A 12 months in the past, the markets had been simply starting their restoration from bear occasions. Development shares began to take off, and traders puzzled once we might formally name a bull market. Nicely, that point is now, providing us a superb begin to 2024. The S&P 500 lately hit a brand new document excessive, confirming the market is certainly in certainly one of these much-awaited phases of optimism and progress.

In additional excellent news, historical past exhibits us bull markets typically last more than bear markets, providing our portfolios time to profit. And to maximise your bull market potential, it is a terrific concept to purchase shares of progress shares. That is as a result of they have an inclination to excel in bull market environments and occasions of financial restoration and enlargement. Listed here are my high progress shares to purchase in 2024.

1. Amazon

Amazon (NASDAQ: AMZN) is a the best progress inventory as a result of it is a chief in two high-growth markets: e-commerce and cloud computing. The corporate is also investing closely within the scorching space of synthetic intelligence (AI), which is boosting earnings in two methods.

AI is driving effectivity in Amazon’s operations, serving to it to decrease prices. And Amazon, via cloud computing enterprise Amazon Internet Companies (AWS), provides AI instruments to purchasers. Contemplating the excessive demand on this space, AWS’ AI instruments might maintain these purchasers coming again, boosting AWS’ income. That is significantly essential since AWS historically has pushed revenue at Amazon.

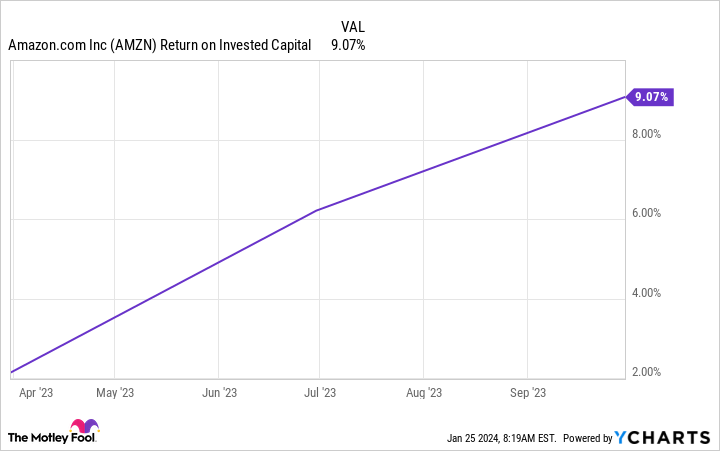

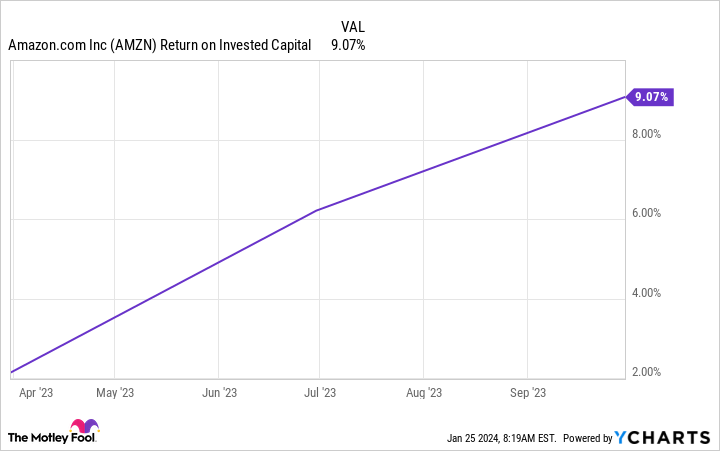

Amazon’s latest efforts to revamp its price construction — to battle rising inflation and different challenges — have been bearing fruit. Again in 2022, the corporate reported its first annual loss in a few decade. However by early final 12 months, Amazon already was reporting quarterly features in internet revenue, and its outflow of money had shifted to an influx. In the newest quarter, the corporate’s internet revenue greater than tripled, and free money circulate improved to an influx of greater than $21 billion. Return on invested capital additionally has been on the rise over the previous 12 months.

These strikes ought to profit the corporate in higher occasions, too. Amazon improved effectivity throughout its success community, for instance switching to a regional mannequin from a nationwide mannequin within the U.S. The shorter supply distances are driving enhancements in Amazon’s “price to serve,” and the corporate sees potential for ongoing progress right here.

So, although Amazon inventory climbed final 12 months, the potential for features is much from over — and the inventory may very well be one to excel on this bull market.

2. Carnival

Carnival (NYSE: CCL) had a tough time of it earlier within the pandemic when sailings had been halted, however the world’s largest cruise operator has since roared again to progress. Demand for cruise holidays soared, as we will see in Carnival’s income and bookings. In the newest quarter — the fiscal fourth quarter — Carnival reported document income, and bookings within the two weeks round Black Friday hit an all-time excessive for that interval.

For the fiscal 12 months that resulted in November, Carnival reported document income of greater than $21 billion and entered the brand new 12 months with its greatest booked place ever, making an allowance for occupancy and value. And this has helped the corporate make features in earnings, for instance, reporting a narrower-than-expected U.S. GAAP internet lack of $74 million for the 12 months and constructive adjusted internet revenue of $1 million.

Buyers’ largest concern about Carnival has been the corporate’s debt ranges. Whereas ships had been docked throughout early pandemic days, Carnival constructed up a wall of debt simply to remain afloat (excuse the pun). However Carnival has made important progress right here, too, reducing debt by $4.6 billion from its peak, and Carnival says ongoing progress in adjusted free money circulate will assist it pay down extra debt over time.

Carnival’s reserving volumes and buyer deposits, which even have reached data, are cause to be optimistic about earnings. And the corporate’s different efforts to streamline operations and lower gas prices add to earnings progress potential.

That is why now, as Carnival costs forward in its restoration and progress story, is the proper time to choose up this inventory.

3. Apple

Apple (NASDAQ: AAPL) is a market large because of main merchandise just like the iPhone and Mac computer systems, however that does not imply the corporate has reached a plateau in relation to progress. The truth is, three issues are set to drive earnings progress nicely into the longer term.

The primary is Apple’s model power, which helps maintain Apple customers coming again to purchase the newest iPhone or Apple Watch as an alternative of attempting a rival product. This model power is a part of Apple’s moat, or aggressive benefit — a key component that might maintain this firm forward over time.

The second progress driver is Apple’s providers enterprise, which in the newest quarter reported document income. It is because all of these loyal Apple followers additionally subscribe to sure providers via their gadgets — from digital content material to cloud storage. The large consumer base Apple has constructed through the years (the put in base of energetic gadgets topped 2 billion) now represents a supply of recurrent income.

And, importantly, gross margins on providers are greater than these on merchandise — 70% in contrast with 36% in the newest quarter.

Lastly, Apple nonetheless continues to achieve new clients, so it hasn’t but reached a most in relation to gaining market share. Within the quarter, half of Mac and iPad patrons had been new to these merchandise.

Contemplating all of this, Apple’s progress story is ready to be a protracted one, and the brand new bull market could also be one of the crucial thrilling chapters — for the corporate and for shareholders.

Do you have to make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 22, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adria Cimino has positions in Amazon. The Motley Idiot has positions in and recommends Amazon and Apple. The Motley Idiot recommends Carnival Corp. The Motley Idiot has a disclosure coverage.

My Prime Bull Market Development Shares to Purchase in 2024 was initially printed by The Motley Idiot