OSWEGO, N.Y. — On the snowy jap shore of Lake Ontario sits a beige metallic transport container roughly the dimensions of a cellular dwelling. Inside, a machine referred to as an electrolyzer is zapping tanks of freshwater with sufficient volts to separate the hydrogen out of H2O to reap the gasoline, which the U.S. authorities is banking on changing fossil fuels.

Hydrogen, the lightest and most plentiful factor within the universe, has lengthy been manufactured to be used in fertilizers and oil refining. Just about all the worldwide provide at present is produced by means of a chemical course of that strips the hydrogen out of pure gasoline. Since hydrogen produces solely water when burned, making the gasoline as an alternative with water and electrical energy that comes from a zero-carbon supply presents one thing that capabilities like oil and gasoline with out including carbon dioxide to the ambiance.

The difficulty is that making hydrogen from electrical energy nonetheless generates far fewer molecules than utilizing pure gasoline, making the clear stuff way more costly. The trade makes use of a shade scheme to explain how several types of hydrogen are made: “Grey” hydrogen prices lower than $3 per kilogram to provide at present, and typically drops under $1. The value of “blue” hydrogen, which makes use of that very same fossil technique however captures the planet-heating carbon dioxide earlier than it enters the ambiance, maxes out under $5 and might be lower than $2. The “inexperienced” hydrogen wanted to make a distinction on local weather change can go for as a lot as $12, and prices greater than grey in each market that analysts surveyed this 12 months.

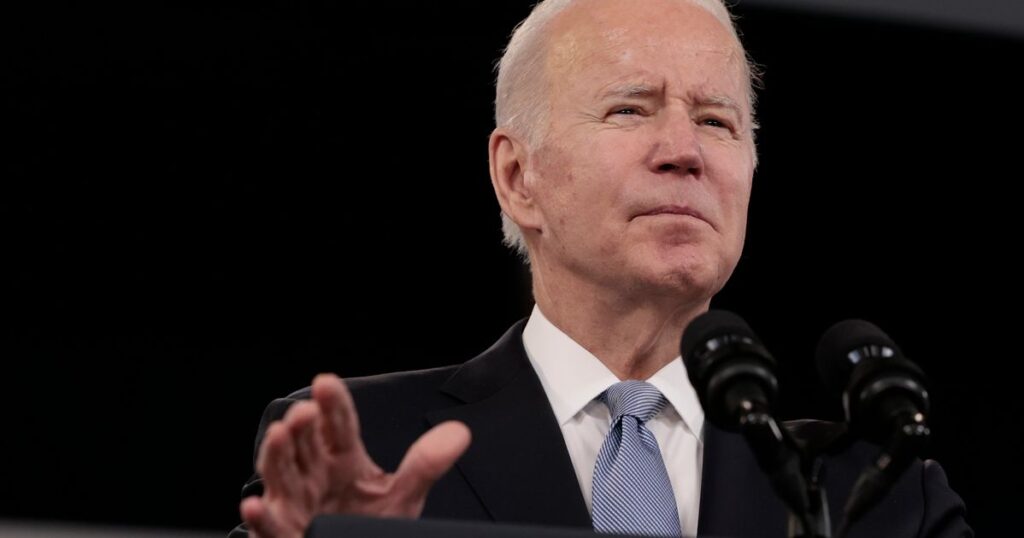

That’s why the Joe Biden administration is spending billions of {dollars} to construct an entire new American hydrogen trade from the bottom up, and produce the worth of inexperienced hydrogen right down to $1 by the tip of the last decade. The president’s Bipartisan Infrastructure Legislation arrange eight regional hubs throughout the nation to develop hydrogen industrial clusters. In the meantime, essentially the most profitable subsidies within the Inflation Discount Act, or IRA — Biden’s landmark local weather spending legislation — provide firms that make hydrogen with clear electrical energy a $3 per kilogram write-off.

