-

Technical analysts consider that inventory costs usually commerce in patterns, because the motivating driver behind the motion of shares is people, and people exhibit the identical feelings with regards to their cash: concern and greed.

-

These two predictable feelings assist create predictable buying and selling patterns that technical analysts attempt to capitalize on.

-

Listed here are seven of the highest bullish patterns that technical analysts use to purchase shares.

-

Go to Enterprise Insider’s homepage for extra tales.

One of many largest drivers of inventory costs is human feelings, notably concern and greed.

Buyers sometimes exhibit predictable feelings when a inventory value strikes up and down, and these feelings can result in buying and selling exercise that creates predictable charting patterns.

Technical analysts try and take the emotion out of investing by solely counting on the patterns discovered inside charts to commerce shares, doubtlessly giving them an edge over buyers who’re inclined to to creating commerce choices pushed by concern and greed.

Whereas these patterns might be predictable, they are not bullet-proof. Head fakes, bull traps, and failed breakdowns happen usually and have a tendency to shake merchants out of their positions proper earlier than the massive transfer.

That is why self-discipline is so essential in technical evaluation.

Having a plan earlier than coming into a place can assist merchants climate uneven value actions, rising their probabilities of driving an uptrend and avoiding a downtrend.

A plan earlier than coming into a commerce contains defining a “cease loss” degree the place if the inventory falls to a sure value level, you robotically promote, take a small loss, and transfer on to the subsequent buying and selling alternative.

A plan would additionally embody a value goal the place the dealer would look to unload some if not the entire place to take earnings.

Listed here are seven of the highest bullish chart patterns that technical analysts use to purchase shares.

Learn extra: Financial institution of America says a brand new bubble could also be forming within the inventory market — and shares an inexpensive technique for defense that’s ‘considerably’ extra worthwhile than through the previous 10 years

1. Double Backside

A double backside is a bullish reversal sample that describes the autumn, then rebound, then fall, after which second rebound of a inventory.

A profitable double backside sample seems like a W.

The sample sometimes marks the tip of a downtrend, and the start of an uptrend.

It is usually accepted that the primary and second backside ought to be inside a pair % close to one another, if not on the similar degree.

A double backside sometimes takes two to 3 months to kind, and the farther aside the 2 bottoms, the extra probably the sample might be profitable.

2. Ascending Triangle

An ascending triangle is a bullish continuation sample and one in every of three triangle patterns utilized in technical evaluation.

The buying and selling setup is normally present in an uptrend, shaped when a inventory makes larger lows, and meets resistance on the similar value degree.

Rising help and horizontal resistance in the end converge on the breakout degree.

This sample creates a well-defined setup for merchants. If the inventory breaks above horizontal resistance, merchants will purchase the inventory, and set a cease loss order normally just under the prior resistance degree.

But when the inventory breaks beneath the rising help degree, a brief commerce sign could be generated.

An ascending triangle is a excessive likelihood setup if the breakout happens on excessive quantity, and is extra dependable than a symmetrical triangle sample.

3. Cup and Deal with

A cup and deal with is a bullish sample that resembles a cup, shaped by a basing sample that sometimes seems like a “U,” adopted by a deal with that’s shaped by a short-term down development.

As soon as a inventory breaks out above the deal with, a technical analyst would purchase the inventory.

A dealer might generate a measured transfer value goal by measuring the depth of the cup in value, and add that quantity to the lid of the cup.

This sample normally extends an uptrend that’s already in place.

A U-shaped cup is a better likelihood arrange than a V-shaped cup, however each can work.

4. Bull Flag

A bullish flag sample happens when a inventory is in a robust uptrend, and resembles a flag with two essential elements: the pole and the flag.

This sample is a bullish continuation sample. Sometimes merchants would purchase the inventory after it breaks above the short-term downtrend, or flag.

A measured-move value goal might be obtained by measuring the gap of the pole, and including it to the highest proper nook of the flag.

Bullish flags are short-term patterns that ideally final one to 4 weeks, sometimes do not last more than eight weeks, and normally comply with an sharp uptrend.

5. Bull Pennant

Just like a bull flag, a bullish pennant is a continuation sample that consists of a pole and a symmetrical triangle, normally following an uptrend in value.

Slightly than a interval of sideways consolidation within the form of a rectangle, value consolidates within the form of a symmetrical triangle, making a sequence of upper lows and decrease highs.

The uptrend within the safety will probably proceed on if the inventory breaks out above the pennant.

Within the chart instance above, an instance of a failed breakdown, or a bear lure is proven.

At first, the safety breaks beneath the pennant, signaling a breakdown and doubtlessly decrease costs forward.

However then, it rapidly recovers, breaks above the pennant, and the uptrend continues.

A measured transfer goal might be obtained by measuring the gap of the pole and including it to the apex of the pennant triangle.

