Demand for chips that present the processing energy to coach and help synthetic intelligence (AI) fashions is growing quickly as governments and expertise corporations across the globe race to deploy AI purposes. That is exactly the explanation why Nvidia has witnessed an enormous leap in its income and earnings in current quarters.

Nvidia’s AI graphics processing models (GPUs) are in such excessive demand relative to produce that clients are reportedly having to attend wherever between 36 weeks and 52 weeks to get deliveries of its flagship H100 processors. Not surprisingly, the chipmaker is trying to ramp up the manufacturing capability for these AI chips, which may enable it to maintain its excellent share worth rally.

Nevertheless, Nvidia’s 239% beneficial properties over the previous yr have left the inventory buying and selling at costly valuations, with a price-to-sales ratio of 40 and a trailing earnings a number of of 96. After all, Nvidia’s ahead earnings a number of of 36 reveals that it’s anticipated to ship terrific bottom-line progress, whereas its 5-year worth/earnings-to-growth ratio (PEG ratio) of simply 0.7 implies that the inventory is definitely undervalued relative to the expansion that it’s anticipated to ship.

Nonetheless, sure traders might wish to search for cheaper various investments they’ll purchase to revenue from the AI growth. I would level these traders towards Utilized Supplies (NASDAQ: AMAT) — an organization that is going to learn from Nvidia’s efforts to extend its AI chip manufacturing.

Utilized Supplies is benefiting from AI-driven semiconductor spending

Utilized Supplies produces semiconductor manufacturing gear that enables chipmakers and foundries to manufacture chips and built-in circuits. It will get a pleasant chunk of its income from gross sales to Samsung, Taiwan Semiconductor Manufacturing, and Intel.

In its fiscal 2023 (which ended Oct. 29, 2023), Samsung and Taiwan Semiconductor Manufacturing, also referred to as TSMC, collectively accounted for 34% of Utilized Supplies’ income. Intel’s contribution was lower than 10%. On condition that these corporations need to enhance spending on semiconductor gear in 2024, it was not stunning to see Utilized Supplies’ newest outcomes turning out to be higher than anticipated.

Utilized Supplies launched its fiscal 2024 first-quarter outcomes on Feb. 15. For that interval, which ended Jan. 28, the corporate’s prime line was almost flat year-over-year at $6.7 billion — however that was higher than the $6.48 billion consensus estimate. Non-GAAP earnings elevated 5% yr over yr to $2.13 per share, simply crushing the $1.91 per share Wall Avenue estimate.

Administration’s steerage turned out to be the icing on the cake. Utilized Supplies expects fiscal Q2 earnings of $1.97 per share on the midpoint of its steerage vary, on income of $6.5 billion. Analysts have been on the lookout for $1.79 per share in earnings on $5.9 billion in income. Utilized Supplies, nevertheless, identified that “there’s a reacceleration of capital funding by cloud corporations, fab utilization is growing throughout all system sorts and reminiscence stock ranges are normalizing,” which explains why the corporate’s outlook is best than anticipated.

AI, particularly, is growing the corporate’s addressable alternative. As an illustration, Utilized Supplies estimates that the demand for high-bandwidth reminiscence (HBM) deployed in AI servers may develop at an annualized fee of fifty% within the coming years. The corporate additionally factors out that the semiconductor die required to fabricate HBM is greater than double the scale of a normal dynamic random entry reminiscence (DRAM) die. So, chipmakers want to extend their capacities considerably to maintain up with rising HBM demand.

In the meantime, the superior chip packaging course of used for manufacturing AI chips can be giving Utilized Supplies a lift. On the newest earnings convention name, CEO Gary Dickerson stated:

In fiscal 2024, we count on our HBM packaging revenues to be 4 instances bigger than final yr, rising to virtually $0.5 billion. And throughout all system sorts, we count on income from our Superior Packaging Product portfolio to develop to roughly $1.5 billion.

Utilized Supplies additionally factors out that the rising deployment of high-performance AI information facilities will set off quantity manufacturing of gate-all-around (GAA) transistors, that are 30% extra environment friendly than fin-shaped field-effect (FinFET) transistors. The corporate estimates that its addressable market may broaden “by $1 billion for each 100,000 wafer begins per thirty days of [GAA transistor] capability.”

