Warren Buffett is without doubt one of the most well-known figures within the monetary world. His knack for selecting shares has made him a billionaire a number of occasions over, and it has created astonishing wealth for different buyers. Shares of Berkshire Hathaway have doubled the annual return of the S&P 500 since Buffett took management in 1965.

Not surprisingly, buyers usually search inventory market recommendation from Buffett, however readers could also be stunned to study Buffett has constantly provided the identical recommendation, as he reminded attendees at Berkshire’s annual assembly in 2021: “I like to recommend the S&P 500 index fund, and have for a protracted, very long time to individuals.”

This is how Buffett’s suggestion may flip $400 monthly into $847,800 for affected person buyers.

The Vanguard S&P 500 ETF

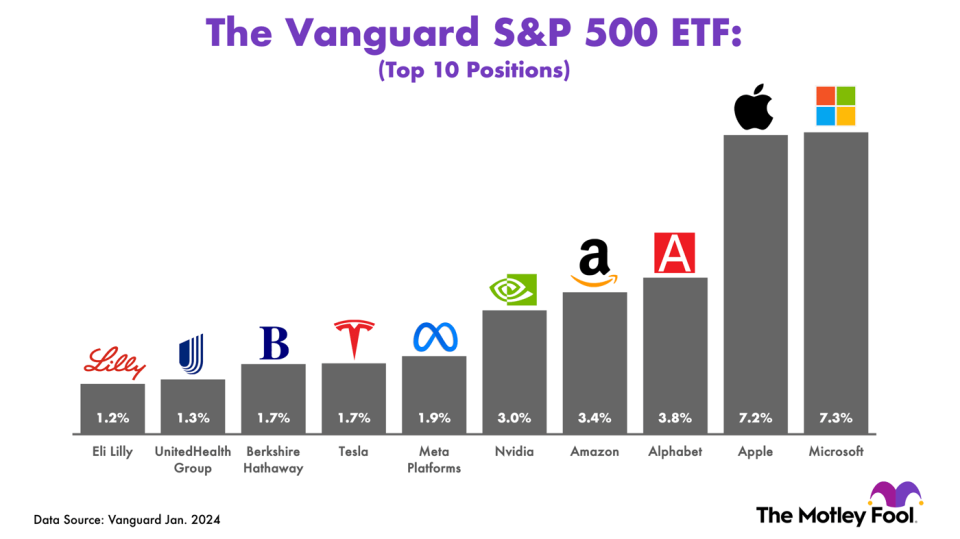

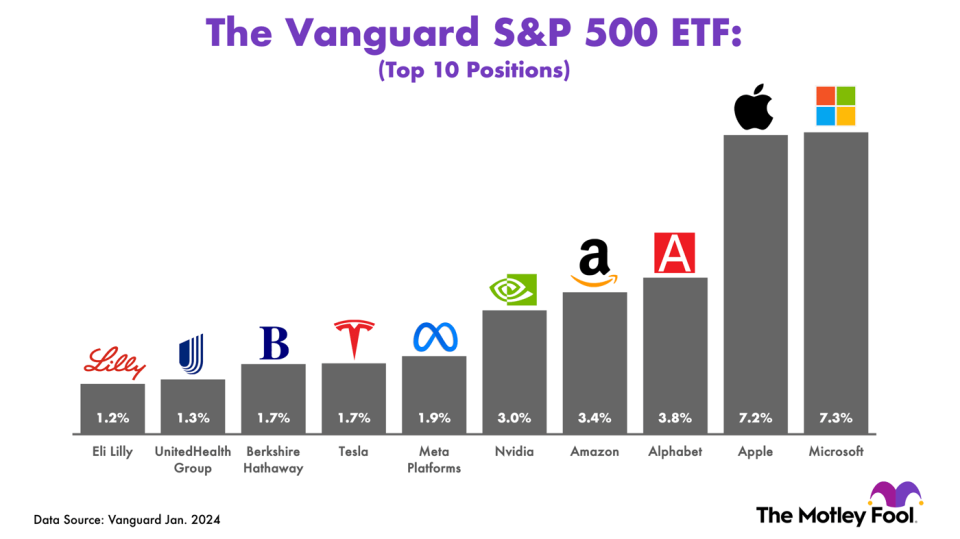

The Vanguard S&P 500 ETF (NYSEMKT: VOO) measures the efficiency of 500 U.S. firms that embrace worth shares and development shares from all 11 market sectors. Its constituents cowl 80% of the home equities market and greater than 50% of the worldwide equities market.

