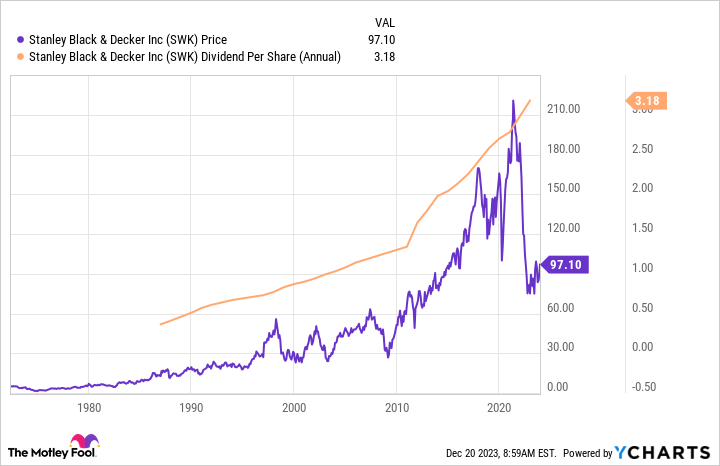

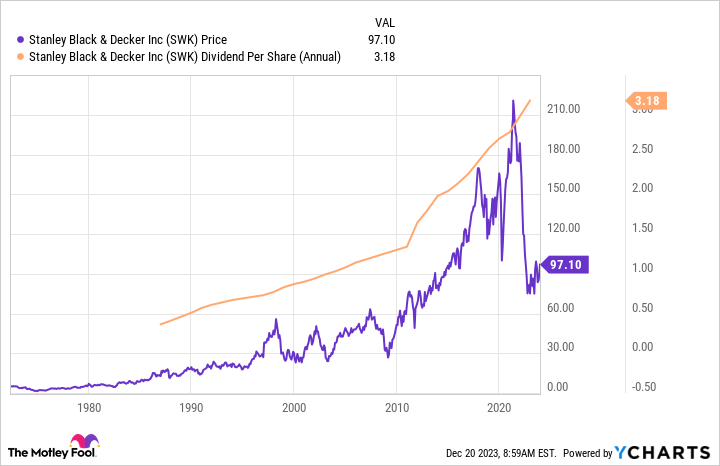

Shares of Stanley Black & Decker (NYSE: SWK) are down roughly 50% from their 2021 highs. There are superb causes for this, as you may study beneath. However the firm is anticipating an unbelievable enchancment in earnings in 2024. Assuming it could actually dwell as much as this forecast, the inventory may very well be in for an enormous rebound, too. Here is what you have to know.

Stanley Black & Decker dropped the ball

Throughout the coronavirus pandemic, demand for the instruments that Stanley Black & Decker produces was fairly sturdy. It is smart: Folks caught at residence took on residence enchancment tasks to reinforce their dwelling expertise. Adjusted earnings in 2021 rose 30% versus 2020 and hit a file of $10.48 per share. As 2022 received underway, the corporate was projecting adjusted annual earnings to return in between $12.00 and $12.50 per share, which might have been one more file consequence.

That did not precisely play out as anticipated. As an alternative, Stanley Black & Decker posted adjusted earnings of $4.62 per share. That was greater than a 50% decline. It is not arduous to grasp why buyers may need discovered that upsetting after the corporate set a lot larger expectations. Issues have solely gotten worse in 2023, with administration now anticipating full-year adjusted earnings to be within the vary of $1.10 to $1.40 per share. That may be one other enormous decline and helps clarify the inventory worth malaise.

The backstory for this weak efficiency is equally as troubling. Excessive leverage, slowing gross sales, and weak margins had been all contributing elements. However Stanley Black & Decker has been working to get again on monitor by lowering leverage, slicing prices, and elevating costs, amongst different issues. The enhancements are already beginning to present up within the firm’s earnings.

Stanley Black & Decker is getting higher quarter by quarter

Stanley Black & Decker is an industrial big and you’ll’t flip a ship like this round on a dime. It takes time, however sluggish and regular progress has been on clear show. For instance, the corporate’s adjusted gross margin has climbed every quarter since hitting a low level in This autumn 2022. The development is large, too, with adjusted gross margin rising from roughly 20% to twenty-eight%.

In the meantime, the Dividend King (it has elevated its dividend for 56 consecutive years) entered 2023 anticipating adjusted earnings to be between zero and $2.00 per share. That is been narrowed to $1.10 to $1.40 per share, which tells you that the worst-case state of affairs did not even come near transpiring. Certain, the highest finish received lowered, however the actual threat for buyers was that the underside fell out of the enterprise, and that simply did not occur.

In the meantime, searching to 2024, Stanley Black & Decker has reiterated its earlier steerage for adjusted earnings of between $4.00 and $5.00 per share. That was a goal used to justify the corporate’s turnaround plans, so it will be affordable to anticipate that administration was being aggressive. However the enterprise is nicely into that turnaround plan and it’s nonetheless supporting the vary, which is an excellent signal.

2024 may very well be an important 12 months for Stanley Black & Decker

So 2023 appears like it is going to be the nadir for earnings, which is value noting. However the actual takeaway might be the advance that can come about in 2024, if administration can hit the focused adjusted earnings vary. Assuming the corporate can earn $1.40 per share in 2023, the excessive finish of the projected vary, adjusted earnings will improve by 285% in 2024 if it solely hits the low finish of expectations ($4.00). The excessive finish — $5.00 — would result in a 350% leap in adjusted earnings. Wall Road will probably change its view of Stanley Black & Decker in a really constructive approach if both of these eventualities performs out.

Do you have to make investments $1,000 in Stanley Black & Decker proper now?

Before you purchase inventory in Stanley Black & Decker, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Stanley Black & Decker wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Reuben Gregg Brewer has positions in Stanley Black & Decker. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

This Dividend King Is Set for a Large Rebound in 2024 was initially revealed by The Motley Idiot