Not surprisingly, Utilized Supplies’ largest buyer, Samsung, has been fast to undertake GAA to make superior chips utilizing the 3nm course of node. What’s extra, the marketplace for GAA transistors is reportedly rising at an annual tempo of 39%. This bodes properly for Utilized Supplies as the corporate claims that it’s “on observe to realize share and seize over 50% of the spending for the method gear used on this new transistor module.”

An acceleration in progress may ship the inventory worth greater

Utilized Supplies is anticipating $26.1 billion in fiscal 2024 income, which might be virtually according to its fiscal 2023 income of $26.5 billion. Nevertheless, the corporate’s first-quarter efficiency and the steerage for the present one recommend that it may ship better-than-expected ends in an enhancing spending atmosphere.

It’s also price noting that Utilized Supplies’ earnings elevated on a year-over-year foundation. Analysts, nevertheless, are anticipating that in fiscal 2024, its earnings will drop to $7.73 per share from $8.05 per share final yr. Once more, the corporate’s fiscal Q1 bottom-line efficiency and the steerage for the present quarter, which is near fiscal Q2 2023’s adjusted earnings of $2.00 per share on the midpoint, point out that it may ship a optimistic shock on this entrance.

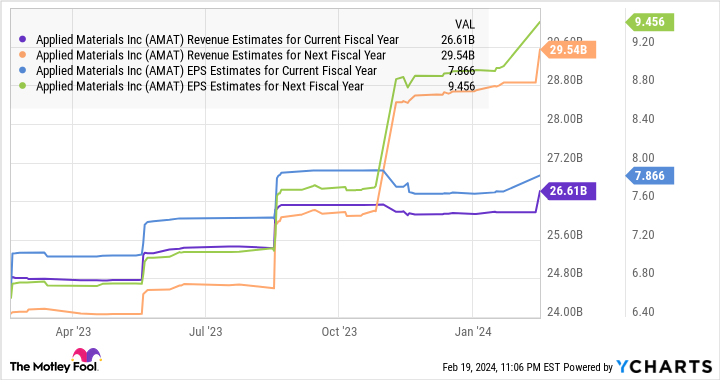

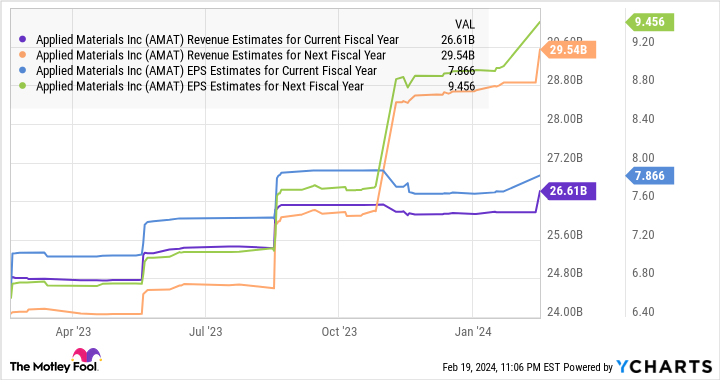

Extra importantly, analysts are forecasting a pleasant leap in Utilized Supplies’ income and earnings for fiscal 2025.

Utilized Supplies trades at 22 instances trailing earnings proper now — an enormous low cost to Nvidia’s trailing earnings a number of. After all, Nvidia is rising at a a lot quicker tempo, however conservative traders on the lookout for a less expensive AI inventory to purchase proper now may contemplate Utilized Supplies. Given the AI-fueled leap in semiconductor spending, it might not be obtainable at such enticing ranges sooner or later.

In any case, Utilized Supplies jumped 6% following its newest quarterly report, and it seems to be properly positioned to maintain this momentum and go on a bull run.

Do you have to make investments $1,000 in Utilized Supplies proper now?

Before you purchase inventory in Utilized Supplies, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Utilized Supplies wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 20, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Utilized Supplies, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick February 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

Missed Out on Nvidia? 1 Synthetic Intelligence (AI) Chip Inventory to Purchase Earlier than It Goes on a Bull Run was initially printed by The Motley Idiot