Many individuals have the purpose of turning into a millionaire earlier than they retire. Not solely is it a enjoyable achievement, nevertheless it’s additionally near what many individuals want to keep up their life-style of their golden years. However should you solely have a decade left earlier than retiring, reaching millionaire standing would require some huge cash (there aren’t any shortcuts).

Nonetheless, by investing in these three shares, you possibly can increase your returns from the market’s common 10% annual return to round 12% to 13%. That can require slightly below $300,000 ($294,588 to be precise) to hit millionaire standing. So, what are these three shares?

Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is the father or mother firm of Google, YouTube, and the Android working system. Its main enterprise is promoting, nevertheless it additionally has its palms in two essential industries: synthetic intelligence (AI) and cloud computing.

These may very well be large progress catalysts for Alphabet over the following decade. With Alphabet’s newest technology of its Gemini generative AI mannequin beating the competitors on almost each base mark check, it is positive to be a best choice for builders. Alphabet hasn’t acknowledged any income from this section but, however will probably be one to observe within the coming years.

Cloud computing has been an enormous enterprise pattern in previous years as corporations discover it simpler to outsource computing assets as a substitute of trying to estimate what they want on-site. It is also a beneficiary within the AI pattern as corporations want large computing energy to develop AI fashions and seize and retailer knowledge wanted for them. Google Cloud grew 22% final quarter, making it Alphabet’s fastest-growing division. With the cloud computing market anticipated to develop from $626 billion in 2023 to $1.27 trillion by 2028, Alphabet is working in a large alternative.

Throw in Alphabet’s low cost 20 occasions 2024 earnings inventory valuation, and you have a recipe for an organization that may outperform the market by a few share factors every year.

MercadoLibre

MercadoLibre (NASDAQ: MELI) is one in all my highest-conviction inventory picks. It is a chief within the Latin American e-commerce and fintech areas and has develop into the mixture of Amazon and PayPal in a area with twice the inhabitants of the U.S.

It constantly delivered unimaginable outcomes from each its commerce and fintech segments, with the 2 delivering 76% and 61% year-over-year currency-neutral progress, respectively, in Q3. Whereas MercadoLibre has been a large progress machine for some time, it is also beginning to enhance its margin profile. In Q3, all three main profit-margin measurements elevated.

|

Metric |

Q3 2022 |

Q3 2023 |

Enchancment |

|---|---|---|---|

|

Gross margin |

50.1% |

53.1% |

2.95% |

|

Working margin |

11% |

18.2% |

7.24% |

|

Revenue margin |

4.85% |

9.5% |

4.89% |

Information supply: MercadoLibre.

This exhibits MercadoLibre’s sturdy pricing energy and its dedication to turning into a extra environment friendly enterprise. With the Latin American alternative simply beginning, MercadoLibre ought to simply ship market-crushing returns over the following decade.

Amazon

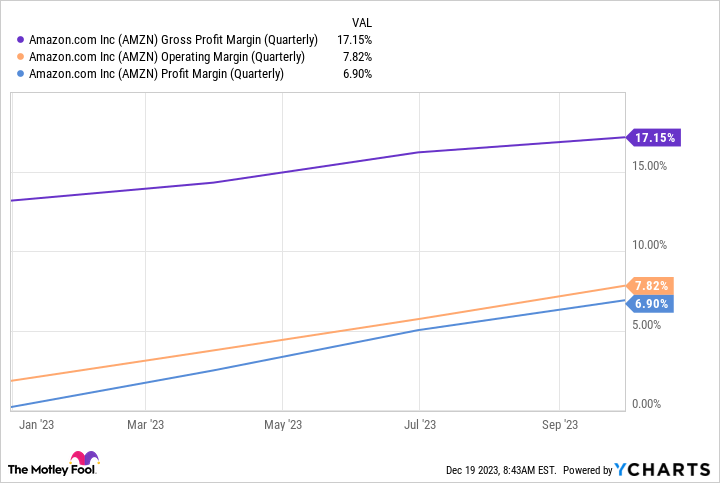

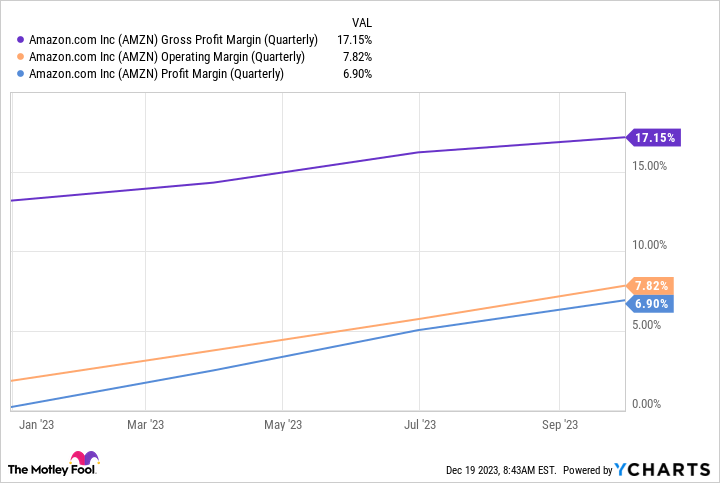

Amazon had an unimaginable 2023. Whereas its progress hasn’t been spectacular for a lot of the yr, its effectivity positive factors have been.

This bodes properly for shareholders as we’re but to see Amazon absolutely worthwhile for a whole yr. Moreover, Amazon’s largest progress engine could have an amazing yr in 2024.

Amazon Net Companies (AWS), its cloud computing wing, is a direct competitor to Google Cloud. Nonetheless, with the large $1.27 trillion market alternative, there’s loads of room for a number of winners. All through 2023, many consumers selected to optimize their spending with AWS. Administration sees that pattern slowing down, and new workloads (many associated to AI) are beginning to come on-line. This shall be a welcome change of tempo and may energy Amazon greater in 2024.

Nonetheless, Amazon’s commerce segments have been doing higher, with its promoting and third-party vendor providers rising at 26% and 20%, respectively, in Q3. Amazon is a cash-flow-generating powerhouse whose full potential we have but to see. Nonetheless, we’ll expertise it within the coming decade, and the inventory returns ought to simply prime 10% yearly.

Whereas all three shares are nice buys, a well-diversified portfolio contains at the least 25 shares. Investing your entire almost $300,000 in these shares alone is harmful, as one in all them may very well be hit with an unexpected headwind and destroy its funding thesis. However as part of a broader portfolio, I am assured this trio will publish market-beating returns.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Alphabet wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet, Amazon, and MercadoLibre. The Motley Idiot has positions in and recommends Alphabet, Amazon, and MercadoLibre. The Motley Idiot has a disclosure coverage.

Need $1 Million in Retirement? Make investments $300,000 in These 3 Shares and Wait a Decade was initially printed by The Motley Idiot