As you’ll have discovered lately, the “Magnificent Seven” is a bunch of powerhouse shares together with Nvidia, Apple, and Microsoft, most of which have benefited considerably from the keenness surrounding their synthetic intelligence (AI) efforts. However which might be the equal companies if the identical idea have been utilized to the healthcare sector reasonably than the know-how sector?

Because it seems, there are solely 4 shares which have the appropriate mixture of ongoing development and market-outperforming returns. All 4 of those magnificent healthcare firms have stable enterprise fashions, upwardly trending share costs, and, sadly, considerably frothy valuations.

However additionally they have very lengthy development runways and a historical past of fine execution, so there is a stable probability that their worth tags will likely be justified by continued robust efficiency. Let’s meet the gamers.

Eli Lilly and Novo Nordisk

Eli Lilly (NYSE: LLY) and Novo Nordisk (NYSE: NVO) are two huge pharma shares that do not want a lot introduction because of the more and more absurd recognition of their smash-hit medicines for weight problems and sort 2 diabetes.

Eli Lilly makes the drug Mounjaro for diabetes in addition to Zepbound, which is identical remedy however formulated for weight reduction. It is the most important healthcare firm by market capitalization with a measurement of $729 billion.

Novo Nordisk is the second-largest healthcare competitor by market cap, clocking in at $549 billion. It is answerable for the sort 2 diabetes medication Ozempic, in addition to the obesity-oriented model of the identical drug, Wegovy.

Each firms plan to proceed the method of penetrating those self same metabolic-disease markets, along with others, over the remainder of the last decade and past. Their pipelines are filled with mid-stage and late-stage packages that would develop into the right instruments in a smattering of various medical niches, or which may broaden the indications and addressable market of their already-approved medicines.

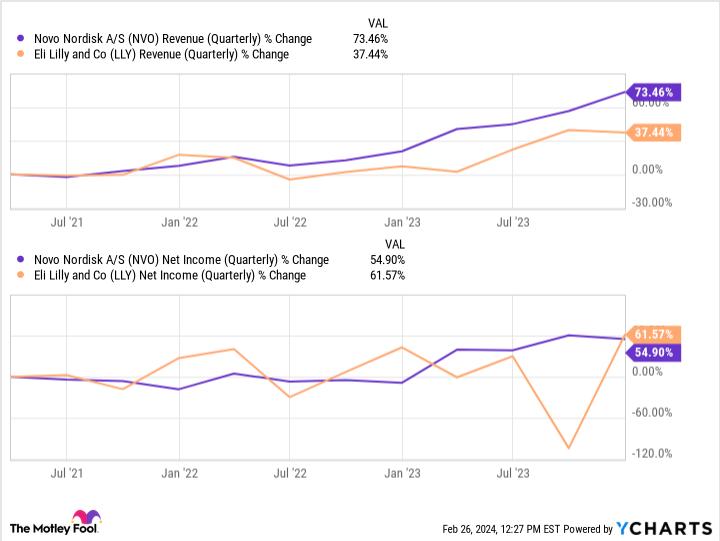

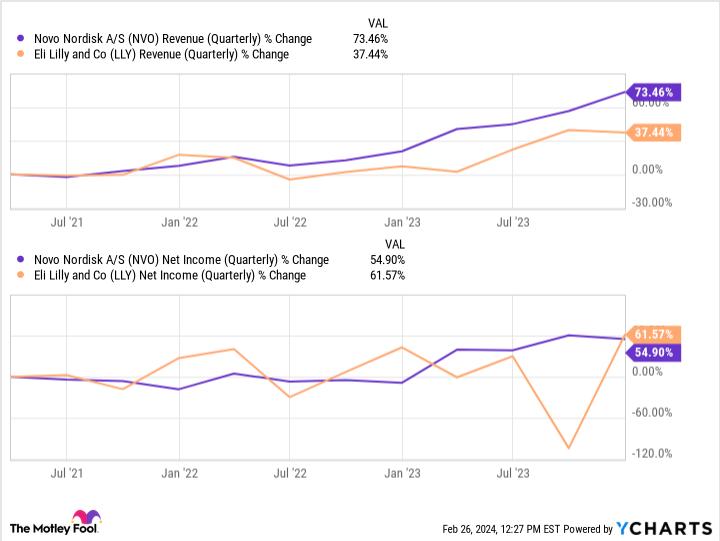

And neither firm anticipates a lot of an issue with competitors over market share, provided that the markets they’re taken with are tremendously deep and anticipated to continue to grow. Not satisfied that their trajectories are according to magnificence? Think about this chart beneath. As you possibly can see, they’re ramping up sharply, and so they’re value shopping for should you do not thoughts their valuations.

Vertex Prescribed drugs

Vertex Prescribed drugs (NASDAQ: VRTX) is a drug developer specializing in uncommon ailments like cystic fibrosis (CF). Lately, it commercialized a brand new gene remedy known as Casgevy for each sickle cell illness (SCD) and beta thalassemia with the assistance of CRISPR Therapeutics. Its market cap is $111 billion. And in fittingly magnificent style, its shares are up by a powerful 45% within the final 12 months.

One of many key issues that drives Vertex’s inventory to higher and higher heights is that its cystic fibrosis drugs, of which it is at all times producing and testing extra, are deeply entrenched available in the market. Actually, of the 92,000 identified sufferers with CF within the Western world, Vertex is presently treating all however 20,000 of those that are eligible.

On prime of that, there is no direct competitor for its gargantuan market share. And sufferers must take its medicines for all times to manage their signs.

With a secure base of income from gross sales of its CF medication, the corporate has leeway to put money into analysis and growth (R&D) focused at bigger and extra aggressive markets, like for acute ache therapies. Which means it might afford to take quite a lot of formidable photographs on aim with out overextending. And that is an enormous a part of the explanation its trailing-12-month internet revenue rose by 68% over the past 5 years, reaching $3.6 billion. As extra of its packages get permitted on the market, that determine will solely improve, as will its share worth.

Intuitive Surgical

Final however not least is the robotic surgical procedure firm Intuitive Surgical (NASDAQ: ISRG), which boasts a market cap of $136.9 billion and a prime line of $7.1 billion in 2023.

In its line of enterprise, clients in hospitals first buy its da Vinci model robotic surgical models. Then they pay Intuitive for upkeep contracts, spare components, new surgical toolheads, and coaching packages for surgeons, producing a protracted tail of recurring income through the years.

The extra procedures clients carry out with their da Vinci models, the extra recurring income it rakes in, and the extra the system turns into established as a workhorse in bariatric, urologic, and common surgical procedure working rooms.

And the competitors is, for now, nowhere to be seen. So it is no shock that Intuitive’s revenue margin, at 25%, is as huge as it’s. Contemplating that the demand for surgical procedure just isn’t going to say no anytime quickly, the stunning half is that the corporate is not already included within the current set of Magnificent Seven shares.

Must you make investments $1,000 in Eli Lilly proper now?

Before you purchase inventory in Eli Lilly, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Eli Lilly wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of February 26, 2024

Alex Carchidi has positions in Apple and Microsoft. The Motley Idiot has positions in and recommends Apple, CRISPR Therapeutics, Intuitive Surgical, Microsoft, Nvidia, and Vertex Prescribed drugs. The Motley Idiot recommends Novo Nordisk and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

These 4 Shares Are the “Magnificent Seven” of Healthcare was initially revealed by The Motley Idiot