Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) inventory posted one other day of serious positive factors in Monday’s buying and selling. The tech large’s share worth closed out the day by day session up 2.4%, in keeping with information from S&P International Market Intelligence.

Alphabet’s inventory gained floor at the moment, buying and selling amid a spurt of broader momentum for large tech shares with vital publicity to synthetic intelligence (AI) traits. Even on the heels of massive positive factors throughout 2023’s buying and selling, Wall Avenue seems to be changing into more and more bullish on the long-term prospects for the market’s largest AI shares.

Large Tech’s massive rally retains rolling

Because of its place as a number one supplier of web-search providers by means of its Google platform, Alphabet stands to learn from synthetic intelligence providers enhancing search and digital promoting outcomes. Nevertheless, the corporate’s alternatives to learn from AI are hardly restricted to the Google search platform.

Past its market-leading search engine providers, Alphabet additionally has robust positions in cell working system software program, cloud infrastructure providers, video streaming, and different influential product classes. Alphabet’s different and far-reaching ecosystem of services and products provides the corporate a variety of the way to learn from the rise of synthetic intelligence. The tech large’s numerous product suite additionally generates an unimaginable quantity of information, which can be utilized to generate priceless insights and enhance the efficiency of AI algorithms.

Is Alphabet inventory a purchase proper now?

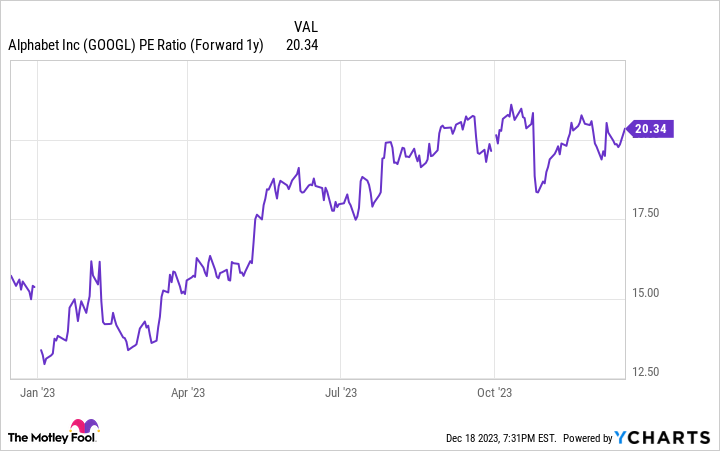

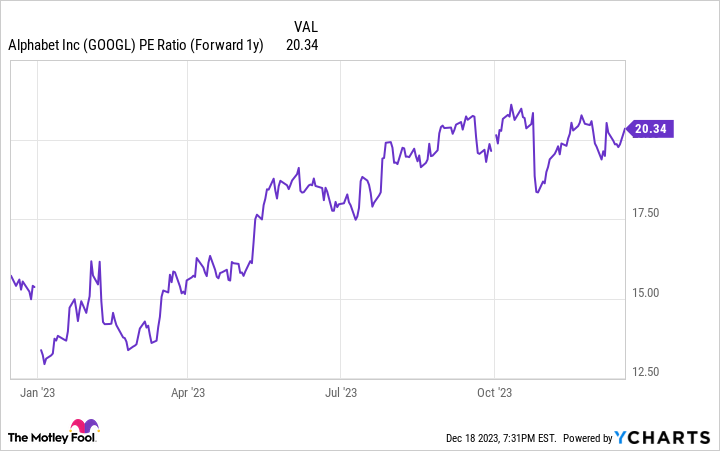

Alphabet inventory has already climbed roughly 54% throughout 2023’s buying and selling, however that does not imply long-term buyers ought to ignore the inventory. The corporate nonetheless trades at affordable earnings multiples, and it may ship robust returns for individuals who take a buy-and-hold strategy at at the moment’s costs.

Valued at roughly 20 instances subsequent 12 months’s anticipated earnings, Alphabet inventory nonetheless has the potential to ship market-beating positive factors for affected person buyers. Because of their current infrastructure and data-generating benefits, massive tech corporations have massive benefits within the AI race.

Whereas the extent to which Alphabet will be capable to leverage these strengths nonetheless stays to be seen, the corporate’s place in synthetic intelligence and the broader tech business continues to look fairly robust. For long-term buyers in search of methods to play AI and know-how traits, Alphabet inventory seems to be like a worthwhile portfolio addition, even on the heels of current positive factors.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Alphabet wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keith Noonan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet. The Motley Idiot has a disclosure coverage.

Alphabet Jumped Once more As we speak Because of AI — Is the Inventory a Purchase? was initially printed by The Motley Idiot