It seemed like a windfall to the US’ ailing nuclear energy trade, whose shrinking fleet of reactors is growing in worth because the nation struggles to fulfill electrical energy calls for and supply a 24-hour provide of zero-carbon energy with out the fluctuations innate to wind and photo voltaic vitality. Late final 12 months, Constellation, the largest U.S. nuclear plant operator, started work with the federal authorities on a pilot undertaking to generate clear hydrogen from its two reactors at 9 Mile Level Nuclear Station right here within the rural lakeside school city in northwestern New York.

Hailed by the Vitality Division as a historic “milestone,” it was to be the nation’s first-ever experiment in producing hydrogen from nuclear energy — and, in response to Constellation, the one main industrial effort on the planet.

By March, the electrolyzer’s hum was vibrating the corrugated partitions of its transport container in a fenced-off space outdoors the nuclear plant’s major facility, pulling energy from the reactors. Whereas the corporate declined to supply a greenback determine, Constellation mentioned its home made gasoline was low-cost sufficient for the ability plant right here to cease shopping for the hydrogen it makes use of in its personal reactors from outdoors distributors, and made plans to maintain the electrolyzer going completely. Wanting past its personal facility, the corporate began working with the state vitality company in Albany to provide extra hydrogen to assist hold New York’s lights on.

Constellation now desires to go nationwide with its hydrogen. The Baltimore-based utility large introduced a $900 million funding to construct 1000’s of instances as a lot electrolyzer horsepower at its LaSalle nuclear station in Illinois. In October, the White Home gave the corporate its blessing.

All these plans might go up in flames as early as this week.

That’s when the Treasury Division is predicted to launch its proposed guidelines for a way firms can qualify for the clean-hydrogen tax credit score, often called 45V.

It might change into among the many Biden administration’s most consequential — and controversial — local weather coverage choices.

The controversy — and ensuing lobbying warfare — heart on whether or not firms have to construct new energy vegetation to ensure that hydrogen is, actually, clear and never simply cannibalizing the grid’s provide of zero-carbon electrical energy, driving demand to maintain fossil gasoline stations going.

Amongst those that say hydrogen is just clear if it comes from new inexperienced sources of electrical energy are the European Union, the world’s largest hydrogen-maker, environmentalists and local weather hawks like Sen. Sheldon Whitehouse (D-R.I.), who helped write the IRA laws within the first place.

“With out safeguards, 45V dangers making a shell recreation in energy markets,” the senator wrote in a letter to the White Home, signed additionally by Sens. Jeff Merkley (D-Ore.) and Martin Heinrich (D-N.M.). “We can not afford the hydrogen tax credit score to function one more subsidy for the fossil gasoline trade.”

Alexander C. Kaufman/JHB

A leaked draft of Treasury’s proposal means that the Biden administration agrees.

Such a rule would successfully bar the nuclear trade from getting in on the hydrogen bonanza. By the point any new reactors might be constructed — a course of which will take greater than a decade — the tax credit score would expire. Eleven Democrats who additionally authored the invoice — starting from liberal Sens. John Fetterman (D-Pa.) and Sherrod Brown (D-Ohio) to conservative Sen. Joe Manchin (D-W.Va.) — say the laws was written particularly to permit for using present nuclear stations and different already-built clean-electricity sources.

It’s not simply nuclear operators that need the new-supply requirement nixed. Lobbying alongside Constellation is the Florida-based utility large NextEra Vitality, which operates the biggest fleet of renewable energy vegetation within the nation, as are commerce associations for the hydrogen trade. With some analysts forecasting inexperienced hydrogen to remain costlier than the fossil stuff for many years to return, federal scientists and highly effective labor unions say there’s little hope of overcoming the percentages if the federal government makes it too onerous for firms to learn from the tax credit score, particularly when it notoriously takes years to get new energy provide onto the U.S. grid.

The Washington Publish by way of Getty Photographs

If the Biden administration strikes ahead on its proposal, Constellation mentioned it might cancel its plans to provide extra hydrogen. It might additionally sue. Manchin, the highly effective head of the Senate’s vitality committee, mentioned the White Home is misinterpreting the statute and vowed to throw his weight behind a lawsuit.

“We’re preventing it,” Manchin informed Bloomberg final week, calling the idea of requiring new electrical energy provide “horrible” and overly restrictive.

The Biden administration didn’t reply to a request for remark.

