Sizzling off the approval of its gene remedy for a pair of uncommon hereditary blood issues, Vertex Prescribed drugs (NASDAQ: VRTX) will quickly have one other remedy up for approval, and the monetary implications are large. However they are not large simply because it stands to crank out billions in further income. As an alternative, the plan is to shell out the equal of $100 million in order that the potential new drug can compete for the market share of certainly one of its already commercialized medicines as quickly as attainable.

What is going on on right here? It is time to dig in and determine it out in order that traders can determine what to do.

Is that this excellent news truly unhealthy information for shareholders?

Per the outcomes of a section 3 scientific trial reported Feb. 5, Vertex’s newest candidate for treating cystic fibrosis (CF), a uncommon and severe genetic illness of the lung, is each protected and efficient. The drugs is presently referred to as “vanza triple” as a result of it combines the molecule vanzacaftor and two different medicine. One of many three compounds, tezacaftor, is already in one of many firm’s medicines in the marketplace, although the others aren’t.

Within the scientific trial, the vanza triple combo carried out at the least in addition to Trikafta, the biopharma’s best-selling product for CF. By one metric — how a lot the remedy lowered the extent of detectable chloride in sufferers’ sweat — the combo was superior, and its facet impact burden comparable. That poses an fascinating downside.

In 2023, Trikafta was accountable for roughly $9 billion in gross sales from a high line of roughly $10 billion. If the brand new medication will get approval from regulators on the Meals and Drug Administration (FDA), which administration plans to petition for by mid-2024, Vertex may have two merchandise in direct competitors with one another in the marketplace concurrently. There’s seemingly not any alternative for sufferers to take each therapies without delay, and it’s unclear whether or not there’s a probability that a big group of sufferers will reply higher to the older mixture than the brand new one.

Due to this fact, the likelihood of the vanza triple mixture cannibalizing Trikafta’s market share could be very excessive. Buyers might balk at any choice to proceed and go for the approval as they’d reasonably proceed milking income from gross sales of Trikafta for years and years, transitioning to a brand new product solely when generic opponents begin to encroach.

They usually may balk even more durable on the management-endorsed concept of expending an asset value within the ballpark of $100 million to begin the cannibalization course of even sooner. The asset in query is what’s referred to as a precedence evaluation voucher (PRV), which is a government-issued piece of paper that entitles the bearer to get (you guessed it) a privileged regulatory standing within the evaluation phases of the drug approval course of, thereby slicing the time it takes to go from submitting the paperwork to getting a choice on commercialization by a handful of months. In current instances, many biopharmas have traded PRVs to one another, preferring to get money reasonably than save time, and $100 million is the worth of a typical sale.

Buyers are more likely to marvel why administration appears to be in such a rush to torpedo the corporate’s most profitable product.

One essential element explains every part

Vertex is not being impatient, neither is the choice to make use of the PRV a poor one. The truth is, the transfer was fastidiously calculated and can seemingly prove for the most effective for sufferers and shareholders alike. This is why.

Per administration, a smaller proportion of income from gross sales of the vanza triple drug shall be siphoned off to pay out royalties to exterior events than with its present portfolio of CF medicines. So, by commercializing the vanza mixture, the enterprise will fatten its revenue margin, even when it doesn’t dramatically enhance its income, as a result of it would pay fewer royalties.

Utilizing the PRV thus implies that administration sees the earnings advantage of getting the drug to market a bit sooner as being bigger than the sale worth of the voucher. That perspective is all of the extra credible when taking the royalty challenge under consideration, because it considerably modifications the financial profit of every month the medication spends in the marketplace.

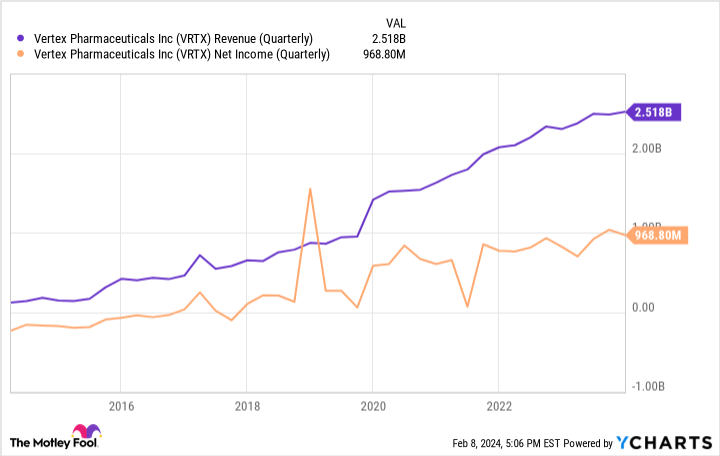

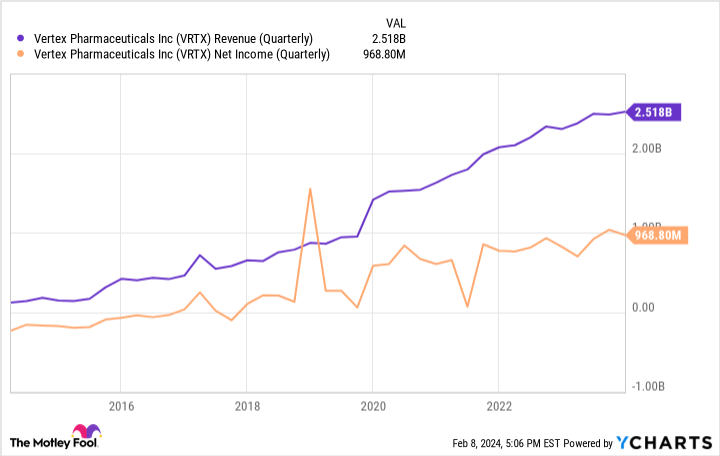

Moreover, it is necessary to acknowledge that this is not Vertex’s first rodeo with regards to gracefully changing certainly one of its older merchandise with a shinier newer model that works a bit higher. If something, the corporate is an skilled at cannibalizing its CF market share many times whereas nonetheless rising, having commercialized 4 totally different however overlapping medicine in succession over time. Simply take a look at this chart:

As you possibly can see, the earlier shakeups of its CF merchandise did not go away shareholders within the poorhouse, and this time will not both. If something, this can be a bullish setup for the inventory. In any case, it will quickly be raking in much more cash by serving the identical core market, and sufferers will get higher remedy, too.

The place to speculate $1,000 proper now

When our analyst staff has a inventory tip, it will probably pay to hear. In any case, the e-newsletter they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They only revealed what they imagine are the 10 finest shares for traders to purchase proper now… and Vertex Prescribed drugs made the listing — however there are 9 different shares you could be overlooking.

See the ten shares

*Inventory Advisor returns as of February 12, 2024

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Vertex Prescribed drugs. The Motley Idiot has a disclosure coverage.

Vertex Prescribed drugs Will Use $100 Million to Tank Its Personal Market Share. This is Why That is a Sensible Transfer. was initially printed by The Motley Idiot