PayPal (NASDAQ: PYPL) and Block (NYSE: SQ) are two of the most well-liked fintech shares at the moment. Each have market caps of about $50 billion to $60 billion. Each have robust histories of progress. And each have loads of progress potential.

One inventory, nevertheless, is a a lot better purchase at the moment.

PayPal bets $5 billion on itself

PayPal the corporate doesn’t want a lot introduction. Spun off from guardian firm eBay in 2015, the corporate has amassed greater than 400 million international customers. From e-commerce transactions to paying again associates, virtually everybody has both used PayPal personally or is aware of somebody who has.

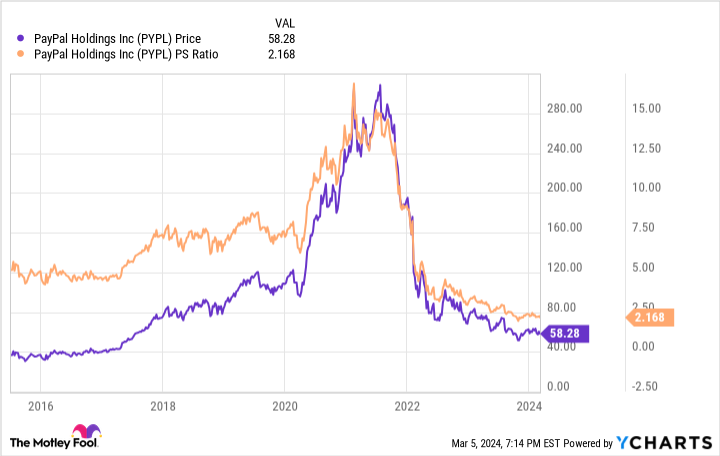

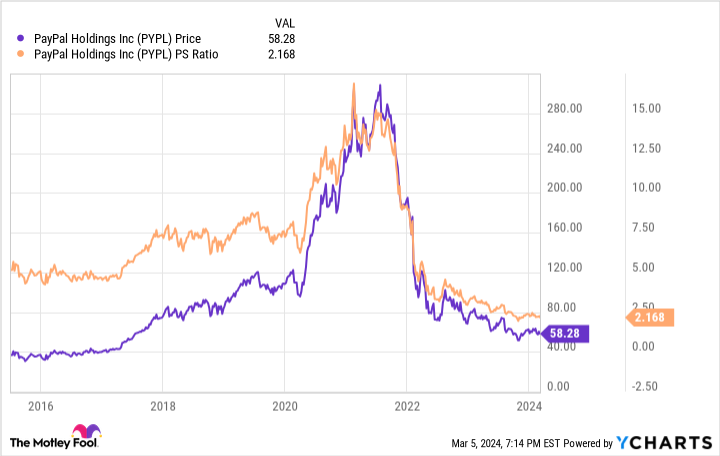

PayPal the inventory has a extra unstable historical past.

After its cut up from eBay, PayPal inventory zoomed in worth, from $40 per share to $300 per share in simply three years. Since these all-time highs, nevertheless, the share value has cratered. PayPal shares now commerce at 2017 costs.

PayPal inventory now trades at simply 2.2 instances gross sales — a preferred valuation metric for progress shares. That is the most affordable shares have ever been.

Administration has seen the decline in valuation, opting to speculate $5 billion in share repurchases. By shopping for again its personal inventory at discounted costs, the corporate hopes to double down on a turnaround.

There’s just one downside: PayPal has been right here earlier than. The corporate has already spent $15 billion in share repurchases since going public in 2015. These buybacks had been executed at costs a lot greater than at the moment, which means they destroyed shareholder worth.

PayPal is not going wherever as an organization, however do not be fooled into considering a budget valuation a number of is a transparent purchase sign. The rationale the shares are low-cost is that the corporate’s finest days of progress in all probability are behind it. In truth, its consumer base has been shrinking the previous two years.