Why Getting Clear Hydrogen Proper Issues

This, as Heatmap author Emily Pontecorvo not too long ago wrote, is about way more than hydrogen. It boils right down to: “How do you show your electrical energy is clear?”

Weaning off oil and gasoline will depend on changing inside combustion engines in vehicles and furnaces in basements with battery-electric automobiles and warmth pumps that heat houses the identical manner air conditioners cool them.

If these machines are hooked as much as a grimy grid, emissions don’t go away; they only transfer from one sector to a different. Which may not be too huge a deal so long as the grid retains getting cleaner over time. For instance, the Worldwide Council on Clear Transportation discovered {that a} midsize electrical sedan will nonetheless add practically 70% much less carbon to the ambiance over its lifetime than a comparable combustion-engine automobile, even when factoring in how a lot vitality is wasted as electrical energy travels throughout transmission strains and through battery charging.

Plugging into an electrical energy supply doesn’t, nonetheless, work for every part at the moment powered with fossil fuels. Steelmaking requires reaching temperatures too sizzling for an electrical battery. Batteries large enough to energy a industrial airline would additionally possible make the craft too heavy to go far. The identical could also be true of long-haul trucking. For purposes like these, hydrogen — which, like fossil fuels, releases vitality when burned — is extensively thought-about among the many most promising climate-friendly options.

Batteries additionally lose cost over time, making the present know-how unreliable for long-term vitality storage. Hydrogen, in contrast, maintains its vitality whereas it sits in a tank.

However getting the hydrogen into storage within the first place requires much more vitality than the gasoline itself will include, resulting from how a lot energy is misplaced within the conversion course of. Giant-scale electrolyzers will guzzle electrical energy.

“Eliminating the requirement for brand new provide is as dangerous or worse for emissions as persevering with to provide hydrogen from fossil methane,” mentioned Jesse Jenkins, the Princeton College vitality techniques modeler whose analysis laid the groundwork for the local weather spending legislation. “It’d be taking us backward from a local weather perspective at a time once we’re speculated to be transferring ahead quickly.”

Individuals’ demand for electrical energy sank for many years, as factories moved abroad and extra environment friendly new home equipment changed previous ones. However that demand is tacking upward once more. Among the many largest sources of latest demand are knowledge facilities powering the digital “mining” of cryptocurrencies like bitcoin, whose starvation for extra electrical energy has helped coal and gasoline vegetation keep open and even reopen.

Star Tribune by way of Getty Photographs by way of Getty Photographs

To keep away from the identical impact from large amenities producing hydrogen, the European Union adopted a technique for figuring out whether or not hydrogen is inexperienced that will depend on three pillars.

The primary is geographical — deciding if the hydrogen was generated shut sufficient to clean-energy energy sources to qualify. The second is temporal — deciding if the hydrogen was generated throughout a time interval when the grid was principally powered by clear sources.

The third and most vital step — known as “additionality” — requires {that a} hydrogen producer hoping to money in on a tax credit score purchased electrical energy from a brand new zero-carbon energy plant that may not in any other case be promoting energy to the grid.

“In case you had been working off-grid on a brand new wind and photo voltaic farm with batteries, you’d know bodily you’re 100% clear. However once you’re linked to the grid, all of the electrons, all of the vitality that flows onto the grid, goes based mostly on physics to the trail of least impedance,” Jenkins mentioned. “The one method to present you’re a clear grid-connected useful resource is, everytime you’re consuming energy, someone is producing clear energy from a brand new useful resource that wouldn’t have in any other case been there.”

If nuclear reactors get an exemption, he mentioned, present wind and photo voltaic vegetation will possible get one, too. The extra clear electrical energy siphoned away from the grid to generate hydrogen, Jenkins mentioned, the extra demand for fossil-fueled energy vegetation to make up the distinction.

That’s what’s occurred in locations like New York and California and abroad in Germany and Taiwan, the place fossil fuels compensated for nuclear reactors that shut down. Paying atomic energy stations to provide hydrogen as an alternative of electrical energy for the grid would have the identical impact, Jenkins mentioned.

