2022 was a troublesome yr within the inventory market. Considerations stemming from a challenged economic system brought on pronounced promoting exercise, sending shares right into a nosedive. The tech-heavy Nasdaq Composite dropped 33% in 2022 — marking solely the sixth time in over 50 years it is dropped by that degree or extra.

Within the midst of 2022’s sell-off, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) accomplished a 20-for-1 inventory cut up. Analyzing stock-split shares might be an fascinating train as it might shed some mild on firms which have skilled larger buying and selling volumes and witnessed a surging share value. Whereas inventory splits don’t inherently enhance the worth of an organization, seasoned buyers know that following a inventory cut up, the corporate’s shares sometimes are likely to see elevated demand — given its perceived lower cost — that ultimately pushes up the inventory value.

Since splitting in July 2022, Alphabet inventory has returned about 28% — a lot decrease than its huge tech counterparts akin to Microsoft, Apple, Amazon, Meta, and Nvidia. I believe a variety of this has to do with synthetic intelligence (AI), and which firms are seen as rising leaders.

One may argue that Microsoft, Nvidia, and even Tesla garner probably the most consideration in terms of AI. Microsoft kicked off the AI race after a $10 billion funding in OpenAI, the developer behind ChatGPT. In the meantime, demand for Nvidia’s semiconductor chips, that are used to coach generative AI fashions, is surging, and Tesla seems to be getting ready to commercially out there autonomous driving.

Given this degree of competitors, AI buyers might have missed out on Alphabet’s progress. In truth, billionaire hedge fund supervisor Invoice Ackman thinks Alphabet’s AI enterprise is so ignored that buyers can purchase it “totally free.”

I agree with Ackman’s place and assume Alphabet inventory appears to be like like a discount. Let’s dig into why 2024 may very well be a good time to purchase some shares on this underappreciated AI chief.

A visit down reminiscence lane

Because it was based in 1971, the Nasdaq Composite has solely generated adverse returns 14 occasions. The one durations that the index had consecutive years of declining returns had been in 1973 and 1974, in addition to 2000, 2001, and 2002.

These tendencies underscore the resiliency of the Nasdaq, given it tends to bounce again after a down yr. Nonetheless, whereas inflation is starting to chill and lots of economists consider the Federal Reserve is completed with fee hikes, I would not be stunned if the tumultuous market situations from 2022 may nonetheless be lingering at the back of your thoughts — inflicting some hesitation in terms of tech shares specifically.

Over the past 20 years, the Nasdaq has solely dropped by 30% or extra on three events — 2002, 2008, and 2022. Apparently, following the market crashes of 2002 and 2008, the Nasdaq went on to surge for consecutive years thereafter. From 2002 to 2007, the Nasdaq returned a median of 15.9% per yr. And from 2009 to 2010, the index elevated by a median of 30%.

To be clear, the previous efficiency of the Nasdaq does not assure future outcomes. Nonetheless, given the booming demand for AI, I believe 2024 may very well be one other sturdy yr for tech shares following the Nasdaq’s 43% bounceback return final yr.

Alphabet’s good points in AI may simply be the start

Over the past couple of years, the broader economic system has been plagued with excessive inflation and borrowing prices, forcing firms of all sizes to reign in spending and function on leaner budgets. These macroeconomic components took their toll on many alternative sectors, and the know-how panorama was notably impacted as demand for costly software program functions began to wane.

Because it pertains to Alphabet and its gigantic promoting enterprise, entrepreneurs have turn out to be more and more selective in tips on how to allocate marketing campaign {dollars}. It ought to come as no shock that this put Alphabet on the heart of an intense battle amongst competing social media platforms TikTok, Fb, and Instagram.

Nonetheless, Alphabet has invested vital capital into new services — that are already serving to the corporate return to development. It has been integrating AI capabilities throughout its total ecosystem, together with areas akin to Google Cloud, Google Search, video-sharing web site YouTube, and productiveness instruments inside Google Workspace.

Moreover, the discharge of its ChatGPT competitor referred to as Gemini may simply be the catalyst the corporate must be thought-about a frontrunner amongst AI builders. But regardless of all of those thrilling good points, Alphabet inventory is not garnering a premium commensurate with its big-tech counterparts — making the inventory a tempting purchase at its present valuation.