In brief, the index fund lets buyers unfold cash throughout most of the most influential companies on the earth. That features enterprise software program chief Microsoft, shopper electronics large Apple, digital promoting chief Alphabet, cloud computing chief Amazon, and synthetic intelligence chipmaker Nvidia.

The next chart reveals the highest 10 positions within the Vanguard S&P 500 ETF as of Jan. 1, 2024.

Buffett believes the typical particular person can’t decide shares — not as a result of individuals lack the psychological capability however fairly as a result of figuring out good shares requires a stage of persistence and dedication to which most individuals are unwilling to commit.

In lieu of particular person shares, Buffett sees an S&P 500 index fund as the most suitable choice for the typical particular person as a result of it offers publicity to a “cross-section of companies that in mixture are sure to do nicely.” Certainly, the S&P 500 has been a constant moneymaker for affected person buyers.

The S&P 500 has been a surefire funding over lengthy durations

The S&P 500 has been a worthwhile funding over each rolling 20-year interval since its inception in 1957, and its precursor was a worthwhile funding over each rolling 20-year interval since its inception in 1926.

Furthermore, the S&P 500 elevated 1,720% over the previous three many years, compounding at 10.14% yearly. At that tempo, $400 invested month-to-month could be price $80,500 in a single decade, $292,000 in twenty years, and $847,800 in three many years.

Some buyers might not have $400 monthly to take a position, and others might want to save extra. Assuming an annual return of 10.14%, the next chart explores how completely different month-to-month contribution quantities would develop over time.

|

Holding Interval |

$200 Per Month |

$600 Per Month |

$800 Per Month |

|---|---|---|---|

|

10 years |

$40,300 |

$120,800 |

$161,100 |

|

20 years |

$146,000 |

$438,100 |

$584,200 |

|

30 years |

$423,900 |

$1.2 million |

$1.6 million |

Knowledge supply: writer. Greenback totals have been rounded to the closest $100.

Traders can diversify their portfolios with an S&P 500 index fund

I’ve already talked about that Buffett does not consider the typical particular person can decide shares, however buyers should not be discouraged. Anybody keen to do the requisite analysis ought to really feel comfy shopping for particular person shares, notably together with an S&P 500 index fund.

Figuring out good investments requires an understanding of particular person firms and the industries through which they function. Constructing that information takes time, and only a few individuals have sufficient time to recurrently analysis each inventory market sector, so buyers can use an S&P 500 index fund to complement their information gaps and diversify their portfolios.

To be clear, diversification just isn’t important to earning profits within the inventory market, nevertheless it does mitigate the danger inherent to a concentrated portfolio. I discover that very compelling. I hold a big portion of my portfolio in particular person shares, a lot of which come from the know-how sector, and I hold the remaining within the Vanguard S&P 500 ETF.

I like that technique for 2 causes. First, if my particular person shares outperform the S&P 500, then my complete portfolio will beat the market. Second, if my particular person shares underperform the S&P 500, my portfolio will nonetheless carry out fairly nicely as a result of the S&P 500 has returned 10.14% yearly over the past 30 years.

Do you have to make investments $1,000 in Vanguard S&P 500 ETF proper now?

Before you purchase inventory in Vanguard S&P 500 ETF, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Vanguard S&P 500 ETF wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Trevor Jennewine has positions in Amazon, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Idiot recommends UnitedHealth Group. The Motley Idiot has a disclosure coverage.

Warren Buffett Recommends This Surefire Index Fund. It May Flip $400 Per Month Into $847,800 was initially printed by The Motley Idiot