If the 2023 inventory market had an MVP, it must be Nvidia (NASDAQ: NVDA).

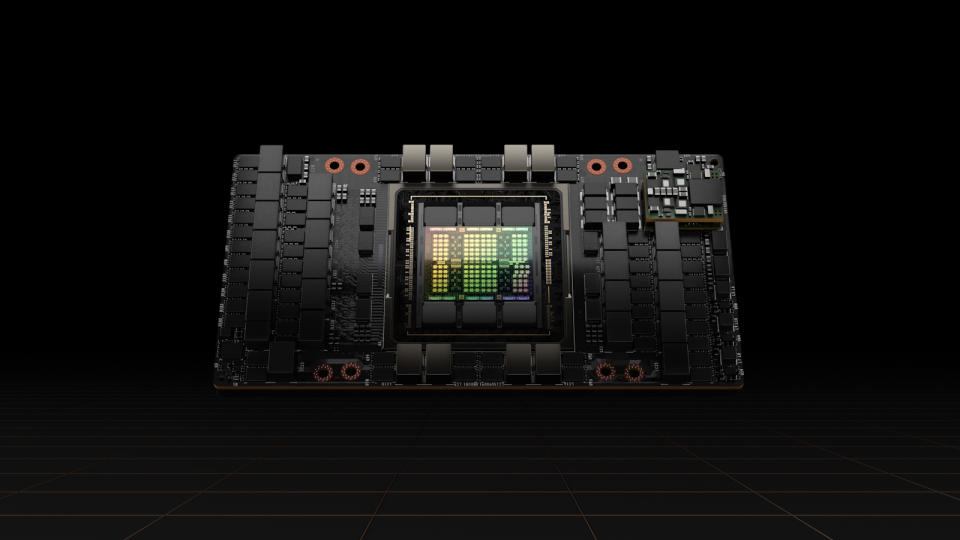

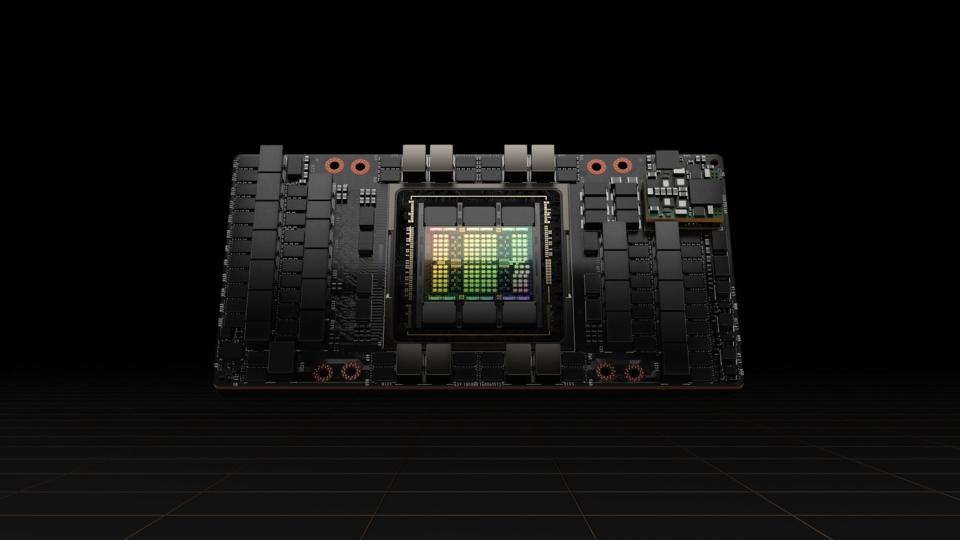

The chip maker and inventor of the graphics processing unit (GPU) has been the largest winner within the generative synthetic intelligence (AI) gold rush up to now by far. Its income and income have soared this 12 months, and the inventory has greater than tripled 12 months up to now by way of Dec. 20. Alongside the best way, the inventory crossed the $1 trillion market cap, including roughly $700 billion in market worth and making it simply certainly one of 5 U.S. firms in that membership.

