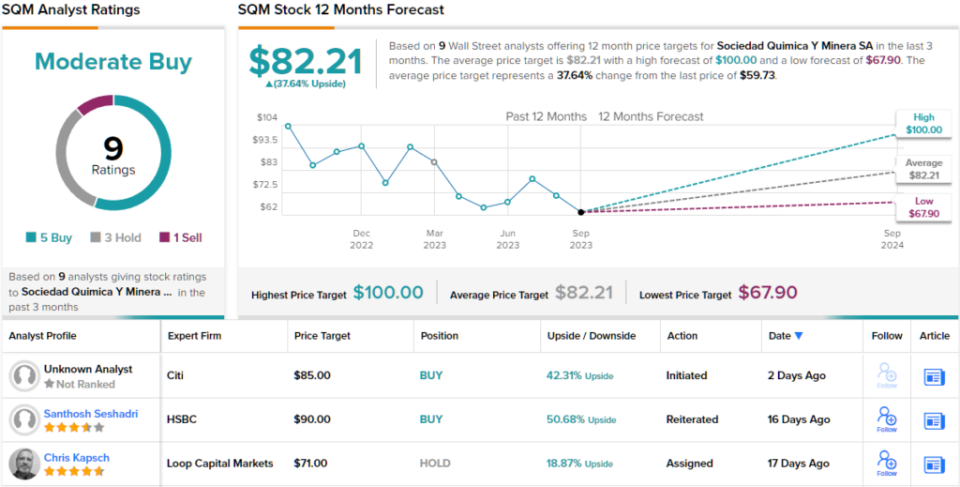

SQM shares have declined greater than 21% to date this yr. That decline doesn’t hassle Citi analyst Carolina Cruzat, nevertheless, who believes that SQM is promoting effectively beneath the place it ‘ought to.’

“Bearing in mind that SQM has been an underperformer within the native market and present valuations appear to be on the underside, we consider the share low cost to be extreme, contemplating: (i) stable mid-term fundamentals on the lithium market; and (ii) the inventory is at present priced beneath the worth of the money flows till 2030, with a related upside in the event that they get truthful renewal situations on their lease settlement with Corfo. We consider traders internalize a really damaging situation concerning the potential consequence from the proposed new lithium regulatory framework, even when it means dropping the concession over the Salar de Atacama,” Cruzat defined.

Including that the primary dangers listed here are already priced in, Cruzat charges the inventory a Purchase. Her value goal, of $85, factors towards a 42% upside potential on the one-year horizon.

What does the remainder of the Road assume? Trying on the consensus breakdown, opinions from different analysts are extra unfold out. 5 Buys, 3 Holds and 1 Promote add as much as a Average Purchase consensus. As well as, the $82.21 common value goal signifies ~38% upside potential from present ranges. (See SQM inventory forecast)

Sunrun, Inc. (RUN)

Final however not least is Sunrun, a pacesetter within the area of residential solar energy installations. Sunrun is named a full-service supplier within the residence photo voltaic area of interest, designing, constructing, and putting in bundle photo voltaic offers and made-to-order installations for single-family properties. Their packages embody the whole lot wanted for a selected set up, from rooftop photovoltaic panels to native grid connections, in addition to good management techniques and energy storage batteries.

Along with residence photo voltaic installations, Sunrun additionally presents financing companies. Prospects can select to pay in full upfront or amortize the total value of the set up as a lease on the tools, with long-term or month-by-month fee choices. Sunrun payments itself because the #1 firm within the US residential solar energy market, with over 800,000 clients throughout 22 states plus Puerto Rico and $1.1 billion in annual recurring income.

This robust basis is the results of Sunrun’s ongoing efforts to broaden its presence out there. Whereas income in 2Q23, the final reported, elevated by just one% year-over-year to $590.2 million, the corporate achieved notable milestones. Gross sales exercise outdoors the state of California, the place the corporate has its largest footprint, grew by 25% year-over-year. Furthermore, the overall put in storage capability elevated by 35% year-over-year, reaching 103 megawatt hours. The corporate’s most stunning achievement, nevertheless, was posting a web revenue of 25 cents per diluted share in Q2, surpassing the anticipated web loss by 64 cents per share.

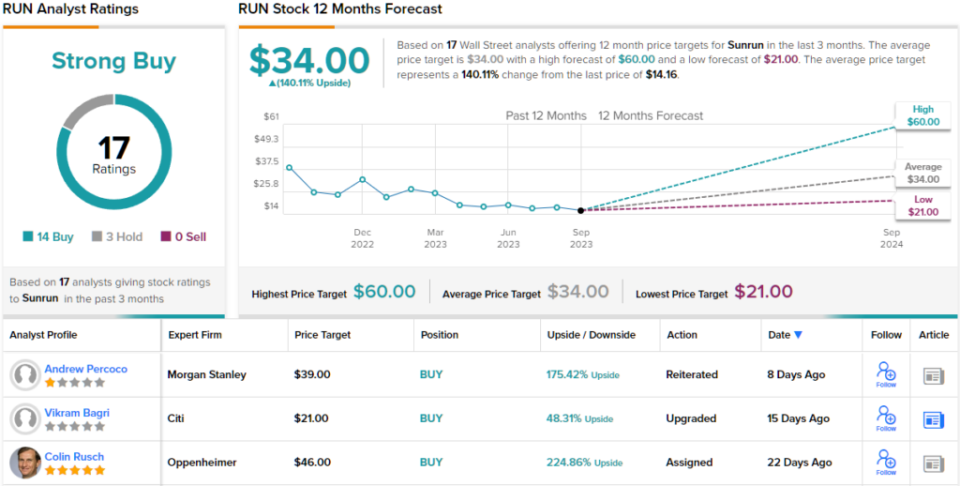

The corporate’s non-California progress caught the attention of Citi analyst Vikram Bagri, who sees that as an vital issue supporting the inventory going ahead.

“Larger charges and NEM impacts look like largely priced-in, however RUN just isn’t getting due credit score for 1) market share positive factors from TPO shift, 2) path to FCF technology, 3) no company degree fairness raises, 4) projected part value deflation, 5) ITC adder advantages, and 6) demonstrated success in promoting battery storage (>80% connect fee on new gross sales in CA and >30% nationally). CA will face headwinds in ’24 however RUN’s main >60% TPO market share and financing runway means consensus expectations for ~6% MW set up progress in FY24 seem achievable as shoppers search out photo voltaic+storage to avoid wasting on utility payments. As well as, we consider there’s upside to web subscriber worth estimates,” Bagri opined.

“We obtained a number of questions on valuation for RUN and consider the inventory is conservatively price ~$21/sh within the LT,” Bagri provides, declaring a stable backside line to his stance.

General, the analyst’s Purchase score and $21 value goal point out confidence in a 48% acquire going ahead into subsequent yr. (To look at Bagri’s monitor report, click on right here)

The Citi view might turn into the conservative take a look at Sunrun – the inventory’s Sturdy Purchase consensus score relies on 17 analyst critiques that embody 14 Buys and three Holds. The shares are priced at $14.16 and the $34 common value goal suggests a sturdy upside of 140%. (See RUN inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your individual evaluation earlier than making any funding.