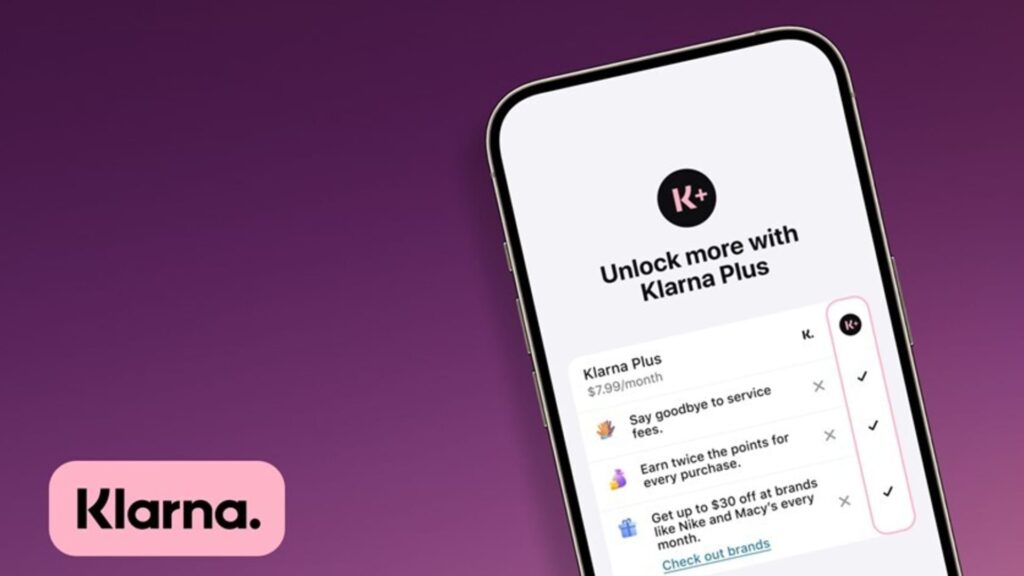

Swedish purchase now, pay later agency Klarna unveils a $7.99 month-to-month subscription plan referred to as Klarna Plus

Courtesy: Klarna

Swedish fintech agency Klarna is launching a month-to-month subscription plan within the U.S. to lock in its heaviest customers forward of an anticipated preliminary public providing this yr, the corporate informed CNBC.

The product is about to be introduced later Wednesday and can value $7.99 monthly, the Stockholm-based firm stated.

Customers of the subscription plan, named Klarna Plus, will get service charges waived, earn double rewards factors and have entry to curated reductions from companions together with Nike and Instacart, in accordance with Chief Advertising and marketing Officer David Sandstrom.

Purchase now, pay later providers resembling Klarna and Affirm have surged in reputation in recent times as extra People depend on a brand new, fintech-enabled type of credit score. The providers sometimes break up a purchase order into 4 funds.

When Klarna customers store exterior the agency’s community of 500,000 retailers — at locations resembling Walmart, Goal, Amazon and Costco — they pay $1 to $2 in transaction charges.

“The primary proposition of Klarna Plus proper now’s that you do not pay any service charges,” Sandstrom stated. “So when you love Klarna and when you love procuring at Goal and Walmart, it makes a ton of sense financially.”

Klarna’s IPO yr

Klarna’s month-to-month plan is the newest instance of a fintech participant constructing out its choices to spice up recurring income. Wall Avenue buyers are inclined to favor subscription income due to its predictability versus one-time transactions. Rival Affirm has explored its personal subscription plan, although it hasn’t launched one but.

The strategy is particularly well timed as Klarna nears an IPO that might worth it at greater than $15 billion, Sky Information reported in November. Klarna CEO Sebastian Siemiatkowski informed Bloomberg this week {that a} itemizing within the U.S., the agency’s largest market, was in all probability imminent.

Attaining that valuation could be a redemption of kinds for Klarna. The corporate was Europe’s most respected startup earlier than a collapse made it the poster little one for so-called “down rounds” of funding. Klarna’s valuation sank 85% to $6.7 billion in 2022 as rising rates of interest reined in high-flying fintech corporations.

Financial savings sweetener

Klarna Plus might assist persuade buyers that the corporate can develop past its core product. The subscription, which was piloted in Ohio for six months final yr, is a “no brainer” for about 15% of the agency’s heaviest customers, Sandstrom stated. The corporate stated it has about 37 million American prospects.

“The factor we have to show to ourselves and to the market is that we will add a brand new sort of income stream to Klarna,” Sandstrom stated. “That is one thing that a whole lot of firms have struggled to do.”

Up subsequent for the U.S. is a high-yield financial savings account, Sandstrom stated. Klarna Plus prospects would in all probability earn a better rate of interest on financial savings than nonusers, he added.

“If you happen to have a look at our enterprise from the skin, it appears to be like very very like ‘purchase now, pay later,'” Sandstrom stated. However “a world of alternative opens up with somebody you’ve got helped in a monetary relationship. You get to say, ‘Hey, would not it make sense to get the Klarna card?'”