A sensible investor is a affected person investor, within the recreation for the lengthy haul. Warren Buffett, a legend within the markets, has lengthy been recognized for advocating long-term holdings – and so does the banking big Morgan Stanley. The financial institution’s annual ‘Classic Values’ report factors out the agency’s high shares for a ‘buy-and-hold’ technique on the one-year horizon.

The present Classic Values record has lots to say on the topic, however just a few options of their picks stand out. First, all of their selections are mid- or large-cap shares. Second, their Classic Values alternatives lean strongly in the direction of high-quality names. And at last, these names are buying and selling at a cut price in comparison with the market.

There’s another necessary level to make about Morgan Stanley’s Classic Worth record. Since they began publishing these picks 14 years in the past, the record has tended to outperform the S&P 500. The 2022-2023 record, the predecessor of this one, beat the index by 941 foundation factors over 12 months.

So let’s see simply what Morgan Stanley says buyers can buy and maintain. Listed here are two of the agency’s Classic Values.

NextEra Power, Inc. (NEE)

The primary Classic Worth decide we’re taking a look at is NextEra, a renewable power firm and an necessary element of the clear power trade. NextEra has between $85 billion and $95 billion in infrastructure enhancements deliberate for the subsequent two years, and has 67 gigawatts of energy era in operation. NextEra is the proprietor of the Florida Energy & Mild firm, the biggest electrical utility within the US, and supplies energy to greater than 12 million folks throughout the state of Florida.

Along with its Florida operations, NextEra has belongings in a number of different states, together with emission-free nuclear energy era in Wisconsin and New Hampshire. The corporate is a pacesetter in wind and solar energy era, and operates a number of renewable energy era services in Texas.

All of that’s good, however NextEra sees the way forward for energy era within the hydrogen power sector. The corporate is working with US authorities businesses to develop and fund inexperienced hydrogen power tasks, and is investing as much as $20 billion into hydrogen capital tasks, with a objective to develop as much as 15 gigawatts of renewable hydrogen energy era by 2026.

On the backside line, the corporate’s revenues have been growing in recent times. Within the final quarterly report, for 2Q23, NextEra reported revenues of $7.35 billion, beating the estimates by $1.18 billion and growing nearly 42% year-over-year. The corporate’s backside line, a non-GAAP EPS of 88 cents, was 6 cents per share higher than had been anticipated.

All of this leads Morgan Stanley’s David Arcaro to an upbeat view of the corporate. The analyst writes, “We stay bullish given low earnings threat, continued robust renewables demand, enhancing provide chain backdrop, and inexperienced hydrogen upside… Hydrogen tasks would require deep talent units throughout a number of areas the place NEE has benefits. We count on NEE to be a pacesetter within the inexperienced hydrogen market whatever the Treasury provisions.”

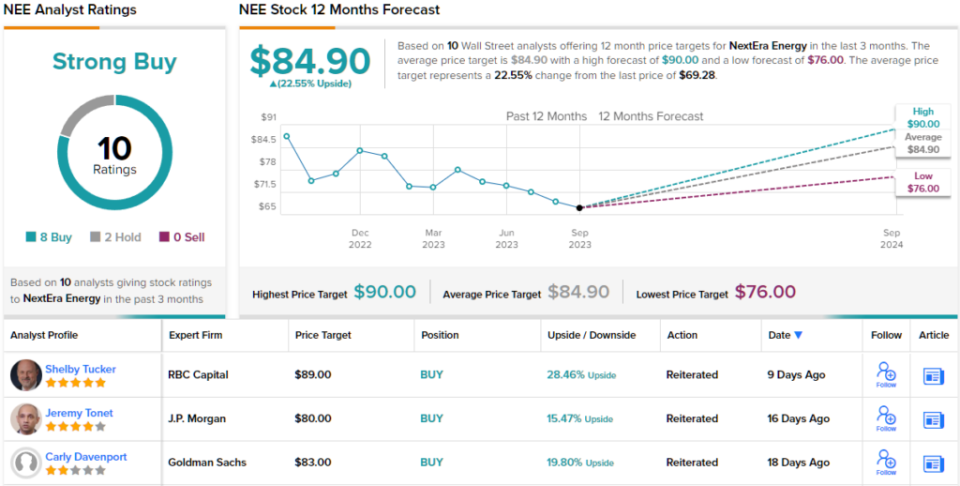

Arcaro’s feedback again up his Obese (i.e. Purchase) ranking on NEE, and his value goal, now set at $90, suggests ~30% upside potential on the one-year timeline. (To look at Arcaro’s observe file, click on right here)

General, this inventory has attracted 10 current evaluations from the Road, with an 8 to 2 breakdown favoring Buys over Holds for a Sturdy Purchase consensus ranking. The shares’ $69.28 buying and selling value and $84.90 common value goal give the inventory ~23% potential achieve within the subsequent 12 months. (See NextEra inventory forecast)

Medtronic PLC (MDT)

The subsequent inventory we’ll take a look at from the Morgan Stanley Classic Worth record is Medtronic, a medical system firm with a variety of merchandise focusing on quite a lot of situations. The corporate has a world footprint, and is a pacesetter in healthcare know-how, describing its mission as ‘attacking probably the most difficult well being issues going through humanity.’

