The previous 5 years have been rewarding for Nvidia (NASDAQ: NVDA) traders. The semiconductor specialist’s inventory is a strong multibagger, turning a January 2019 funding of $1,000 into $14,550 as of this writing.

This terrific bounce in Nvidia’s inventory value over the previous decade might be attributed to the excellent development within the firm’s income and earnings. This development is fueled by a number of catalysts, together with the booming demand for gaming {hardware}, the rising demand for high-performance computing purposes, the rising deployment of semiconductors in vehicles, and now the necessity for graphics playing cards for coaching synthetic intelligence (AI) fashions.

The great half is that Nvidia is setting itself as much as ship even stronger returns over the following 5 years via its aggressive product roadmap, which ought to enable it to capitalize on a number of multi-billion-dollar alternatives. It is value noting that the corporate identified a few years in the past that it sees a $1 trillion income alternative throughout a number of finish markets reminiscent of automotive, gaming, enterprise software program, and chips and methods.

Provided that it is on monitor to complete fiscal 2024 (which is able to finish this month) with $59 billion in income, it will not be stunning to see Nvidia’s income and earnings development accelerating massive time over the following decade because it dives deeper into its addressable market. Let us take a look at the explanation why which will occur and the place the inventory could possibly be after 5 years.

Nvidia is rising at an eye-popping tempo that reveals no indicators of slowing

When Nvidia reported its fiscal 2019 outcomes 5 years in the past, the corporate generated annual income of $11.7 billion. So, Nvidia’s income is on monitor to extend 5 occasions in an area of 5 years contemplating its fiscal 2024 forecast, translating right into a compound annual development price (CAGR) of 38%. An analogous CAGR over the following 5 years would take Nvidia’s annual income to a whopping $295 billion in fiscal 2029.

Nonetheless, sure Wall Avenue analysts imagine that Nvidia might do even higher. Take Mizuho analyst Vijay Rakesh, for instance. He predicts that Nvidia might generate annual income of $300 billion in 2027 from promoting AI chips alone, because of having a strong 75% share of this fast-growing market. Whereas which will appear outrageous at first, a more in-depth have a look at the marketplace for AI chips signifies that Nvidia might certainly hit that bold mark.

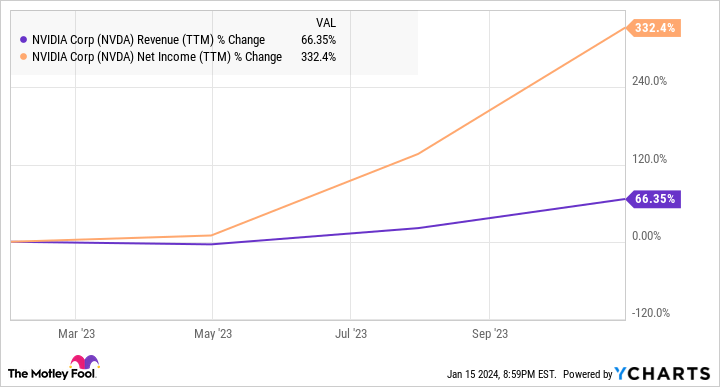

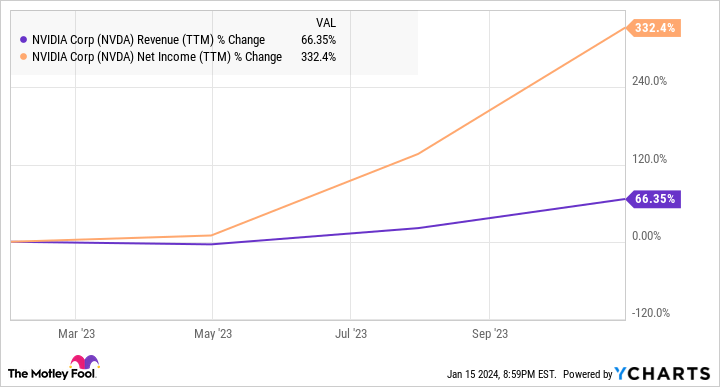

It is well-known that Nvidia is the most important participant in one of many hottest tech niches proper now — AI chips — which has allowed the corporate to file a terrific bounce in income and earnings over the previous yr.

Notice that this marketplace for AI chips is in the beginning of an enormous development curve. Nvidia’s rival Superior Micro Gadgets estimates that the marketplace for AI accelerators might bounce to $400 billion in 2027, a giant bounce from final yr’s estimate of $45 billion. Citi analysts count on Nvidia to take care of a large 90% share of this market over the following two to 3 years, regardless of the efforts its rivals are making to chop Nvidia’s lead on this market.

That is as a result of Nvidia has doubled down on the tempo of innovation in AI chips, which ought to assist it preserve a strong share of this market in the long term. As such, the potential for Nvidia certainly producing $300 billion in annual income from AI chip gross sales after 5 years can’t be dominated out. It could actually hit that mark even when its share falls to 75% — as Rakesh suggests — contemplating that the general AI chip market measurement is anticipated to hit $400 billion as per AMD’s estimates.

The excellent news is that Nvidia is trying to flex its muscle tissue past the AI accelerator market. The corporate lately revealed new consumer-focused graphics playing cards folks can use to run AI purposes proper on their desktops and laptops for gaming, creating giant language fashions (LLMs), customizing generative AI fashions, and even inferencing purposes. As an example, Nvidia claims that its new RTX 4080 Tremendous graphics card “generates AI video 1.5x sooner — and pictures 1.7x sooner — than the GeForce RTX 3080 Ti GPU.”

Provided that the demand for units that may run AI on the edge — reminiscent of smartphones, private computer systems, and cameras — is anticipated to clock annual development of 26% via 2032 and generate $143 billion in annual income on the finish of the forecast interval, Nvidia is doing the appropriate factor by tapping this market early.

Additionally, contemplating the opposite notable catalysts that Nvidia may benefit from, it will not be stunning to see the corporate’s prime line head nearer to $300 billion after 5 years. If that is certainly the case, traders can count on the inventory to ship excellent beneficial properties as soon as once more over the approaching 5 years.

Buyers can count on the inventory to make them richer

Nvidia has a five-year common price-to-sales ratio of 20. As we’re assuming that the corporate’s income development over the following 5 years can match the speed it has clocked prior to now 5, we will count on Nvidia to take care of its common gross sales a number of over the following 5 years as effectively. Primarily based on a prime line of $300 billion after 5 years, a gross sales a number of of 20 factors towards a market cap of a whopping $6 trillion. That might be means greater than Nvidia’s present market cap of round $1.35 trillion.

Nonetheless, Nvidia carries a reduced ahead price-to-sales ratio of 14. Assuming an analogous a number of after 5 years implies that its market cap might enhance to $4.2 trillion utilizing the $300 billion income estimate. Once more, that factors towards a 3x bounce in Nvidia’s inventory value over the following 5 years.

All this means that traders can count on Nvidia to leap considerably over the following 5 years and multiply their investments as soon as once more, making it a prime development inventory to purchase proper now.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of the S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 8, 2024

Citigroup is an promoting companion of The Ascent, a Motley Idiot firm. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets and Nvidia. The Motley Idiot has a disclosure coverage.

The place Will Nvidia Inventory Be in 5 Years? was initially revealed by The Motley Idiot