From groundbreaking technological developments to disruptive enterprise fashions, every member of the “Magnificent Seven” has carved a distinct segment for itself within the world economic system. This group of megacap firms, consisting of Apple, Amazon, Alphabet, Microsoft, Meta Platforms, NVIDIA, and Tesla (NASDAQ: TSLA), represents the epitome of success, boasting market dominance, visionary management, and unparalleled development prospects.

Nevertheless, amid this esteemed lineup, one inventory presents a very compelling alternative for development traders — Tesla.

Explaining Tesla’s current woes

After an explosive begin to the 2020s, Tesla’s inventory has been on a slide because it hit its all-time excessive of $407 in 2021. And that slide has worsened in 2024, with shares down greater than 25% this yr alone.

A number of elements may clarify Tesla’s lack of efficiency, however one stands out particularly — the weakened outlook for electrical automobile (EV) gross sales development in 2024. Whereas the market remains to be anticipated to develop in 2024, forecasts challenge it can develop at a slower price than beforehand as greater rates of interest have raised the price of buying a automobile and deterred many would-be consumers.

As well as, the shopper base for electrical automobiles is shrinking, not less than briefly. Many customers who can afford new EVs and sure think about themselves trendsetters have already bought one. The remaining buyer base consists largely of those that do not essentially care about switching to EVs or who cannot afford one.

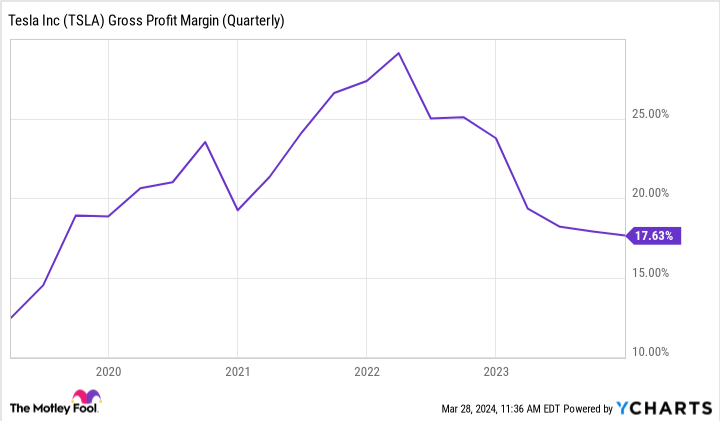

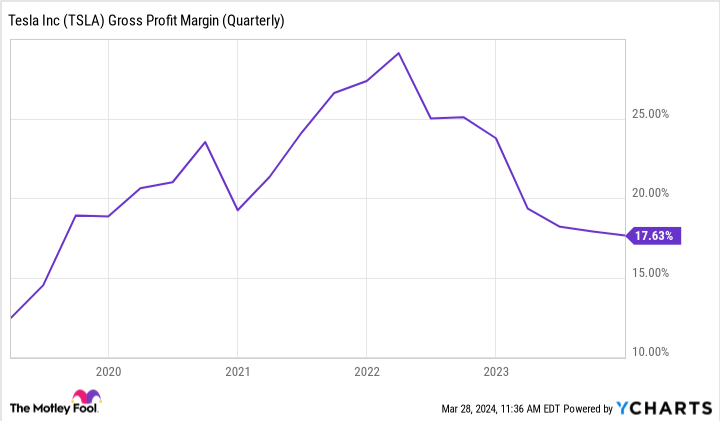

To handle this, Tesla applied a collection of serious worth cuts throughout its fashions in 2023. Whereas this helped to maintain demand afloat, it negatively impacted its revenue margins. In 2022, Tesla’s gross revenue margin reached practically 30%, a formidable accomplishment in a capital-intensive enterprise that put it on the prime of the automotive business by that metric. Nevertheless, for the reason that implementation of worth cuts, Tesla’s margins have slipped. At this time, they hover round 17%, which is extra in keeping with the remainder of the auto business.

Including just a little context

In gentle of all that, it is not arduous to see why Tesla’s inventory has shed greater than half its worth. Nevertheless, to see the chance presenting itself immediately, one should zoom out just a little additional and acknowledge simply how prolific an organization Tesla is, and acknowledge that these struggles are minor pace bumps in its development journey.

Even amid these challenges, Tesla continued to show why it belongs in a category of its personal. In 2023, it as soon as once more set new information in whole manufacturing and gross sales on a per-unit foundation. On prime of that, even with the value cuts, it set a brand new document on annual income at greater than $95 billion, a brand new internet earnings document of $15 billion, and bolstered its money reserves to a whopping $29 billion.

It’s this money, particularly, that makes it engaging. Its massive capital reserves give Tesla the flexibility to make strikes that few different EV makers can afford as nicely within the present panorama, akin to increasing its manufacturing capabilities.

The corporate is within the early levels of setting up a brand new manufacturing facility in Mexico and is in preliminary discussions to construct its first crops in India and Thailand. Whereas different producers have been pressured to reduce operations as a consequence of greater prices and rates of interest, Tesla has moved full steam forward to extend its buyer base and manufacturing capability.

Moreover, rates of interest and weakened gross sales projections are probably short-term phenomena that make Tesla geared up to climate market turbulence. Ought to rates of interest begin to come down, which is prone to happen this yr, Tesla ought to see demand climb again.

Taking it a step additional

From strictly an EV perspective, Tesla’s prospects look fairly engaging immediately. Nevertheless, its true potential comes into focus when analyzing the opposite endeavors it’s pursuing. Fueled by its massive money reserves, Tesla is actively growing a number of promising applied sciences. Humanoid robots, autonomous driving, and synthetic intelligence are a few of its major areas of focus immediately. It’ll pour greater than $1 billion into the analysis and growth finances for its supercomputer this yr alone.

As Tesla executives described it on the latest earnings name, the corporate at present finds itself between two development cycles. The primary one catapulted Tesla to the standing of world’s most precious automaker and made its Mannequin Y the best-selling automobile worldwide. However the coming development cycle shall be fueled by its sub-$25,000 next-gen automobile, robotics, synthetic intelligence, and far more. As soon as these applied sciences are totally developed, Musk envisions Tesla sooner or later changing into essentially the most helpful firm on the earth.

In some ways, investing in Tesla immediately could be just like investing in it pre-2020. So, as many skeptics and critics foment concern, it is worthwhile so as to add some context, zoom out a bit, and see the place Tesla is headed relative to its present place.

Whereas Musk has a status for visions of grandeur and setting overly optimistic timelines, it is arduous to dismiss his potential to ultimately observe via. For traders who’ve a while on their aspect and are in search of the inventory with essentially the most potential out of the Magnificent Seven, the tumble in Tesla’s share worth makes it extraordinarily alluring.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it might probably pay to hear. In spite of everything, the e-newsletter they’ve run for twenty years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They only revealed what they imagine are the 10 finest shares for traders to purchase proper now… and Tesla made the listing — however there are 9 different shares you could be overlooking.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. RJ Fulton has positions in Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Down Extra Than 50%, This “Magnificent Seven” Inventory Is a Screaming Purchase was initially revealed by The Motley Idiot