Nvidia (NASDAQ: NVDA) inventory has been sizzling over the quick and lengthy phrases. Shares of the bogus intelligence (AI) chip chief have returned a whopping 241% in only one 12 months, and 21,320% over the 10-year interval by means of March 27. (For context, the S&P 500 index returned 34% and 242%, respectively, over these intervals.)

Given these wonderful performances, it is pure to surprise if it is too late to put money into Nvidia inventory. A software that may be helpful in serving to you make investing choices is the outlining of the place you suppose an organization’s enterprise can be sooner or later. Think about the enterprise; do not give attention to the inventory. Over the long term, the inventory will carry out nicely if the enterprise is performing nicely.

In March 2020, I outlined the place I believed Nvidia’s enterprise could be in 5 years, or in March 2025. This text is a 12 months 4 replace of these predictions.

1. CEO Jensen Huang will nonetheless be main the corporate

Standing at 12 months 4: On the right track.

In March 2020, I wrote that “so long as [Huang] stays wholesome, the chances appear in favor of his nonetheless being at Nvidia’s helm in 5 years.” For context, co-founder and CEO Jensen Huang turned 61 earlier this 12 months, in response to public data.

Many CEOs who’re very rich retire early. However as I stated in 2020, “One solely must hearken to the corporate’s quarterly earnings calls to know that it is a man who simply loves his work.” 4 years later, it is nonetheless evident that Huang is intellectually energized by his work.

2. Nvidia will nonetheless be the main provider of graphics playing cards for laptop gaming

Standing at 12 months 4: On the right track — and Nvidia has elevated its market share.

Here is a snippet from my March 2020 article:

Nvidia dominates the marketplace for discrete graphics processing models (GPUs) — the important thing part in graphics playing cards for desktop laptop gaming. Within the fourth quarter of 2019, the corporate managed 68.9% of this market…

Nvidia has not solely remained the chief on this class, however has elevated its market share over the past 4 years. Within the fourth quarter of 2023, it had an 80% share of the desktop discrete GPU market, in contrast with Superior Micro Units‘ 19% share, in response to Jon Peddie Analysis. Intel, which entered this market in Q3 2022, had a 1% share.

3. The worldwide gaming market will proceed its sturdy development

Standing at 12 months 4: On the right track.

The worldwide video gaming market grew at a compound annual development charge (CAGR) of about 13% in the course of the four-year interval resulted in 2023, in response to Statista. Its market measurement was about $250 billion in 2023.

4. Nvidia’s GPUs will nonetheless be the gold commonplace for AI coaching

Standing at 12 months 4: On the right track — and Nvidia has elevated its market share.

In March 2020, I wrote, “Nvidia is sitting within the catbird seat in the case of making the most of this humongous [artificial intelligence] development development.”

This subject is a large one and deserves its personal article. Suffice it to say right here that Nvidia’s dominance within the total AI chip market has elevated over the past 4 years. Furthermore, the market measurement itself has been quickly rising, thanks largely to the sturdy demand for chips to allow generative AI capabilities. Generative AI, which is the tech behind OpenAI’s ChatGPT chatbot, “permits customers to shortly generate new content material based mostly on a wide range of inputs,” within the phrases of Nvidia.

5. The legalization of driverless autos will turbocharge its auto platform’s development

Standing at 12 months 4: My timeline will possible be too optimistic.

This subject additionally deserves its personal article. Briefly, I nonetheless absolutely imagine on this prediction, however my timeline will possible be too optimistic, so I get a minimum of a partial “ding” on this class. In March 2020, I wrote:

In 2025, absolutely autonomous autos must be authorized — or very near being so — throughout america. Nvidia is nicely positioned to majorly revenue from [this event]. It is inked partnerships with main gamers, [and I listed a bunch of auto industry companies].

6. The X issue

Standing at 12 months 4: Achieved.