The shares may be a worthwhile worth at at the moment’s depressed costs, however there’s a better option for progress buyers — a inventory with a turnaround story already in motion.

That is the fintech inventory price betting on

Block has confronted its personal struggles. The corporate — historically a cost processor, however extra lately an investor in different areas just like the peer-to-peer cost service Money App, music platform Tidal, and a number of blockchain-related ventures — has equally seen its inventory value crater after a slowdown in progress and a drop in profitability.

On a price-to-sales foundation, Block inventory is definitely cheaper than PayPal, buying and selling at 2.1 instances gross sales. However as we’ll see, the underlying enterprise is far stronger.

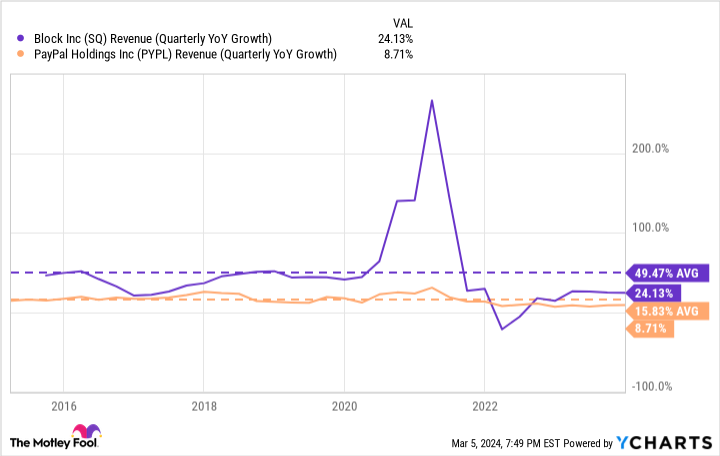

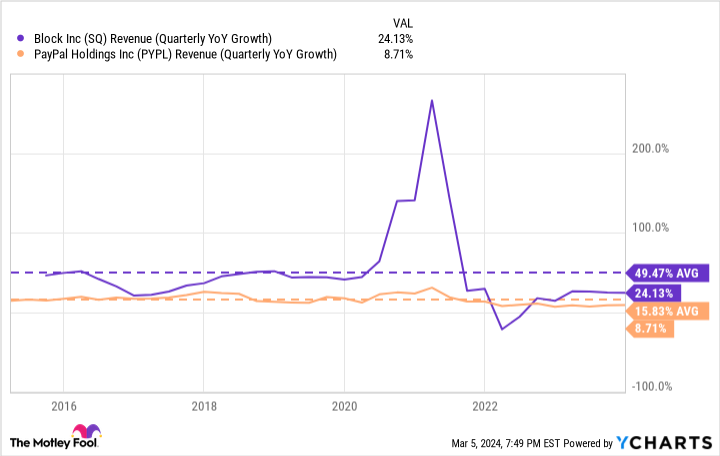

The primary benefit that Block has over PayPal is greater progress charges.

Whereas PayPal’s enterprise is shrinking in line with some metrics, most of Block’s segments are experiencing robust progress. Block, for instance, has 56 million month-to-month customers on its Money App. Whereas progress has slowed considerably in current quarters, the corporate continues to extend this consumer base.

Continued consumer progress has allowed Block to keep up income positive aspects which might be a lot larger than what PayPal has achieved, even throughout its days as a scorching inventory after turning into an unbiased firm.

Block can be higher positioned for future progress.

As the corporate’s identify suggests, Block has made huge bets on rising blockchain applied sciences like Bitcoin. Customers of its Money App can already purchase, promote, and transact in Bitcoin. Its Sq. cost processing platform, in the meantime, is poised to convey cryptocurrency transactions to the lots. Whereas PayPal is defending a plateauing enterprise mannequin, Block is positioned to capitalize on progress tendencies just like the adoption of cryptocurrencies.

Why then is Block inventory cheaper than PayPal?