Some primary numbers will present the dimensions and attain of Medtronic’s operations. The corporate’s merchandise have helped greater than 74 million sufferers through the years, and searching ahead, Medtronic has greater than 210 energetic scientific trials testing out new gadgets and merchandise. In its fiscal 12 months 2023, which ended this previous April, Medtronic reported making $2.7 billion price of R&D investments, a stable indicator of confidence in its strategy. And, of explicit curiosity to return-minded buyers, the corporate paid out $3.6 billion in dividends to its shareholders in fiscal 12 months 2023.

The dividend is price a better look. Medtronic has already declared its dividend for fiscal 2Q24. The cost of 69 cents per widespread share marks a 1-cent improve from the year-ago quarter, and can annualize to three.4%. The corporate has a dividend historical past stretching again to the Seventies.

Medtronic final reported earnings for Q1 of fiscal 2024, and confirmed a 4.5% year-over-year improve on the high line; the income determine of $7.7 billion beat the forecast by over $144 million. The corporate’s non-GAAP EPS, at $1.20 per share, was 9 cents higher than anticipated. In a transfer that bodes effectively going ahead, Medtronic additionally bumped up its earnings steering, to the vary of $5.08 to $5.16 per share, or a 7-cent improve on the midpoint. This in contrast favorably to the $5.05 consensus EPS steering expectation.

Wanting below the hood at this inventory, Morgan Stanley’s Patrick Wooden lays out a number of causes for an upbeat outlook: “We see MDT’s pipe as effectively stocked from the innovation standpoint (e.g. Inceptiv, 780G, Simplera, Spyral, Micra, Pulse Choose and many others.), and gross margins are trending in the proper route with a c. 115bps beat regardless of heavy S&OP and provide chain work. Certainly, gross margin supply again to c. 68% is price c. 12% to group earnings alone, and we count on MDT to drive extra constant execution because it consolidates provide and manufacturing.”

“Buying and selling on sub 15x calendar ’24 P/E, regardless of what we count on to be constant MSD natural development and potential c. 200bps upside to margins, together with much less crowded positioning, we stay bullish on MDT shares,” Wooden summed up.

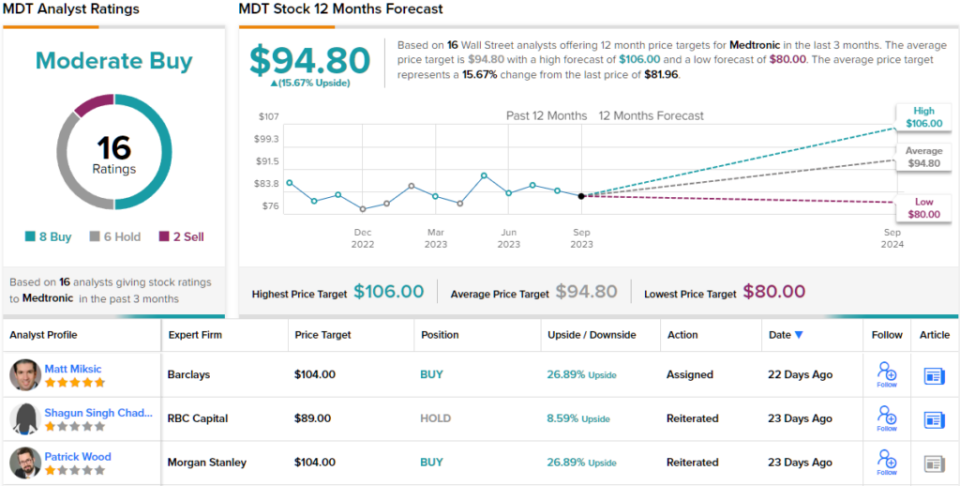

Bullish means an Obese (i.e. Purchase) ranking, and a $104 value goal that factors towards a 27% one-year upside potential. (To look at Wooden’s observe file, click on right here)

General, Medtronic will get a Average Purchase ranking from the analyst consensus. The 16 current analyst evaluations embody 8 Buys, 6 Holds, and a couple of Sells, whereas the $94.80 common value goal suggests ~16% improve from the present buying and selling value of $81.96. (See MDT inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.