Each portfolio ought to have some “perpetually” shares — firms so good that they are value holding for a really, very very long time.

They’re like keepsakes — oftentimes handed down from father or mother to little one. They are often the bedrock of true generational wealth. So, what varieties of shares match that invoice? Nicely, let’s take a look at three that I take into account perpetually shares.

Amazon

Tech large Amazon (NASDAQ: AMZN) is a mainstay of my funding portfolio and can stay so for a few years to come back, for 3 key causes.

-

Relentless give attention to the shopper: This was the creed of founder and former CEO Jeff Bezos, and it nonetheless permeates the corporate immediately. Look no additional than the corporate’s mission assertion: “Amazon’s mission is to be Earth’s most customer-centric firm.”

-

Innovation: Amazon has developed quite a few improvements, starting from its sprawling achievement community to its huge array of information facilities that make it the worldwide chief in cloud computing providers.

-

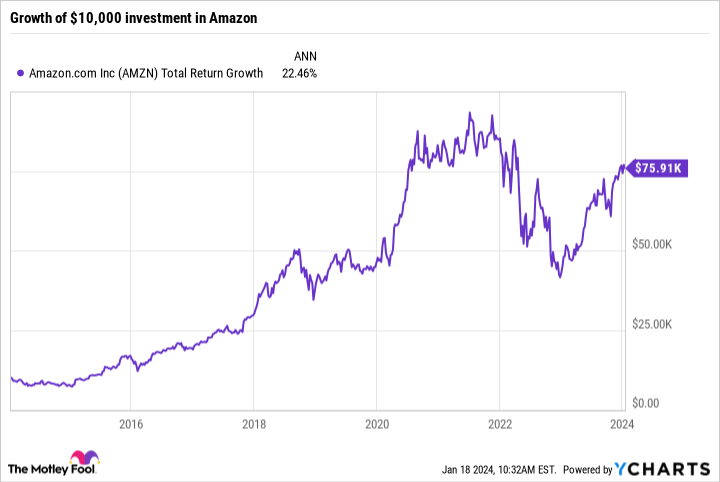

Delivering shareholder worth: The corporate continuously reevaluates its funds and workforce, with a give attention to balancing shareholder returns and reinvestment within the enterprise. Over the past 10 years, Amazon shares have returned 659%, that means a $10,000 funding in early 2014 could be value almost $76,000 as of this writing.

Briefly, Amazon is a good firm. What’s extra, with analysts anticipating it to develop gross sales by 11% this yr as its long-term investments in regional distribution mix with a rebound in enterprise cloud spending.

Coca-Cola

Subsequent up is Coca-Cola (NYSE: KO), the legendary maker of iconic beverage manufacturers comparable to Coke, Sprite, Powerade, Fanta, Schweppes, and Minute Maid, amongst many others.

The rationale I intend to personal Coca-Cola inventory perpetually is that the corporate delivers constant earnings development. Over the past 5 years, Coca-Cola has grown its internet earnings from $6.7 billion to $10.8 billion. Quarterly earnings per share (EPS) have elevated at a mean fee of 19%. Furthermore, free money circulation — the lifeblood of a mature, dividend-paying firm — has grown from $6.0 billion to greater than $10.2 billion.

That, in flip, has allowed Coca-Cola to extend its dividend constantly. The truth is, the corporate has raised its dividend every year, courting again 62 years — representing one of many longest such streaks on Wall Avenue.

And what a dividend it’s! The corporate pays $1.84 per share — good for a dividend yield of three.1% on the present share value. That is greater than twice the 1.4% common yield of the S&P 500 index.

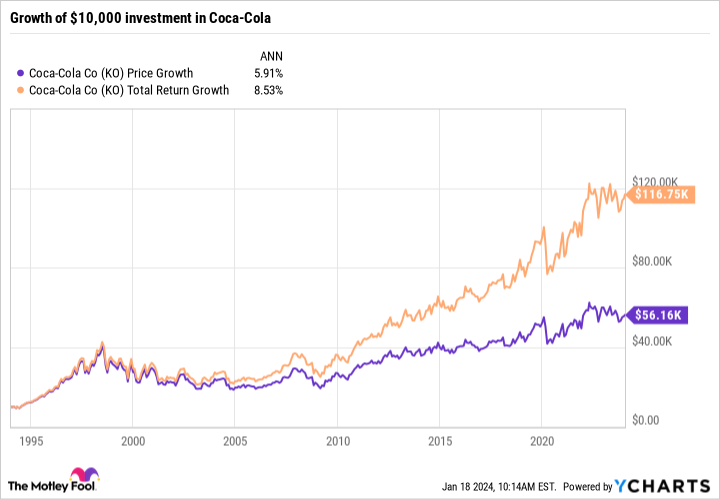

To see how necessary these dividend funds are over the long run, take into account this chart which exhibits the expansion of a $10,000 funding in Coca-Cola over the past 30 years.

The corporate’s steadily rising payouts make an infinite distinction, boosting the full return of the funding from $56,000 to greater than $116,000 (with dividend reinvestment).

Briefly, Coca-Cola stays a strong inventory that buyers can depend on for the very long-term — an almost good perpetually inventory.

Nvidia

Lastly, there’s Nvidia (NASDAQ: NVDA). The rationale to personal Nvidia perpetually is easy: Know-how is the longer term.

By no means has this been extra apparent than proper now. Whether or not it is synthetic intelligence (AI), autonomous driving, superior robotics, or gene enhancing, it is clear that the subsequent wave of technological breakthroughs may have one factor in widespread: They’ll require great quantities of computing energy.

Which means demand for superior semiconductors — the sort used within the supercomputers and server farms of immediately and tomorrow — will proceed to develop massively within the years to come back.

Nvidia, which many consultants imagine makes the most effective and quickest chips for high-performance computing, stands to learn enormously from the rise of AI and different cutting-edge tech improvements.

That is why Wall Avenue analysts are elevating their forecasts for its future gross sales at a breakneck tempo. The consensus amongst analysts is that Nvidia will report over $92 billion in income for its fiscal 2025. Over the past 12 months, it reported $45 billion in revenues.

Nonetheless, Nvidia is not an ideal perpetually inventory for everybody. Earnings-seeking buyers shall be higher off wanting elsewhere, as will value-oriented buyers and those that lack the abdomen for shares with excessive volatility.

Nonetheless, for long-term buyers who a prepared to carry on by means of the inevitable volatility, Nvidia is a perpetually inventory with a excessive ceiling, and one value severely contemplating.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Amazon, Coca-Cola, and Nvidia. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2024 $47.50 calls on Coca-Cola. The Motley Idiot has a disclosure coverage.

3 Shares You Can Hold Perpetually was initially printed by The Motley Idiot