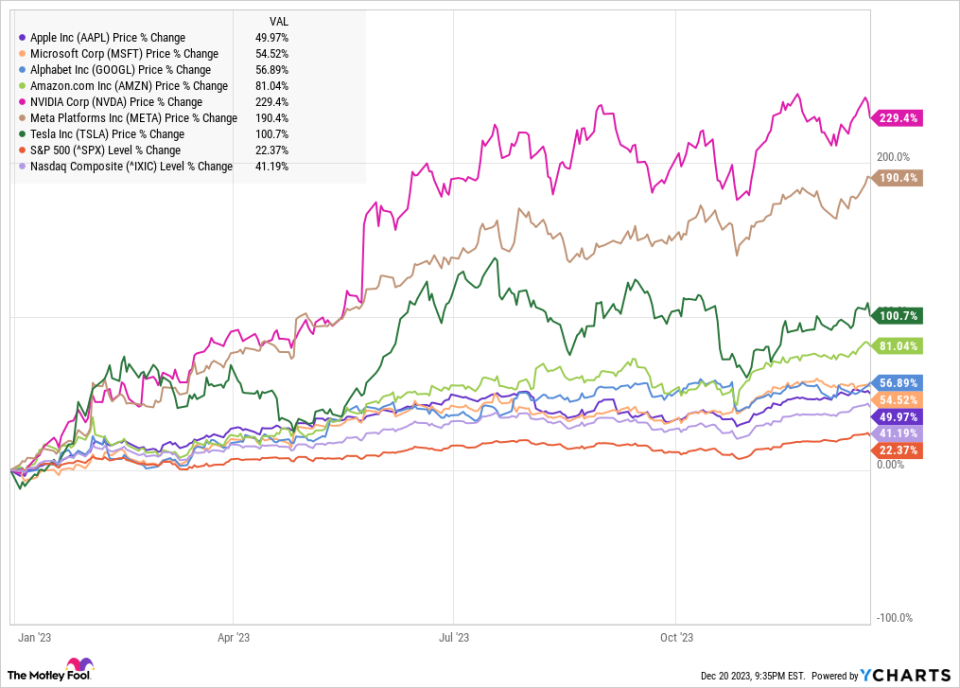

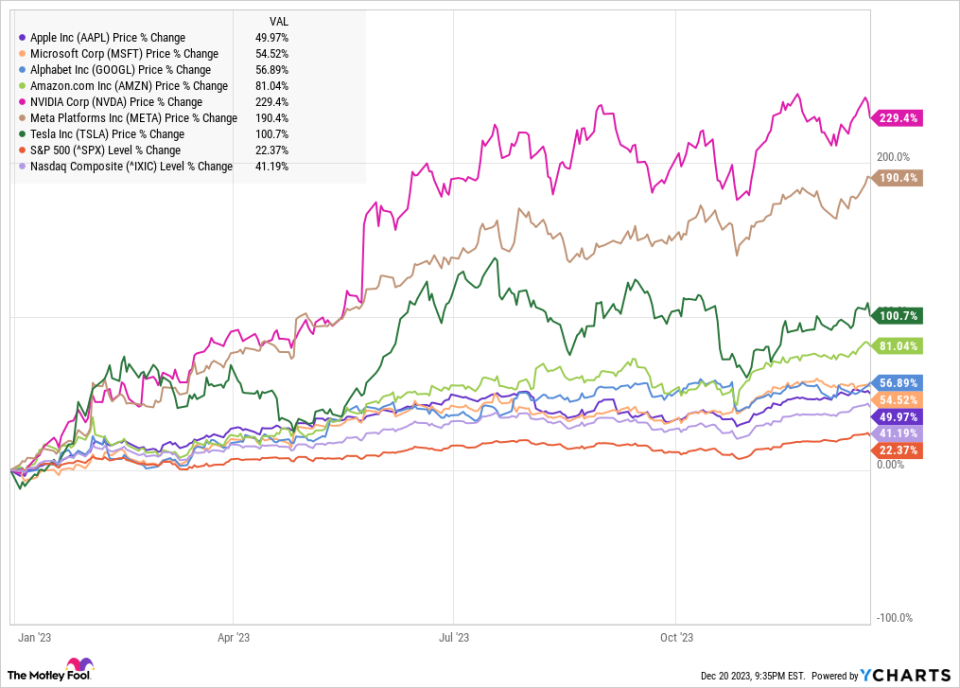

The opposite 4 firms are Apple, Microsoft, Amazon, and Alphabet. Along with Meta Platforms and Tesla, they’ve come to be often called the “Magnificent Seven,” which has changed FAANG shares as shorthand for giant tech shares. Collectively they signify roughly $12 trillion in market cap, and the group has delivered monster returns this 12 months, with each outperforming the S&P 500 and the Nasdaq, as you possibly can see from the chart under.

Why Nvidia was essentially the most magnificent inventory of 2023

Nvidia began 2023 nonetheless reeling from the cryptocurrency crash in 2022, as demand for the corporate’s chips had spiked throughout the crypto mining growth in 2021.

