Wedbush Securities analyst Dan Ives has stated Palantir Applied sciences (NYSE: PLTR) might be the very best pure-play synthetic intelligence (AI) inventory available on the market. He additionally referred to as the corporate an “undiscovered gem” following its fourth-quarter earnings report, which highlighted unprecedented demand for its new platform.

Ives has referred to AI because the fourth industrial revolution, likening its potential affect to the arrival of the web and the invention of the smartphone. These applied sciences created vital wealth for buyers, and the AI increase could possibly be simply as profitable.

Here is what buyers ought to learn about Palantir.

Palantir impressed the market with its fourth-quarter report

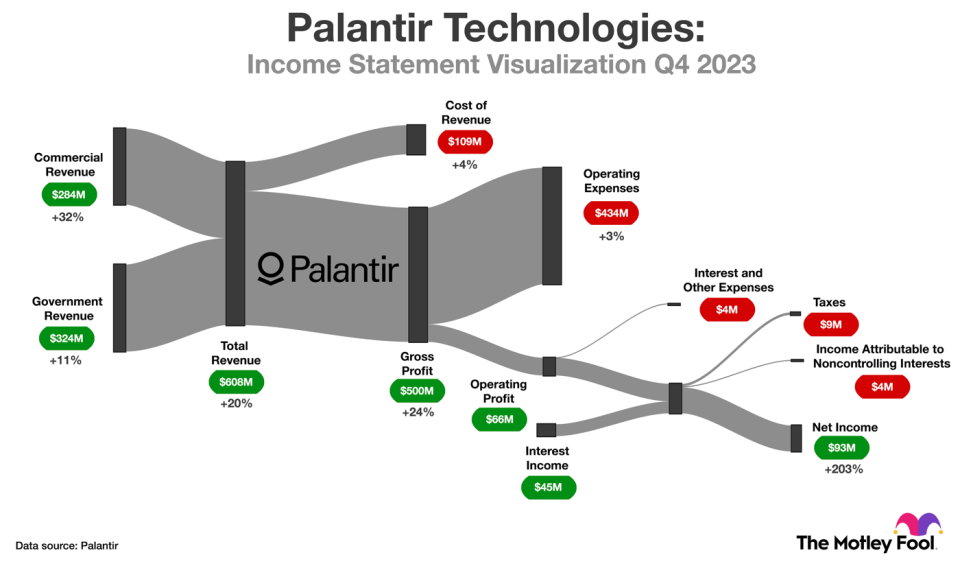

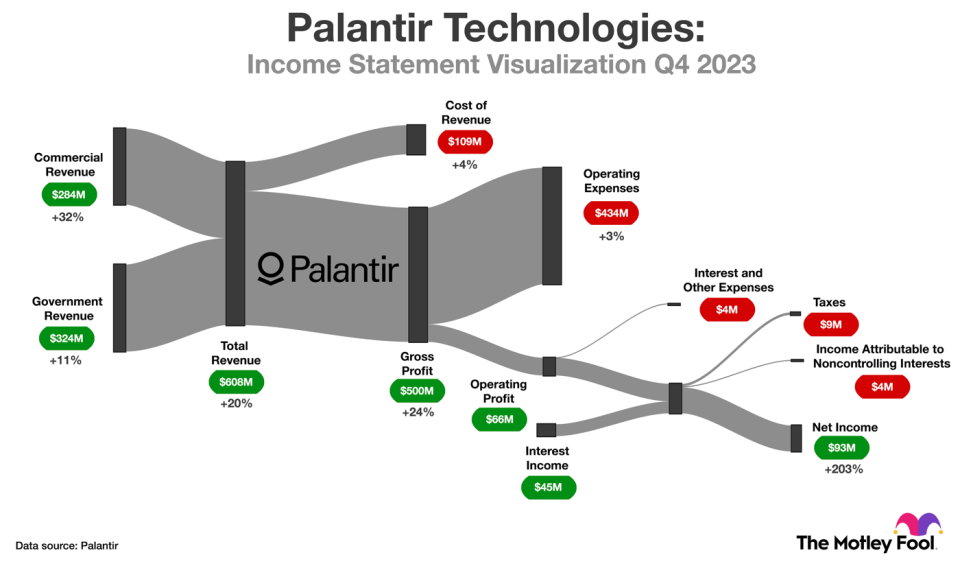

Palantir inventory soared 19% after the corporate reported encouraging monetary leads to the fourth quarter. Income rose 20% to $608 million as a consequence of sturdy demand for AIP (Synthetic Intelligence Platform) amongst business prospects, although development within the authorities phase remained muted. On the underside line, typically accepted accounting ideas (GAAP) web earnings tripled to succeed in $93 million as Palantir leaned into value management.

