Shopping for cash-generating companies when their dividend yields are excessive and their inventory costs are low is a time-tested technique for amassing wealth within the inventory market. In the event you’re fascinated by implementing this strategy in your individual portfolio, listed below are two shares to think about investing in at present.

1. Verizon Communications

Verizon (NYSE: VZ) is a well-liked inventory amongst income-seeking traders. It is simple to see why. The telecom large’s shares are presently providing an attractive 6.5% yield in your funding {dollars}.

As folks spend extra time on-line, 5G wi-fi and broadband web companies are shortly turning into requirements. Verizon, which has garnered a fame for quick and dependable service amongst companies and shoppers alike, is a pacesetter in these more and more indispensable areas.

Verizon’s broadband enterprise is especially strong. The corporate gained 413,000 broadband prospects within the fourth quarter, pushed by robust demand for its mounted wi-fi choices. That introduced its whole broadband subscriber depend to 10.7 million.

Verizon’s fast-growing broadband enterprise and constant wi-fi prospects helped it generate free money circulation of $18.7 billion in 2023, up from $14.1 billion in 2022. That is loads of money to cowl Verizon’s roughly $11 billion in annual dividend funds whereas leaving sufficient left over for additional debt discount. Verizon lower its unsecured debt load by greater than $2 billion in 2023 to $128.5 billion as of Dec. 31, 2023.

Impressively, Verizon has raised its money payout to shareholders for 17 straight years. Higher nonetheless, this reliable earnings stream might be had for a discount worth. The dividend stalwart’s shares presently commerce for less than about 9 occasions its trailing free money circulation.

2. Altria Group

Yield-hungry traders can also need to check out Altria Group (NYSE: MO). The tobacco titan has grown its money payout persistently for greater than 5 a long time. Its surprisingly excessive yield stands at about 9.7% at present.

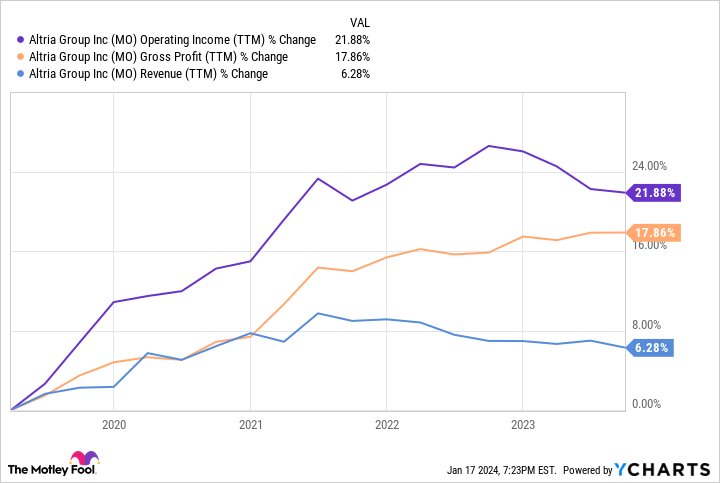

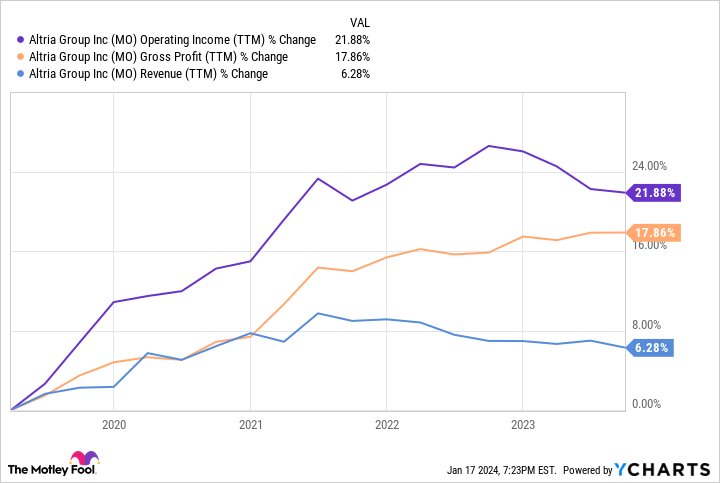

Fewer People are smoking yearly. That is a development that is more likely to persist. But cigarettes might nonetheless be a profitable enterprise. By steadily rising costs on in style manufacturers like Marlboro, Altria has largely offset decrease gross sales volumes. These worth hikes, mixed with the corporate’s cost-reduction efforts, have additionally helped to drive Altria’s revenue margins larger over the previous half-decade.

Altria’s conventional tobacco enterprise is more likely to stay a money cow for the foreseeable future. However, the corporate is working to diversify its product lineup with an increasing array of smoke-free choices.

Altria’s “on!” tobacco-leaf-free oral nicotine pouches are one in every of its fastest-growing enterprise strains, with shipments up 37% 12 months over 12 months to 29 million within the third quarter. To additional broaden its smoke-free lineup, Altria bought digital cigarettes and vaping merchandise maker Njoy Holdings for $2.8 billion in June. It additionally entered right into a three way partnership with JT Group in late 2022 to develop heated tobacco stick merchandise. All advised, administration expects Altria to develop its smoke-free income to $5 billion by 2028, up from $2.6 billion in 2022.

Hashish may very well be one other potent development driver. Altria has a 41% fairness stake in Cronos Group. The rising risk that regulators will reclassify marijuana as a much less harmful drug might make it simpler and extra profitable for hashish producers like Cronos to function within the U.S., thereby boosting the worth of Altria’s stake.

Within the meantime, you should buy Altria’s inventory whereas it is nonetheless on sale. This steadfast dividend payer’s shares might be had at present for less than about 8 occasions its projected earnings for 2023.

Must you make investments $1,000 in Altria Group proper now?

Before you purchase inventory in Altria Group, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Altria Group wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 22, 2024

Joe Tenebruso has no place in any of the shares talked about. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a disclosure coverage.

2 Extremely-Excessive-Yield Dividend Shares to Purchase in 2024 was initially printed by The Motley Idiot