“We want these nuclear vegetation to remain on the grid producing clear vitality in order that they’re our basis to construct on as we decarbonize the remainder of the grid,” he mentioned by telephone final week, noting that he advocated early on for state and federal subsidies to maintain nuclear vegetation open. “The very same causes to assist these insurance policies are the identical causes to be involved about diverting all this present nuclear to wash hydrogen.”

However that logic assumes gas-fired energy vegetation will stay the most affordable and most tasty various to nuclear energy, mentioned Benton Arnett, the senior director of markets and coverage on the Nuclear Vitality Institute, an trade group. He mentioned it additionally creates a warped incentive for energy plant homeowners to prematurely tear down wind and photo voltaic farms earlier than the tip of their 25-year lifespan.

“By way of web emissions, we might find yourself worse off and we’re losing capital constructing stuff that’s already made,” he mentioned.

Arnett challenged the authorized grounds for excluding present nuclear vegetation from the hydrogen handouts. Language within the IRA particularly permits firms to “stack” tax credit. That signifies nuclear vegetation are meant to have the ability to declare each the legislation’s 45U credit score for producing atomic energy and the 45V credit score for utilizing those self same reactors to make hydrogen.

He pointed to different hydrogen-related proposals from the Biden administration. A footnote within the Environmental Safety Company’s proposed regulation to curb greenhouse gasoline emissions from energy vegetation notes that utilizing electrolyzers hooked as much as the grid at present might find yourself producing dirtier hydrogen than a producer utilizing the standard fossil technique. However that “concern is more likely to be mitigated over time because the carbon depth of the grid declines,” the company concluded.

Final 12 months, when the Vitality Division invited firms to bid to hitch the hydrogen hubs that the administration was establishing below the Bipartisan Infrastructure Legislation, the solicitation inspired candidates to “leverage present amenities and infrastructure for hydrogen manufacturing, storage, supply, and end-uses” to “maximize the impression of accessible funding.”

“Any steering that goes off of that, we predict, is in contradiction to the legislation,” Arnett mentioned.

The European Instance

Europe will provide a key check for the inexperienced hydrogen trade. Earlier than the European Union set its personal additionality requirement in its hydrogen rulebook, skeptics warned that the coverage would blunt investments into electrolyzers. However inside days of the bloc unveiling its rules, main initiatives introduced plans to maneuver ahead.

France, which has generated nearly all of its electrical energy from nuclear fission for many years, fought onerous for a particular carve-out permitting its hydrogen producers to learn from EU incentives. However these specific loopholes have solely made an already sophisticated legislation harder to navigate.

“We just like the IRA,” Sanjiv Lamba, chief government of Eire-based hydrogen producer Linde Group, not too long ago mentioned, noting that the American legislation is easier and simpler to know than the EU’s insurance policies.

In Europe, “we fail to draw our personal firms as a result of it’s all too complicated,” Jorgo Chatzimarkakis, chief government of the commerce group Hydrogen Europe and one of many continent’s most influential lobbyists, informed Politico.

The European incentives are additionally geared towards stimulating demand for inexperienced hydrogen. In contrast, the U.S. authorities is spending cash to extend the entire provide. That dynamic might make Europe a sexy export marketplace for American hydrogen producers trying to comply with the pure gasoline trade’s present-day instance of promoting gasoline fracked in Texas and Pennsylvania to Europeans scrambling for alternate options to Russian gasoline.

If U.S. hydrogen producers can not show that their gasoline is definitely inexperienced, it could increase the worth. In 2026, the EU will start imposing a carbon tariff on imports, charging firms looking for to promote to the European market greater charges for dirtier stuff. And the bloc is already in search of hydrogen suppliers abroad.

In June, European Fee President Ursula von der Leyen made a cope with Brazil’s president, Luiz Inácio Lula da Silva, in Brasília to make investments practically $2.2 billion into the Latin American large’s inexperienced hydrogen trade. Final month, Eletrobras Eletronuclear, Brazil’s state-owned nuclear firm, mentioned it might begin making hydrogen.

