Roku (NASDAQ: ROKU) as soon as redefined streaming for a lot of households. The high-flying development inventory of 2020 and 2021 has seen its share value plunge from the pandemic-induced peak, at the moment sitting 87% under the file costs of July 2021.

In case you’re trying to find potential bargains on the crossroads of know-how and client companies, Roku’s dramatic value drop may catch your roving eye. Previous efficiency isn’t any assure of future outcomes, however this steep low cost presents a bargain-priced entry level for individuals who imagine within the firm’s fundamentals and long-term technique.

In my opinion, Roku’s long-term enterprise prospects are stronger than ever. In actual fact, the inventory ought to attraction to die-hard worth buyers in some ways, although Roku nonetheless mainly appeals to growth-stock chasers. So let’s take a deeper take a look at Roku’s present market place, monetary well being, and future prospects to know whether or not this dip represents a shopping for alternative or a sign to tune out.

Is Roku the deal of the day?

I am not kidding. Roku seems to be downright low cost in some ways.

The inventory trades at simply 2.7 instances gross sales these days, or 4.1 instances the corporate’s e book worth. In case you’re on the lookout for deep money reserves, Roku shares are altering arms at 4.6 instances its money equivalents on a pristine steadiness sheet with zero {dollars} of long-term debt.

So the corporate is cash-rich, debt-free, and able to make heavy investments in promising concepts and operations. On the identical time, the inventory value can be extra applicable for a slow-growing participant in mature industries like industrial supplies or telecom companies.

Roku’s pockets is broad open, financing tomorrow’s development

To this point, Roku seems to be like a low-priced worth inventory. However that is not the entire story.

The corporate can also be pulling many efficient levers to help present and future development. For instance, Roku’s annual analysis and improvement (R&D) finances elevated by 90% during the last two years. Gross sales and advertising and marketing prices soared 127% greater in the identical span.

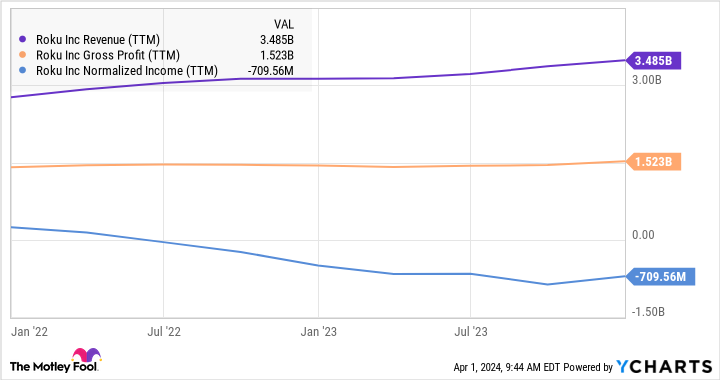

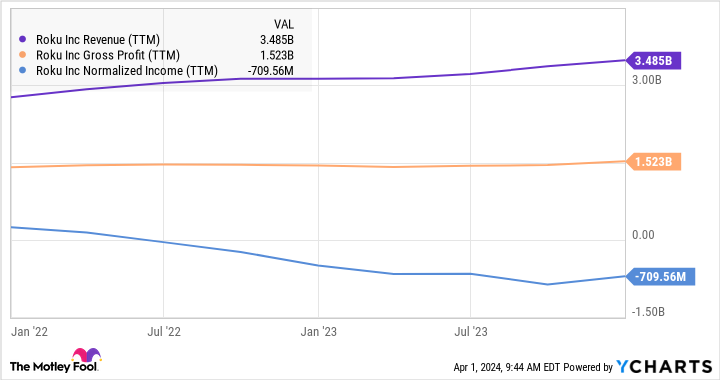

Roku additionally held its product and repair costs regular at a time when most rivals handed on greater bills to their prospects. The ensuing mixture of stalled gross margins and hovering working bills drove bottom-line earnings into adverse territory in the summertime of 2022.

So you may see Roku’s decrease gross earnings as one other kind of selling expense lately. The corporate bore the brunt of rising enterprise bills whereas others contributed to the inflation difficulty with greater costs. Along with these hovering R&D and advertising and marketing efforts, Roku’s enterprise has been rising in the course of a worldwide financial downturn.

Roku’s recipe for recession resilience

Roku ended 2021 with 60 million lively accounts and $2.7 billion of full-year revenues. Two years later, the account assortment rose to 80 million names and annual gross sales jumped to $3.5 billion. Not too shabby whereas knee-deep in an inflation-driven market hunch, proper?

Furthermore, the bottom-line stress is fading. In February’s fourth-quarter report, Roku’s bottom-line figures moved upward for the primary time for the reason that fall of 2021. On the identical time, annual gross sales rose 8% year-over-year and the full-year free money flows solidified at $173 million.

In different phrases, Roku’s development technique is paying dividends and I can not wait to see the monetary outcomes hovering when the world financial system lastly will get again on its toes.

Media-streaming companies are taking the leisure world by storm, and each cord-cutting digital streamer is a possible Roku buyer. Regardless of intense competitors from world-class know-how corporations like Samsung, Amazon, and Google, Roku holds a dominant market share amongst streaming units in North America. It is also a number one participant in Latin America and Western Europe, with a worldwide growth effort within the works.

Roku is my favourite purchase proper now

But, market makers are shrugging off Roku’s wealthy potential for long-term upside, distracted by an ever-changing aggressive panorama and the present lack of bottom-line earnings.

I feel that is a giant mistake. Roku’s enterprise is working simply positive, delivering development the place it issues. Unfavorable earnings look painful at first look, however administration has the state of affairs below management and will generate web earnings anytime by shifting away from this costly development technique.

And I hope they do not try this for years to come back. The untapped long-term market alternative is just too large to disregard. The Roku shares you purchase at at the moment’s bargain-bin value ought to make some huge cash because the streaming leisure business evolves over time.

Must you make investments $1,000 in Roku proper now?

Before you purchase inventory in Roku, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Roku wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 1, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet, Amazon, and Roku. The Motley Idiot has positions in and recommends Alphabet, Amazon, and Roku. The Motley Idiot has a disclosure coverage.

1 Progress Inventory Down 87% to Purchase Proper Now was initially printed by The Motley Idiot