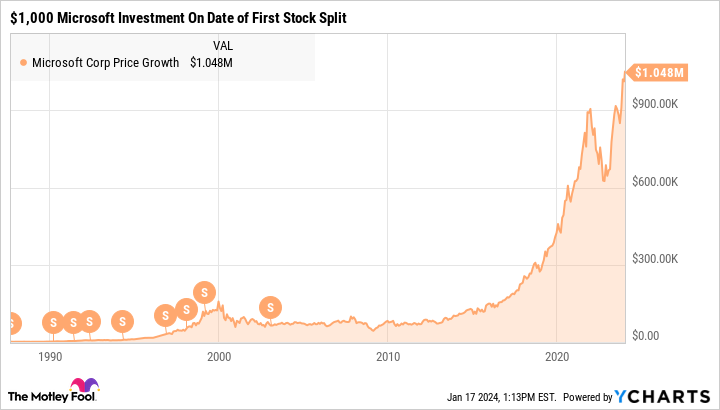

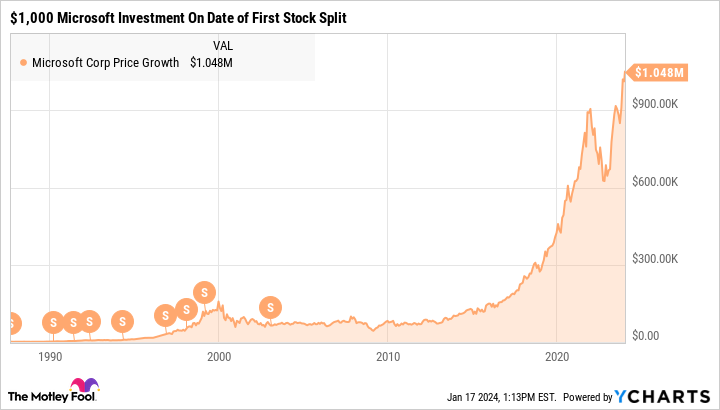

Tech-titan Microsoft (NASDAQ: MSFT) has executed 9 inventory splits over its lengthy historical past. As an instance to procure one share between the preliminary public providing (IPO) in 1986 and the primary break up in 1987. It might have multiplied into 288 stubs after all of the splits. A $1,000 Microsoft funding on the day of that first inventory break up could be value $1.05 million in the present day:

It has been some time since Microsoft took that route. As you’ll be able to see within the chart above, the corporate hasn’t break up its inventory since February 2003, when the share rely doubled for the final time.

Or perhaps I ought to say, “For the final time to date.” Given Microsoft’s super good points during the last 21 years, I would not be stunned to see a contemporary inventory break up sometime quickly.

Thoughts you, I am not holding my breath for this potential — however certainly not assured — occasion. Inventory splits do not add worth or open up shopping for home windows — they solely make it simpler to afford a single share. On the identical time, a inventory break up usually indicators that the corporate’s board of administrators and administration staff have excessive confidence that the inventory will proceed to rise, and that vote of confidence needs to be seen as excellent news.

Under, I will check out why Microsoft may need to take its inventory down from its lofty perch, at the moment buying and selling at $389 per share with a $2.9 trillion market cap.

AI is the primary motive why Microsoft’s inventory may break up quickly

The inventory has finished astonishingly effectively since OpenAI launched the ChatGPT system to an unsuspecting world. Synthetic intelligence (AI) has turn out to be a number one worth driver throughout the tech sector, and Microsoft sits on the epicenter of this game-changing revolution.

The corporate has dedicated a $13 billion funding to OpenAI and the AI engine that drives ChatGPT runs on Microsoft’s Azure cloud-computing platform. Generative AI options are popping up all around the software program mammoth’s product portfolio.

Microsoft is on the forefront of the AI revolution, with AI infusing every part from its Azure platform to enterprise software program. This technique is displaying tangible outcomes — a quickly rising buyer base for Azure AI companies and potential income boosts from the AI-enhanced model of Microsoft 365. It isn’t only a technological leap however a basic technique shift with severe monetary connotations.

It isn’t the one ingredient in Microsoft’s monetary cocktail, after all. The corporate also needs to profit from the bettering well being of the worldwide economic system as inflation pressures fade away. As well as, the just lately closed buyout of online game large Activision Blizzard ought to drive essential adjustments throughout the corporate’s whole enterprise.

However nothing compares to the promise and potential of its AI experience. Within the phrases of Microsoft founder Invoice Gates, “The event of AI is as basic because the creation of the microprocessor, the private pc, the web, and the cell phone.” Securing a number one position in that revolution ought to drive Microsoft’s long-term progress to new heights.

These are the the reason why Microsoft may announce a inventory break up in 2024 as the corporate stands on the threshold of an entire new enterprise period. Projecting energy with a inventory break up looks as if an affordable transfer — and people shares certain look expensive in the present day. Why not reduce the biggest market cap of all into a bigger variety of slices?

How would a inventory break up change Microsoft’s shareholder worth?

It is no large deal if Microsoft would not break up its inventory this 12 months — or ever once more, for that matter. Most inventory brokerages assist shopping for and promoting fractional shares these days, and inventory trades usually do not carry transaction charges anymore.

Should you solely have $50 to spend money on Microsoft this month, it’s extremely straightforward to put an order for one-tenth of a full share. The top consequence could be precisely the identical as ready for a 10-for-1 inventory break up after which shopping for a single stub.

No person is aware of whether or not Microsoft will go for a inventory break up at this level, and inventory costs could change by lots earlier than then. You may make a fractional-share commerce in the present day at firmly established share costs.

Microsoft may very effectively announce a inventory break up sometime quickly. Be at liberty to purchase, promote, or maintain the inventory based on your personal evaluation till that long-awaited break up comes alongside — and do not let it change your funding thesis an excessive amount of. A assured management staff may be excellent news, however that is the one investable high quality I see in inventory splits.

The place to speculate $1,000 proper now

When our analyst staff has a inventory tip, it may possibly pay to hear. In any case, the e-newsletter they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they consider are the ten finest shares for traders to purchase proper now… and Microsoft made the checklist — however there are 9 different shares it’s possible you’ll be overlooking.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Microsoft. The Motley Idiot has a disclosure coverage.

Inventory-Break up Watch: Is Microsoft Subsequent? was initially printed by The Motley Idiot