The macroeconomic challenges that characterised a lot of the previous two years are starting to fade. After plunging 35% in 2022, the Nasdaq Composite bounced again in 2023, gaining 43%. Whereas the market is presently regrouping, historical past suggests there might be extra good points to return.

Reviewing knowledge going again 51 years, in yearly that adopted a market restoration, the tech-centric index has gained once more in a second 12 months by a mean of 19%. That provides us good motive to imagine the present rally nonetheless has legs. The financial system remains to be fragile, and circumstances might erode, however one other sturdy 12 months could also be forward for the inventory market.

Serving to gas the market’s general good points final 12 months have been a bunch of investor favourite shares recognized collectively because the “Magnificent Seven,” which outpaced the broader market in 2023 by a large margin.

Amongst these family names, one which represents a very compelling alternative for traders at present is Amazon. On the heels of its strong good points final 12 months, the stage is about, and the corporate will possible ship one other standout efficiency.

Lingering challenges

The macroeconomic headwinds of the previous couple of years amounted to one thing of an ideal storm for Amazon. Excessive inflation precipitated a slowdown in shopper discretionary spending, and on-line purchases have been among the many first casualties. This additionally prompted a commensurate decline in enterprise spending.

Promoting is one space within the funds that firms can simply and quickly dial down or scale up — and a broad cutback on that entrance weighed on Amazon’s digital promoting enterprise. Moreover, many firms put their digital transformations — highlighted by the shift of workloads to the cloud — on the again burner, which precipitated slowing progress for Amazon Internet Companies (AWS), the corporate’s cloud infrastructure enterprise.

Whereas the consequences of these points linger, issues are wanting up for Amazon.