Even when a new-supply rule knocks “just a few share factors” off the U.S. hydrogen trade’s speedy progress charge, “you may achieve multiples of by unlocking worldwide markets for U.S.-based exports,” mentioned Gniewomir Flis, a hydrogen professional and senior adviser to Kaya Companions, a local weather coverage consultancy based mostly in London and in Copenhagen, Denmark.

“On the finish of the day,” Flis mentioned, “I believe it’s very a lot within the curiosity of the U.S.”

Divided Business, United Labor

The commercial firms set to compete for the 45V tax credit score are break up on how strict the Biden administration ought to make its rulebook.

“If the objective is to scale clear hydrogen, we ought to be exploring methods to encourage its manufacturing, not creating new hurdles earlier than it may even get off the bottom,” Katrina Fritz, government director of the California Hydrogen Enterprise Council, wrote in a latest op-ed for a commerce publication.

Requiring hydrogen producers to spend money on new electrical energy technology was unreasonable, in response to the pinnacle of BP’s U.S. hydrogen division.

“If you wish to get the trade off the bottom, you’ve obtained to be affordable about what it’s going to take,” Tomeka McLeod, the British oil large’s U.S. vp for hydrogen, mentioned at an trade convention in Washington earlier this 12 months. “Being tremendous restrictive is certainly not going to be the factor that’s going to underpin that.”

Talking at a separate panel session of the identical Hydrogen Americas Summit, Sheldon Kimber, chief government of the renewables and hydrogen developer Intersect Energy, mentioned the stricter guidelines should not “unreasonable.” That’s notably so, he mentioned, if — because the leaked draft from final week suggests — the Biden administration is planning to incorporate a grandfathering clause that enables early initiatives to bypass sure rules that may decelerate the constructing course of.

“Let’s say you’ve obtained 2027 because the cut-off for once you start development: you possibly can construct one thing that comes on line in 2030 and also you’ve obtained a ten-year grandfathering within the [production tax] credit score,” Kimber mentioned, in response to a transcript from the commerce publication Hydrogen Perception.

“By 2040 you possibly can nonetheless be producing clear hydrogen from [power] that you simply purchased from a wind farm within the Dakotas, with coal-power in Georgia,” he added. “Come on, let’s simply be trustworthy about that. That’s not what’s going to save the local weather. That’s not likely the place we’re headed. You’ve obtained to go the sniff check when it comes to actual decarbonisation.”

“Clearly we’ve been within the hydrogen enterprise for over 65 years, whereas many of the firms speaking about this haven’t produced any hydrogen of their complete histories. So it’s just a little like me telling somebody the way to fly a aircraft.”

– Eric Guter, vp at Air Merchandise and Chemical substances Inc.

Air Merchandise and Chemical substances Inc., the world’s largest hydrogen producer, has “been a staunch advocate” of strict tax credit score guidelines “since day one,” mentioned firm Vice President Eric Guter.

“That is being funded by means of taxpayer cash. It’s essential we now have the total religion and confidence to know emissions are literally lowered,” he mentioned by telephone final week. “With the complete vitality transition globally, we have to harmonize the certification schemes, and Europe has already made clear” that it was going to require new provide, he added.

Hoping to fulfill that future demand, the Allentown, Pennsylvania-based agency has already introduced a mixed $15 billion in investments into new initiatives, break up roughly evenly between inexperienced and blue hydrogen.

By 2030, the vitality consultancy BloombergNEF forecasts that inexperienced hydrogen made out of a brand new plant might be as a lot as 18% cheaper than persevering with to run an present grey hydrogen plant in Brazil, China, India, Spain and Sweden.

“Remarkably, this holds true even for inexperienced hydrogen vegetation constructed with out subsidies,” Adithya Bhashyam, a hydrogen analyst at BloombergNEF, wrote in a latest shopper memo.

Provided that international trajectory, Guter accused doomsayers demanding decrease obstacles to getting into his trade of not understanding the altering economics of hydrogen.

“Clearly we’ve been within the hydrogen enterprise for over 65 years, whereas many of the firms speaking about this haven’t produced any hydrogen of their complete histories,” he mentioned. “So it’s just a little like me telling somebody the way to fly a aircraft. I’d haven’t any enterprise doing that.”