Early in 2023, nonetheless, Nvidia emerged as a possible winner from the brand new generative AI know-how revealed by the launch of OpenAI’s ChatGPT, and Nvidia has not upset.

As 2023 attracts to a detailed, the chip maker has capitalized on the generative AI growth in a method that no different firm has, and it has the numbers to indicate it. In its third quarter, income tripled from a 12 months in the past to $18.12 billion, and its margins expanded considerably, with usually accepted accounting rules (GAAP) earnings per share leaping greater than 12 instances to $3.71. On a GAAP foundation, its revenue margin was 51% within the quarter, and the corporate expects a fair greater fourth quarter, focusing on income of $20 billion and a modestly increased gross margin.

Why 2024 might be one other profitable 12 months for Nvidia

Nvidia is getting into 2024 with a goal on its again. It is confirmed the marketplace for AI accelerators and GPUs, and now semiconductor rivals like Superior Micro Units and Intel are launching their very own AI accelerators. Huge tech firms like Amazon and Apple are additionally getting into the fray, designing their very own chips for issues like machine studying and neural engines, and for coaching massive language fashions.

Nonetheless, regardless of growing competitors, there is a purpose to wager on Nvidia’s continued progress in 2024. There’s nonetheless a major scarcity of AI chips as cloud infrastructure companies, information facilities, start-ups, and basis fashions race to get ahold of the important thing infrastructure elements to run new generative AI know-how, which requires huge computing energy.

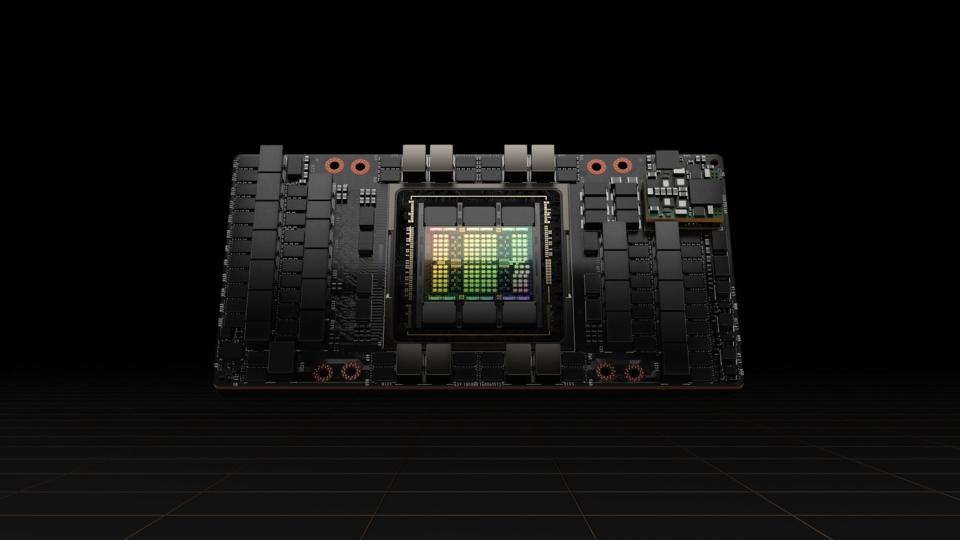

Corporations together with OpenAI, Oracle, Microsoft, and Alphabet have all complained a couple of scarcity of AI chips, however that is anticipated to ease subsequent 12 months — which means Nvidia will face extra competitors for its H100 processors, which might price greater than $40,000.

Nonetheless, Nvidia itself is betting on demand persevering with to ramp up, with plans to triple manufacturing from 500,000 GPUs to a minimum of 1.5 million subsequent 12 months. Elevated competitors might decrease costs, however it’s unclear if anybody can compete with Nvidia in efficiency.

Nvidia has maintained a lead in GPUs because it invented them in 1999, and it might do the identical within the AI house. The corporate additionally advantages from entrenched relationships with cloud infrastructure companies like Microsoft, Oracle, Alphabet, and Amazon, in addition to key clients like Tesla and OpenAI, and it is constructed a strong community of chips, software program, and complementary merchandise that can be troublesome for rivals to match.

Costs for AI {hardware} might come down, however Nvidia appears more likely to hold its fame because the chief in AI efficiency. Repeating its efficiency as the perfect inventory among the many Magnificent Seven will not be straightforward in 2024, however Nvidia seems nicely positioned to maintain gaining subsequent 12 months because the generative AI growth solely appears to be heating up.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Jeremy Bowman has positions in Amazon and Meta Platforms. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and brief February 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

This Is the Greatest-Performing “Magnificent Seven” Inventory of 2023. Will That Change in 2024? was initially revealed by The Motley Idiot