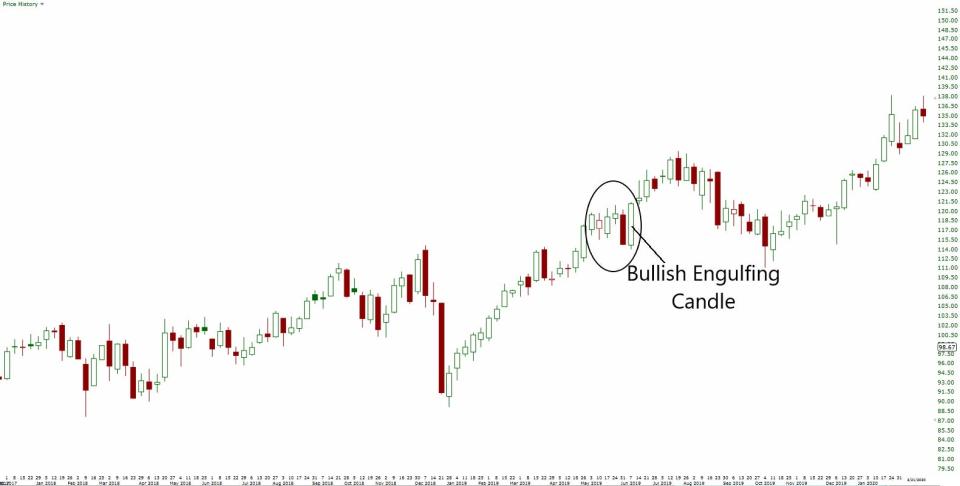

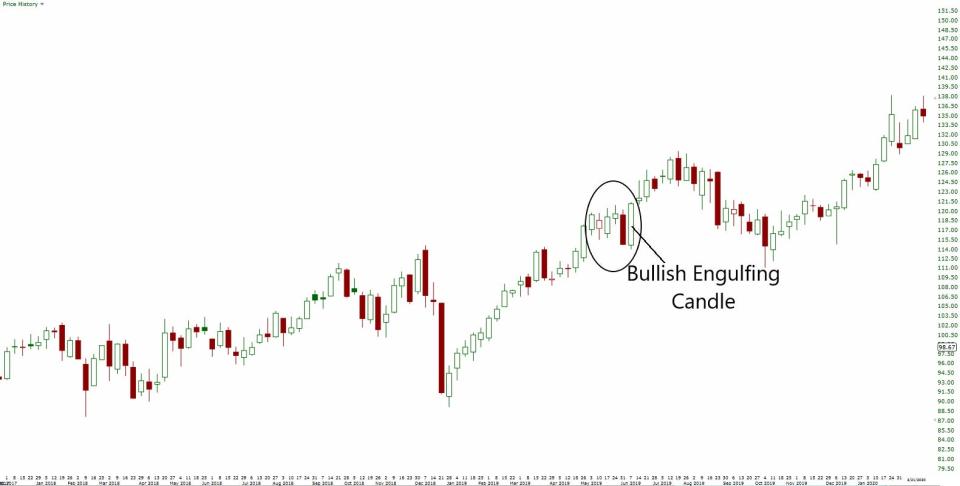

6. Bullish Engulfing Candle

A candlestick is a charting fashion that reveals a safety’s opening value, closing value, intraday excessive, and intraday low.

The “physique” is represented by the opening and shutting value of a inventory, and the “tails” are represented by the intraday excessive and low.

A bullish engulfing candlestick happens when the physique of 1 buying and selling session fully engulfs the earlier session.

This occurs when the day’s open is decrease than the day prior to this, and its shut is larger than the day prior to this.

When the physique of a candle stick “engulfs” prior buying and selling periods, it alerts that bulls are beginning to take management from the bears, and a reversal in development is possible.

The extra buying and selling periods which are engulfed by a single candlestick, the stronger the sign.

Within the chart above, the bullish engulfing candlestick engulfs the earlier 5 buying and selling periods, signifying the chance that shares are on observe to maneuver larger.

7. Inverse Head & Shoulders

An inverse head-and-shoulders sample is a bottoming sample that always alerts a reversal in a inventory following a bearish development.

The inverse head and shoulders is said to the bearish head-and-shoulders sample, which is a topping sample.

The sample takes its form from a sequence of three bottoms, with the second backside being the deepest.

A neckline represents resistance and is shaped by connecting the three restoration peaks related to the three bottoms.

When the inventory breaks above its neckline, that triggers a purchase sign for merchants, with a cease loss degree being set close to the neckline breakout degree.

A measured transfer value goal might be obtained by measuring the gap from the top to the neckline, and including that to the neckline breakout degree.

A proper shoulder that’s larger than the left shoulder is an effective signal that an inverse head-and-shoulders sample will end in a transparent breakout and reversal in development.

Learn the unique article on Enterprise Insider