Investing in synthetic intelligence (AI) could be overwhelming, as many firms profit from this pattern. Whether or not it is an organization deploying AI to enhance its enterprise or one which makes AI software program, there are a variety of alternatives.

Nevertheless, there are additionally {hardware} parts of AI, and plenty of of those firms will probably be winners no matter what occurs to particular person firms. I’ve pinpointed 4 that will probably be huge winners over the approaching years.

1. ASML

A microchip is on the core of each laptop used to create an AI mannequin. These parts require extremely specialised equipment to make them, and one of many key suppliers on this realm is ASML (NASDAQ: ASML). The corporate makes lithography machines, which make the conductive traces on chips.

Semiconductors have reached the purpose the place the space between these traces is as small as 3 nanometers (nm). For reference, the human hair is about 80,000 to 100,000 nanometers huge. With smaller distances between traces, these chips turn out to be extra highly effective and environment friendly — a key want for any machine.

ASML presently holds a technological monopoly on this area, as no different firms make EUV (excessive ultraviolet) lithography machines. If you happen to’re making cutting-edge chips, it’s essential to work with ASML. Because of this, ASML will probably be an enormous winner on this area.

2. Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM) is a big consumer of those machines. The corporate is the world’s largest contract chip producer, which suggests it makes chips for different shoppers.

TSMC is a pacesetter on this subject, because it has 3-nm chips however can be growing 2-nm chips slated to launch in 2025. Taiwan Semiconductor’s revolutionary tradition is all the time engaged on the following factor, which is able to present continuous income boosts as these new merchandise launch.

Amongst Taiwan Semiconductor’s clients are Nvidia (NASDAQ: NVDA) and AMD, which offer one other important part within the AI worth chain.

3. Nvidia

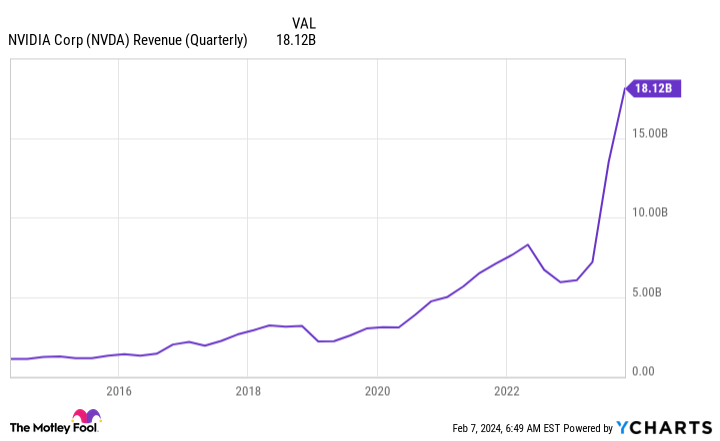

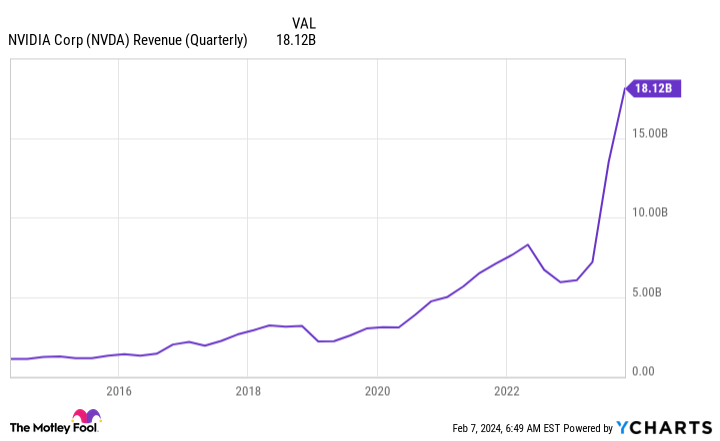

Nvidia has most likely acquired probably the most consideration on this group, as its best-in-class GPUs (graphics processing models) are essential in AI. GPUs are used to course of huge quantities of knowledge and prepare AI fashions, making them must-have {hardware}.

When a enterprise outfits a pc to coach these fashions, they do not simply purchase one or two GPUs; they purchase 1000’s. This induced Nvidia’s income to blow up increased in 2023, because the demand for its GPUs was unprecedented.

Nvidia’s power will proceed so long as AI is a large pattern, because it requires a major computing infrastructure buildout.

4. Tremendous Micro Pc

You possibly can’t simply exit and purchase just a few thousand Nvidia GPUs full of Taiwan Semiconductor chips made with ASML’s lithography machines, hook them up, and anticipate a optimistic consequence. As a substitute, a specialised server is required to maximise effectivity so a enterprise can get probably the most efficiency out of its supercomputer.

That is the place Tremendous Micro Pc (NASDAQ: SMCI) is available in. Supermicro focuses on server design, whether or not it is getting used for engineering simulations, drug discovery, or AI mannequin coaching. Its merchandise are extremely configurable, whether or not an organization needs a few hundred GPUs or a few thousand.

Because the demand for AI computer systems reaches the final market, Supermicro will proceed to excel, which is a part of the explanation the inventory is up round 140% to begin in 2024.

A basket of AI winners

You do not have to choose a single winner to be a profitable AI investor. As a substitute, you might choose a wide range of shares which are important suppliers within the AI subject and certain do fairly properly.

This group will probably be profitable no matter which firm produces the very best AI product, as they supply the constructing blocks obligatory for all AI fashions.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 5, 2024

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends ASML, Superior Micro Gadgets, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Tremendous Micro Pc. The Motley Idiot has a disclosure coverage.

4 Phenomenal Corporations That Will Be Large Winners, No matter Who Wins the Synthetic Intelligence (AI) Arms Race was initially revealed by The Motley Idiot