The undisputed chief in e-commerce

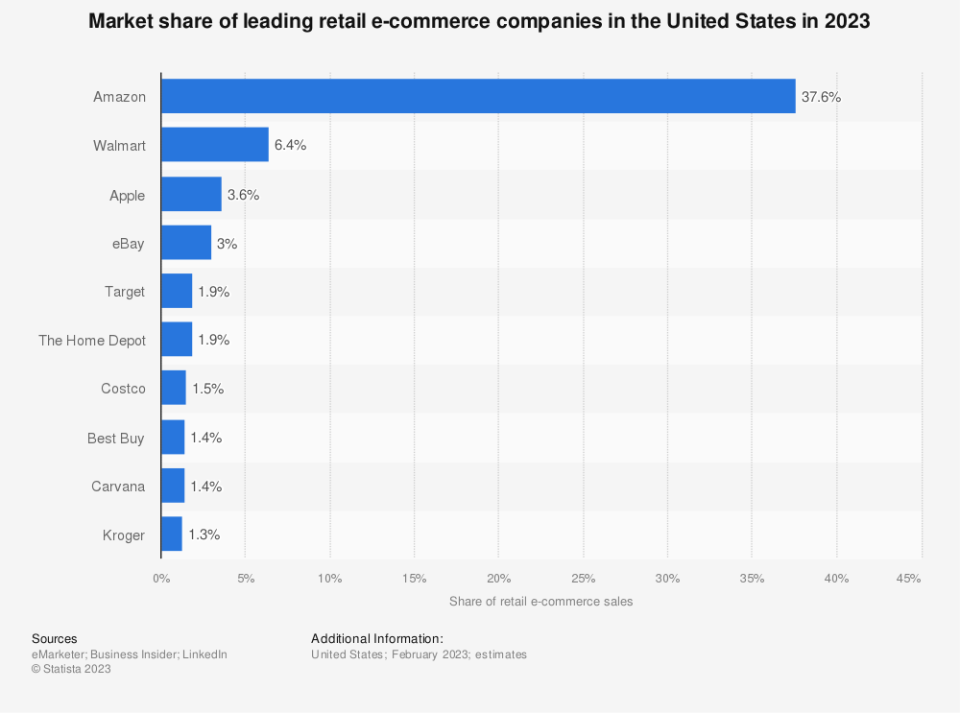

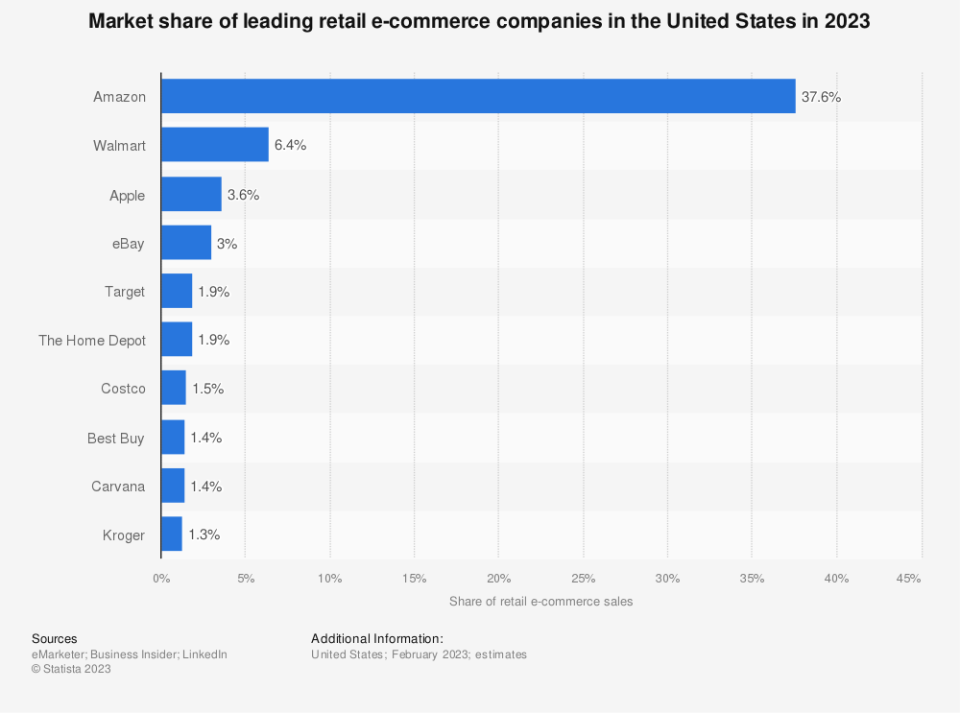

Regardless of persisting unease relating to the financial system, there are causes to stay optimistic. Amazon is synonymous with e-commerce, an {industry} it nonetheless dominates. Whereas the figures for 2023 have but to be tallied, Amazon accounted for roughly 38% of all on-line gross sales within the U.S. in 2022, greater than the subsequent 14 opponents mixed, in accordance with on-line knowledge supplier Statista. It is unlikely the corporate ceded its industry-leading place, although the competitors may need made some inroads.

Moreover, e-commerce gross sales are anticipated to develop by greater than 9% in 2024 to $6.3 trillion, representing greater than 20% of all retail gross sales, in accordance with estimates supplied by Insider Intelligence. As the net gross sales chief, Amazon will profit from this secular tailwind.

All of it “adverts” up

One among Amazon’s largest progress drivers in recent times has been digital promoting, owing to the corporate’s captive viewers. Within the third quarter, Amazon’s digital promoting income grew 26% 12 months over 12 months, outperforming its largest rivals, Alphabet and Meta Platforms, which grew their advert revenues by 9% and 24%, respectively.

Amazon is seeking to increase its advert enterprise by exhibiting “restricted promoting” on its Prime Video streaming service starting this month. Subscribers can have the choice to pay a further $3 per 30 days to maintain their viewing expertise ad-free, however Amazon wins both approach.

Moreover, digital promoting is anticipated to extend by 13.2% in 2024, after climbing greater than 10% final 12 months, in accordance with Insider Intelligence. Because the No. 3 digital advert platform within the U.S., Amazon will little doubt profit from any acceleration in advert spending.

The clouds are lifting

Within the face of financial challenges, AWS maintained its place because the world’s main supplier of cloud infrastructure companies, controlling 31% of the market in Q3, in accordance with market analyst Canalys.

After a interval of subdued progress over a lot of the previous two years, cloud adoption is anticipated to reaccelerate in 2024. Analysis and consulting agency Gartner estimates that public cloud spending will leap 20% to $679 billion. An acceleration in cloud adoption will possible improve the fortunes of AWS.

You’ll be able to’t spell good points with out AI

Final however actually not least, Amazon has a protracted and storied historical past of utilizing synthetic intelligence (AI) to enhance its operations, and has jumped into the generative AI ring with each ft. AWS Bedrock supplies customers with entry to all the commonest AI fashions, permitting them to construct personalized AI apps of their very own. It additionally supplies entry to Nvidia’s newest and best AI chips — the H200 Tensor Core graphics processing items (GPUs) — in addition to Amazon’s personal Inferentia and Trainium AI chips. This lets clients strike a stability between pace and financial system.

The corporate just lately launched Amazon Q for enterprises, a generative AI-powered digital assistant designed to assist automate and streamline time-consuming and mundane duties, thereby making customers extra productive.

Amazon can be offering AI instruments to the retailers that promote on its platform to assist them succeed. The corporate launched AI-powered picture era for digital advertisers whereas additionally utilizing AI to enhance search and product suggestions. Simply this week, Amazon started testing a function that lets clients ask questions on a product and obtain an AI-generated response.

These most up-to-date forays into AI present a glimpse of Amazon’s sport plan.

A compelling alternative

Regardless of the wealth of alternative forward for Amazon, its inventory remains to be fairly valued at 2 instances subsequent 12 months’s anticipated gross sales.

Given the rebound in on-line retail, the restoration of the advert market, the continued digital transformation, and the AI-inspired gold rush, now’s the time to purchase Amazon earlier than the inventory roars even larger.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Amazon wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends Gartner. The Motley Idiot has a disclosure coverage.

Historical past Suggests the Nasdaq Will Surge in 2024: 1 “Magnificent Seven” Inventory to Purchase Earlier than It Does was initially revealed by The Motley Idiot