Chipmakers have attracted numerous traders over the past yr as a growth in synthetic intelligence (AI) has despatched demand for graphics processing models (GPUs) skyrocketing.

Nvidia has stolen a lot of the highlight, with its shares up 200% yr over yr. Nevertheless, chip corporations at earlier phases of their ventures into AI may have extra room to run. That is a part of why Superior Micro Units (NASDAQ: AMD) is a pretty funding possibility within the area.

In 2023, Nvidia turned the primary chipmaker to exceed a market cap of $1 trillion. AMD nonetheless has an extended technique to go earlier than coming wherever near that determine, with its market cap at $286 billion. Nevertheless, that would imply it has way more development potential over the long run.

AMD is on a promising development trajectory because it gears as much as problem Nvidia with a brand new AI GPU and advantages from an bettering PC market. The corporate’s shares are up 123% yr over yr however are nowhere close to hitting their ceiling.

Here is why AMD’s inventory may soar increased in 2024.

Taking its slice out of a $200 billion pie

In response to Grand View Analysis, the AI market reached almost $200 billion final yr and is projected to increase at a compound annual development fee of 37% by 2030. That trajectory would see the trade surpass $1 trillion earlier than the tip of the last decade. Because of this, it is not stunning that tech corporations like AMD are investing closely within the budding sector.

AMD unveiled the following installment in its line of MI300 chips final December, debuting its strongest GPU ever: the MI300X. The brand new chip is designed to compete with Nvidia’s H100 AI GPU. In truth, AMD is promising that the MI300X is on par with Nvidia’s choices for coaching. AMD additionally claims that it beats the H100 for inference by 10% to twenty%.

Nevertheless, the AI market’s fast development fee suggests AMD will not must dethrone Nvidia to nonetheless see main positive aspects from the trade. Nvidia may retain a number one market share in AI GPUs whereas AMD carves out a profitable position within the sector. And its MI300X is already attracting a few of tech’s most outstanding gamers.

Final November, Microsoft introduced Azure would develop into the primary cloud platform to implement AMD’s new GPU to optimize its AI capabilities. Microsoft has an in depth partnership with OpenAI, making the corporate a strong ally for AMD. Alongside an settlement with Meta Platforms — which can see it make the most of the brand new chips as nicely — AMD’s future in AI appears vibrant.

EPS estimates present huge upside potential for AMD’s inventory

Along with AI, AMD is benefiting from a steadily bettering PC market. Knowledge from Gartner reveals world PC shipments elevated 0.3% within the fourth quarter of 2023, rising for the primary time in over a yr. Macroeconomic headwinds are subsiding, with the PC market anticipated to proceed bettering all through 2024.

The enhancements are already mirrored in AMD’s earnings. In its Q3 2023, income in its consumer section rose 42% yr over yr to $1.4 billion. Alongside potential in AI, AMD may very well be in for a stellar development yr in 2024.

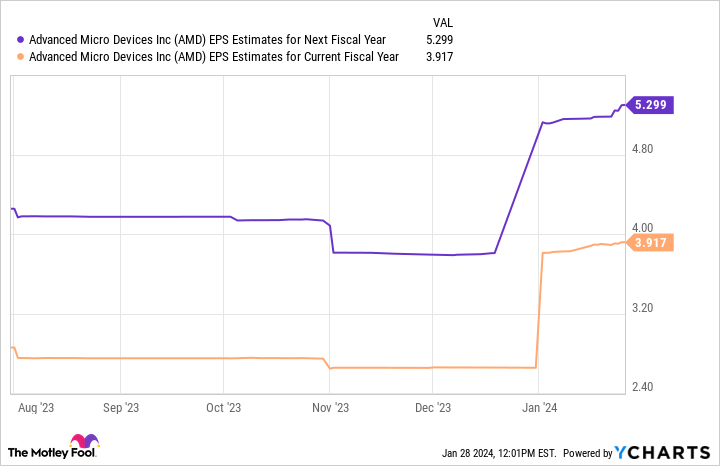

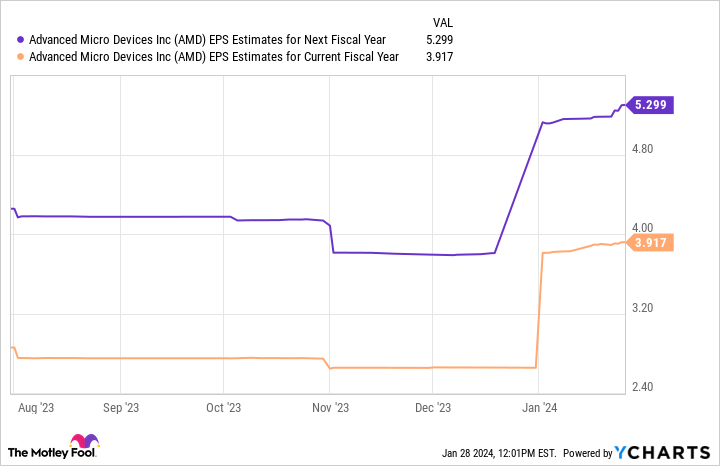

Earnings-per-share (EPS) estimates align with the corporate’s potential, with its inventory projected to soar in its subsequent fiscal yr.

This chart reveals AMD’s earnings may hit simply over $5 per share by the tip of its subsequent fiscal yr. Multiplying that determine by the chipmaker’s ahead price-to-earnings (P/E) ratio of 45 yields a inventory worth of $239.

If projections are right, AMD’s shares would rise 35% by the tip of fiscal 2024, outperforming the S&P 500‘s enhance of 20% over the past 12 months.

AMD is on a promising development trajectory, making its inventory a no brainer within the new yr.

Must you make investments $1,000 in Superior Micro Units proper now?

Before you purchase inventory in Superior Micro Units, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Superior Micro Units wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 22, 2024

Dani Prepare dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Gartner. The Motley Idiot has a disclosure coverage.

Why AMD Inventory May Soar Greater in 2024 was initially printed by The Motley Idiot