JPMorgan Chase CEO Jamie Dimon mentioned he stays cautious on the U.S. financial system over the subsequent two years due to a mixture of monetary and geopolitical dangers.

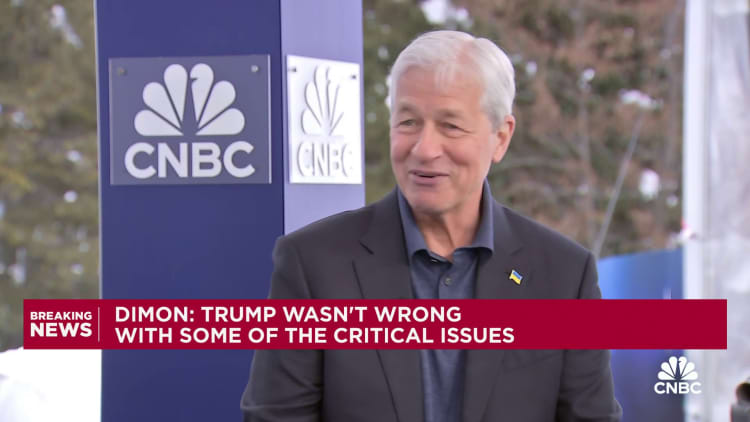

“You’ve gotten all these very highly effective forces which are going to be affecting us in ’24 and ’25,” Dimon instructed Andrew Ross Sorkin on Wednesday in a CNBC interview on the World Financial Discussion board in Davos, Switzerland.

“Ukraine, the terrorist exercise in Israel [and] the Crimson Sea, quantitative tightening, which I nonetheless query if we perceive precisely how that works,” Dimon mentioned. Quantitative tightening refers to strikes by the Federal Reserve to scale back its steadiness sheet and rein in earlier efforts together with bond-purchasing applications.

Dimon has advocated warning over the previous few years, regardless of document earnings at JPMorgan, the nation’s largest financial institution, and a U.S. financial system that has defied expectations. Regardless of the corrosive influence of inflation, the American client has largely remained wholesome due to good employment ranges and pandemic-era financial savings.

In Dimon’s view, the comparatively buoyant inventory market of latest months has lulled traders on the potential dangers forward. The S&P 500 market index rose 19% prior to now 12 months and is not removed from peak ranges.

“I believe it is a mistake to imagine that all the pieces’s hunky-dory,” Dimon mentioned. “When inventory markets are up, it is type of like this little drug all of us really feel prefer it’s simply nice. However keep in mind, we have had a lot fiscal financial stimulation, so I am somewhat extra on the cautious aspect.”

Goldman Sachs CEO David Solomon mentioned Wednesday that whereas the market atmosphere excluding geopolitical points “feels higher at the moment” than a 12 months in the past, he was troubled by hovering U.S. debt ranges.

“I am very involved in regards to the rising debt,” Solomon mentioned. “It is a large danger difficulty that we will must cope with and reckon with, it simply may not occur within the subsequent six months.”

Dimon isn’t any stranger to dire predictions: In 2022, he warned traders of an financial “hurricane” forward due to quantitative tightening and the Ukraine battle.

In Wednesday’s wide-ranging interview, Dimon mentioned his views on Ukraine, former President Donald Trump, immigration, business actual property and bitcoin.

“We have now to show the American public that that is about freedom and democracy for the free world, and that is why the battle is being fought,” Dimon mentioned in regards to the Ukraine battle.

Learn extra: Jamie Dimon says ‘brace your self’ for an financial hurricane brought on by the Fed and Ukraine battle