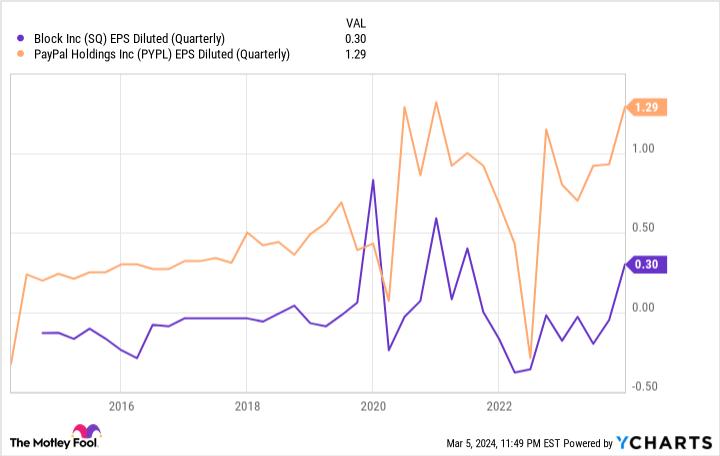

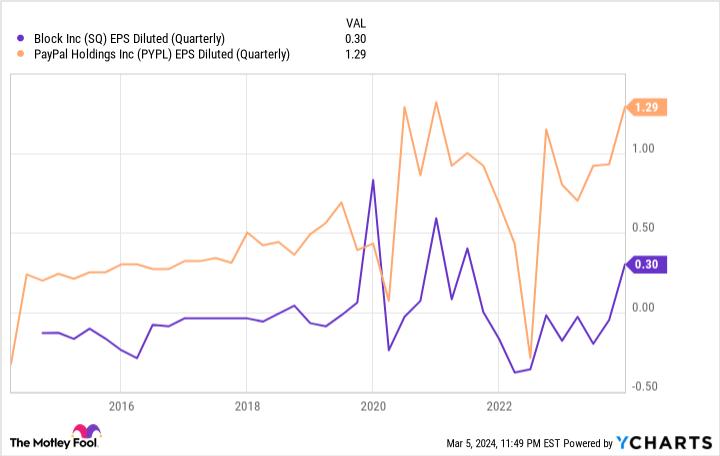

For many of PayPal’s public historical past, the corporate has been worthwhile, racking up billions in free money move — the explanation it has been capable of fund its historic share buyback applications.

Block, in the meantime, has been unprofitable in recent times. When the shares spiked in 2020, nevertheless, the corporate had posted a number of quarters of profitability. That is what the market got here to anticipate, till a string of quarterly losses despatched the inventory value tumbling.

As a complete, Block is much less worthwhile than PayPal, however that is palatable so long as progress charges stay excessive. The market, in spite of everything, is keen to fund a quickly rising firm. When progress charges sluggish, nevertheless, the market instantly turns into much less keen to cowl losses.

Final September, Block co-founder Jack Dorsey rejoined Block because the chief govt officer with one mission: return the corporate to profitability. It did not take lengthy for this imaginative and prescient to be realized. In February, the corporate posted its first web revenue in two years, albeit a small one.

With a return to profitability, anticipate Block’s valuation multiples to choose up, particularly if this feat is repeated in subsequent quarters. A high-growth inventory that is worthwhile, irrespective of how small, deserves a better a number of than 2.1 instances gross sales on this market.

Between PayPal and Block, Block inventory is the clear winner for buyers proper now.

Do you have to make investments $1,000 in Block proper now?

Before you purchase inventory in Block, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Block wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 8, 2024

Ryan Vanzo has positions in Bitcoin. The Motley Idiot has positions in and recommends Bitcoin, Block, and PayPal. The Motley Idiot recommends eBay and recommends the next choices: brief April 2024 $45 calls on eBay and brief March 2024 $67.50 calls on PayPal. The Motley Idiot has a disclosure coverage.

1 Fintech Inventory to Purchase Hand Over Fist and 1 to Keep away from was initially printed by The Motley Idiot