The circulation diagram beneath supplies extra element on the corporate’s efficiency in This fall.

One other noteworthy improvement in This fall was the 35% year-over-year buyer development pushed by particularly sturdy momentum within the business phase. Palantir nonetheless has a comparatively small clientele, with simply 497 prospects, so growth is encouraging as a result of it diversifies income throughout a bigger base. In different phrases, the chance related to extremely concentrated income is slowly diminishing.

Palantir is a pacesetter in synthetic intelligence and machine studying platforms

Synthetic intelligence (AI) and analytics are the IT classes prone to see the biggest spending will increase in 2024, in response to a survey from Morgan Stanley. Palantir is nicely positioned to learn, provided that its enterprise sits between these applied sciences.

Particularly, its platforms combine information and machine studying (ML) fashions to construct ontologies, that are maps defining the connection between digital data and bodily belongings. Customers can run ontology information by way of prebuilt analytics instruments and customized purposes, thereby gleaning insights that enhance decision-making and working effectivity. In brief, Palantir supplies frameworks that assist companies use AI to create actual worth.

Trade analysts have acknowledged Palantir as a pacesetter in AI/ML platforms and ModelOps, a self-discipline involved with the event, analysis, and deployment of fashions. The corporate is leaning into demand for generative AI with AIP, a brand new product that brings assist for big language fashions to its present analytics platforms. AIP has thus far been a convincing success.

To cite CEO Alex Karp’s shareholder letter: “It as soon as took weeks and months, if not longer, for information integration and analytical software program platforms to be arrange and built-in with a buyer’s present programs. AIP can now be up and working in as little as a number of hours.” He additionally commented that demand for AIP is not like something the corporate has seen in its two-decade historical past.

Palantir has restructured its go-to-market technique round AIP boot camps — five-day occasions by which present and potential prospects be taught to use AIP to real-use instances involving information from their companies. Chief Income Officer Ryan Taylor says boot camps are compressing gross sales cycles and accelerating commercial-customer acquisition, and that effectivity leaves room for continued margin growth over time.

Palantir inventory seems to be a bit costly at its present valuation

Palantir helps shoppers construct data-driven intelligence purposes that clear up complicated, high-value use instances, in response to Forrester Analysis. Its platform is good for companies with heavy information necessities that need to deploy AI rapidly. The market has realized that to some extent. Palantir ranked second (behind Microsoft) in AI software program market share in 2022, in response to the Worldwide Knowledge Corp. And AIP ought to assist the corporate preserve its momentum.

With that in thoughts, Straits Analysis expects the big-data analytics market to broaden at 14% yearly by way of 2031. In the meantime, Grand View Analysis believes the unreal intelligence market will compound at 37% yearly by way of 2030. Palantir ought to profit from each tailwinds, and its top-line development ought to land someplace in the course of these projections.

Wall Road expects the corporate to develop income at 21% yearly over the following 5 years. In that context, the present valuation of 24.3 occasions gross sales seems to be dear, particularly when the two-year common is 12.9 occasions gross sales. Buyers wanting to personal this inventory should purchase a really small place in the present day, however it will be prudent to attend for a less expensive value earlier than constructing out a big place.

As a last thought, Wall Road analysts might determine sure corporations as the very best AI shares, however I doubt any analyst would advise concentrating cash in a single model. It might be way more prudent to unfold capital throughout a basket of AI shares. Buyers ought to maintain that in thoughts as they place their portfolios to capitalize on the AI increase.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 5, 2024

Trevor Jennewine has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Microsoft and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

This Is the Single Greatest Synthetic Intelligence (AI) Inventory to Purchase, Based on a Wall Road Analyst was initially revealed by The Motley Idiot