SoundHound AI (NASDAQ: SOUN) inventory has been on fireplace over the previous month, with astounding positive factors of 254%, and Nvidia has performed an enormous function on this beautiful surge. Buyers rushed to purchase SoundHound AI inventory hand over fist after Nvidia disclosed a stake within the firm.

Nonetheless, SoundHound AI’s eye-popping run got here to a halt following the discharge of its fourth-quarter 2023 outcomes, which had been launched on Feb. 29. Let’s examine why that was the case, and test if savvy buyers ought to take into account shopping for SoundHound AI inventory following its newest pullback.

SoundHound AI’s excellent progress wasn’t sufficient to fulfill Wall Avenue

SoundHound AI, which supplies voice synthetic intelligence (AI) options, reported $17.1 million in income for the fourth quarter of 2023. That was a formidable bounce of 80% as in comparison with the prior-year interval, however fell barely in need of the $17.7 million consensus estimate. The highest line was decrease than the midpoint of SoundHound AI’s steerage vary of $16 million to $20 million for the quarter.

Extra importantly, SoundHound’s gross margin elevated by six share factors final quarter to 77%. This allowed the corporate to scale back its internet loss to $0.07 per share from $0.15 per share within the year-ago interval. Nonetheless, SoundHound’s loss was a penny greater than Wall Avenue’s expectations.

For the complete 12 months, SoundHound AI’s income was up 47% to virtually $46 million. Its internet loss fell to $0.40 per share from $0.74 per share within the prior 12 months. The great half is that SoundHound AI expects its strong progress to proceed in 2024 and 2025.

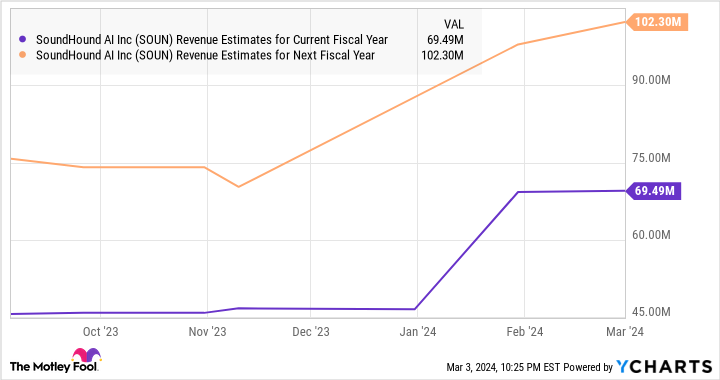

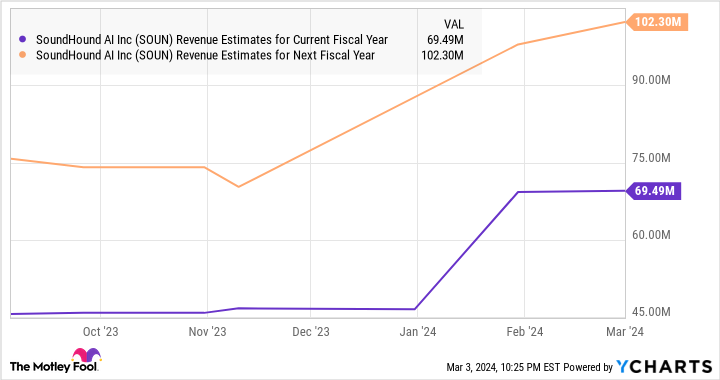

The corporate expects 2024 income to land between $63 million and $77 million, which might translate into 52.5% progress on the midpoint. That might be an acceleration over its 2023 income progress.

Even higher, SoundHound AI is forecasting at the very least $100 million in income in 2025. Administration, nonetheless, identified that progress ought to speed up in 2025, so it will not be shocking to see the corporate exceeding its present forecast subsequent 12 months. Additionally it is value noting that SoundHound AI’s 2024 and 2025 income estimates are barely larger than what Wall Avenue was forecasting.

In all, the corporate’s newest quarterly outcomes practically ticked all of the containers, however the slight miss on the highest and backside traces for This fall led buyers to press the panic button. Once more, that is not shocking, contemplating that SoundHound AI is buying and selling at an costly 30 instances gross sales following its great rally prior to now month, so buyers could have considered reserving some earnings.

Nonetheless, SoundHound AI inventory may regain its mojo with better-than-expected ends in the approaching quarters if buyers check out the corporate’s large bookings backlog.

Buyers should not miss the forest for the bushes

SoundHound AI completed 2023 with a cumulative subscriptions and bookings backlog of a whopping $661 million. That was an enormous bounce over the $342 million backlog within the third quarter of 2023 and twice the studying in the identical interval final 12 months. The corporate’s present backlog is sufficient to assist it smash its income targets for 2024 and 2025.

That is as a result of the bookings backlog refers to “dedicated buyer contracts” that SoundHound AI has in place. In the meantime, the subscription backlog refers to “potential income achievable for the corporate with present prospects the place the corporate is the main or unique supplier.” This in all probability explains why analysts have been elevating their income progress expectations for the corporate.

That is why buyers searching for a progress inventory can think about using SoundHound AI’s pullback to purchase extra shares, as the corporate may begin heading larger due to the large backlog it’s sitting on.

Do you have to make investments $1,000 in SoundHound AI proper now?

Before you purchase inventory in SoundHound AI, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and SoundHound AI wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 8, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Is SoundHound AI Inventory a Purchase Now? was initially revealed by The Motley Idiot