Alphabet inventory appears to be like filth low-cost

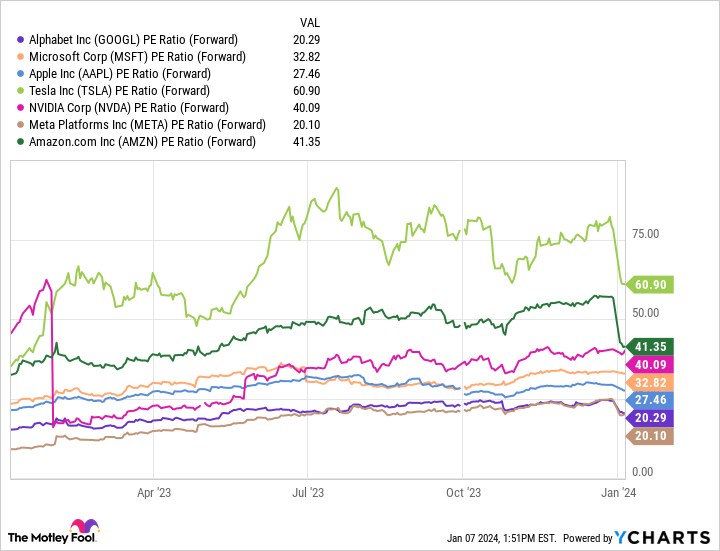

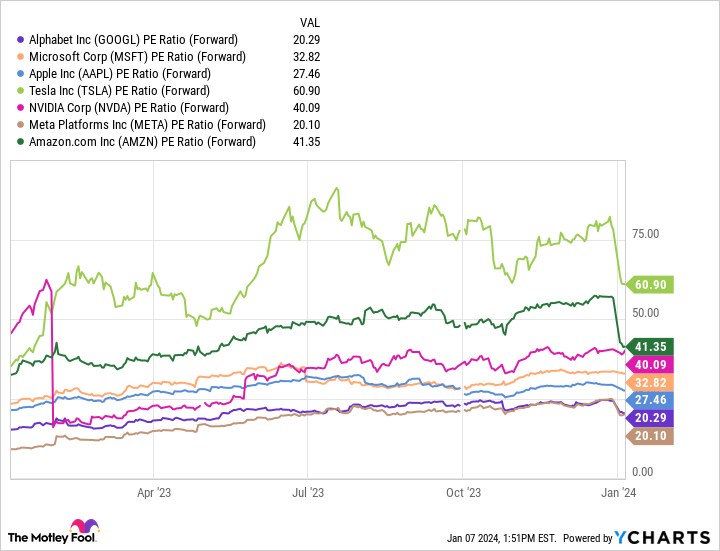

The chart above illustrates the ahead price-to-earnings (P/E) multiples for the “Magnificent Seven” shares. At a ahead P/E of 20.3, Alphabet inventory is successfully tied for final place with Meta. Furthermore, that is proper in step with the S&P 500‘s ahead P/E of 20.7 — probably signaling that buyers do not anticipate Alphabet to outperform the broader markets.

To me, Alphabet inventory is absurdly undervalued. Regardless of cooling inflation and the potential of Federal Reserve tapering rates of interest this yr, I think that many are cautious over the corporate’s development prospects. Extra particularly, the corporate’s rebound in promoting in 2023 is encouraging — however needless to say income solely elevated 7% yr over yr by way of the primary 9 months of 2023.

I believe it is a short-sighted concern, particularly with 2024 containing tailwinds that might increase digital promoting platforms. Moreover, Alphabet is making notable strides in cloud computing — a market largely dominated by Amazon and Microsoft proper now.

There is no doubt that Alphabet has loads to show. However needless to say the inventory has returned over 5,300% to buyers since its preliminary public providing in 2004. Even only a $1,000 funding 20 years in the past would now be value roughly $54,000.

To me, this underscores Alphabet’s robust efficiency over a long-term time horizon. Whereas the corporate will probably proceed keeping off an growing variety of rivals, I believe administration is taking spectacular actions to diversify Alphabet’s services and constructing the inspiration for long-term sustained development. With the inventory buying and selling at such a discount, now appears to be like like a tremendous alternative to scoop up shares and maintain on for the trip.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Alphabet wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has a disclosure coverage.

Historical past Says the Nasdaq Will Crush 2024. Here is 1 Synthetic Intelligence (AI) Inventory-Cut up Inventory to Purchase and Maintain Eternally. was initially revealed by The Motley Idiot