The labor unions angling for jobs constructing out the hydrogen financial system, however, are largely united in opposition to stricter guidelines.

The nation’s largest unions representing laborers, carpenters, electricians and pipe fitters all despatched letters to the U.S. administration urging it to drop the additionality requirement.

North America’s Constructing Trades Unions complained that even the extra extensively accepted provision to restrict hydrogen manufacturing to instances when the grid is flush with clear electrical energy would straight “stifle the creation of excellent union jobs” and “hamstring the greening of our grid.”

No Apparent Atomic Loopholes

On Wednesday afternoon, thick snowflakes whipped off Lake Ontario’s waves and coated Robert Beaumont’s puffy coat as he cranked open the door to the transport container to present a reporter a tour of 9 Mile Level’s electrolyzer operation. Squeezing into the slender construction, previous twisting silver pipes and ducts, the Constellation undertaking supervisor defined how the electrolyzer blasts molecules of extremely purified water from Oswego’s municipal water provide aside with practically 14,000 volts of electrical energy, and filters the hydrogen by means of stacks of polymer-membrane cells.

“Earlier than this, nobody might do what we’re doing right here on this scale,” Beaumont mentioned. “It’s very satisfying for me.”

Like many different former U.S. Navy submariners, Beaumont turned what he realized serving on nuclear-powered vessels right into a profession in civilian atomic vitality. Submarines equally use electrolyzers however in reverse, zapping seawater with electrical energy to reap oxygen for sailors to breathe throughout lengthy voyages underwater. Pairing the machines with nuclear energy simply is sensible, he mentioned.

“All sources of zero-emissions electrical energy ought to be realized to fulfill our hydrogen objectives. Simply utilizing restricted sources, I believe, won’t obtain the full-scale hydrogen financial system we’re looking for.”

– Jess C. Gehin, Idaho Nationwide Laboratory

There are methods that present nuclear vegetation might doubtlessly qualify as new provide. If a nuclear operator makes modifications to a reactor to “uprate” the machine and generate extra electrical energy than earlier than, that extra output may qualify as new. Opening the utility’s books to show {that a} financially troubled atomic station would have shut down if not used to make hydrogen might additionally provide a loophole.

However NEI’s Arnett mentioned that the U.S. nuclear trade has already upgraded most of its present reactors, so there isn’t sufficient potential new provide to faucet to make the numbers on new hydrogen work.

One other potential avenue might come from a completely new technique of manufacturing hydrogen with high-temperature steam, which nuclear reactors create in huge abundance. Way more environment friendly than utilizing electrical energy, the approach extracts hydrogen from water practically as effectively as at present’s dominant pure gasoline strategy. A California producer unveiled a prototype of a high-temperature steam electrolyzer in Could. A month earlier, the Minneapolis-based utility Xcel Vitality introduced plans to start producing hydrogen at its Prairie Island Nuclear Producing Station in Minnesota utilizing the high-temperature steam technique.

It’s no easy answer. Rerouting steam away from a reactor is a large engineering enterprise that dangers lowering a nuclear plant’s electrical output, Beaumont mentioned.

“It’s nonetheless not as sophisticated as constructing an entire new plant,” he mentioned with amusing.

If nuclear operators already lose floor to different vitality sources within the hydrogen trade, “it might possible mute or not encourage” the form of funding wanted to deliver extra cutting-edge applied sciences to market, mentioned Jess C. Gehin, the affiliate lab director for nuclear science on the Idaho Nationwide Laboratory.

“All sources of zero-emissions electrical energy ought to be realized to fulfill our hydrogen objectives,” Gehin mentioned by telephone final week. “Simply utilizing restricted sources, I believe, won’t obtain the full-scale hydrogen financial system we’re looking for.”

At scale, clear hydrogen might feed crops, warmth iron into metal, and gasoline diesel vehicles too huge and heavy for batteries, just like the hulking dumpers plowing Oswego’s quiet nation roads. As snow fell down on cozy-looking farmhouses and trailer parks with twinkling Christmas lights, the vehicles belched thick plumes of black diesel soot upward.