In March 2020, I wrote, “Nvidia is extremely revolutionary, so there appears an amazing probability that the corporate will introduce a minimum of one main new know-how that takes almost everybody unexpectedly.”

This prediction has already come true. Nvidia has launched a handful of main new applied sciences which have possible shocked nearly everybody. One instance is its Omniverse platform, which permits enterprises to create their very own metaverses.

7. And Nvidia’s inventory value in 2025?

Standing at 12 months 4: Even with one 12 months left to 2025, it appears protected to say that my “solidly outperform the market” prediction within the under quote will maintain true.

Here is what I wrote in March 2020:

It is unimaginable to foretell an organization’s inventory value in 5 years as a result of so many unknowns … can have an enormous affect available on the market generally. That stated, given the projections made on this article, I really feel very comfy predicting that Nvidia inventory will solidly outperform the market over the following half decade. [Emphasis mine]

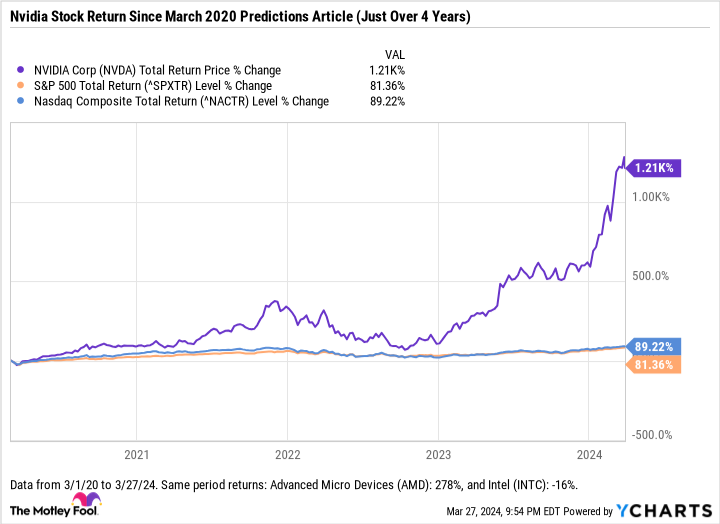

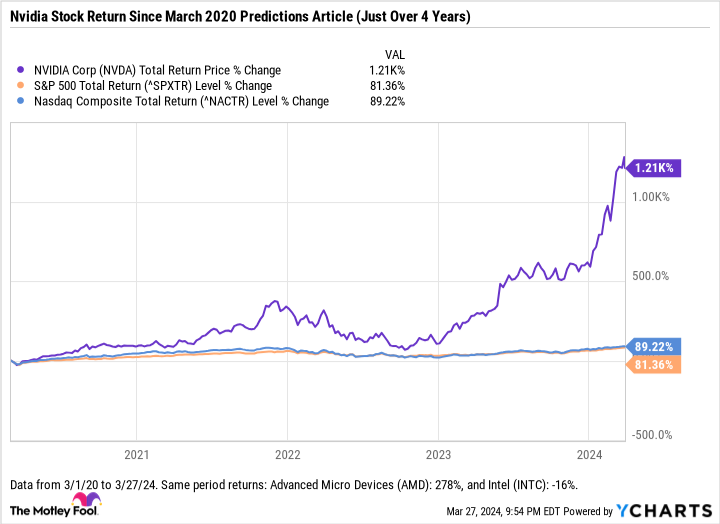

Because the above chart reveals, Nvidia inventory has returned 1,210% within the simply over four-year interval since my March 2020 predictions article. The S&P 500 index and the tech-heavy Nasdaq Composite index have returned 81% and 89%, respectively, over this era.

Based mostly upon this four-year replace to my 2020 predictions, I really feel assured that Nvidia inventory will solidly outperform the market over the following 5 years.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

Beth McKenna has positions in Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and quick Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

The place Will Nvidia Be in 5 Years? A 12 months 4 Replace to My 2020 Predictions was initially revealed by The Motley Idiot