Even with latest market turbulence, it has been an total good yr within the inventory market. However the Dow Jones Industrial Common is barely up 2.4% yr to this point (YTD) — lagging behind the Nasdaq Composite‘s practically 7% YTD return and the S&P 500‘s practically 8% acquire.

The Dow Jones comprises many industry-leading blue chip firms. Nonetheless, there are many Dow shares which might be down this yr, and a few significantly massive names which might be inside 6% of their 52-week lows — together with Apple (NASDAQ: AAPL), Nike (NYSE: NKE), and UnitedHealth (NYSE: UNH). This is why all three dividend shares are down, however why they may very well be value shopping for now.

From sector chief to sector underperformer

Apple is arguably essentially the most shocking inventory on this listing. It makes up over 7% of the Nasdaq Composite. And regardless of Apple weighing down the index, the Nasdaq Composite hit an all-time excessive on March 21 and remains to be up massive on the yr. Buyers have been used to Apple main the market, not lagging behind it.

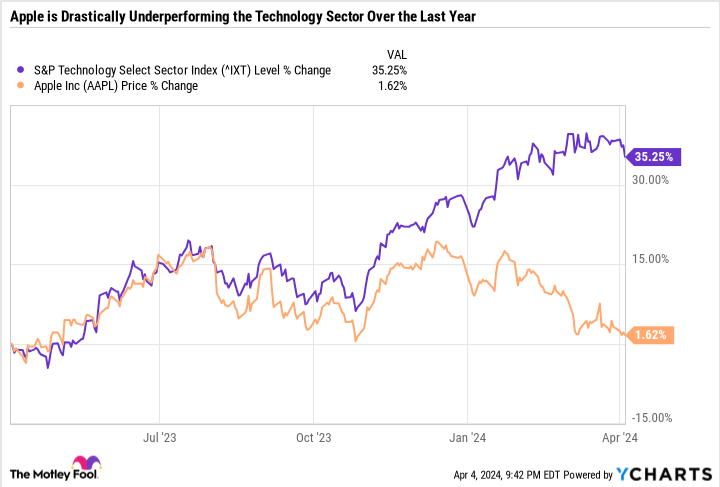

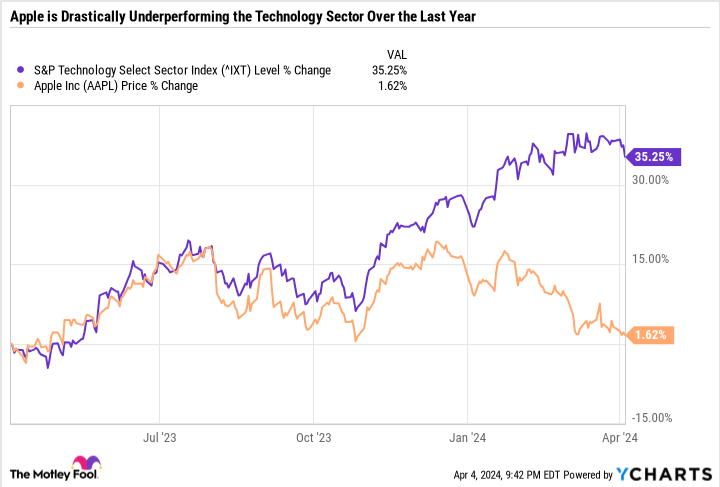

The underperformance is much more drastic when trying on the expertise sector. Apple makes up 19.2% of the Expertise Choose Sector SPDR Fund, an exchange-traded fund that mirrors the efficiency of the tech sector. But, the inventory is about flat over the past yr, whereas the sector is up over 35%.

It will be one factor if Apple have been merely a part of a broader Nasdaq and tech sector sell-off. However any time you see an {industry} chief transfer in the other way of its peer group, that is often an indication that traders have particular considerations about an organization.

For Apple, the considerations are principally justified. The expansion simply is not there. Gross sales in Apple’s second most essential market — China — are declining. Apple’s lack of synthetic intelligence (AI) monetization, and albeit innovation generally, is a nasty look in comparison with different massive tech shares like Microsoft and Nvidia which might be leveraging AI as a coiled spring for multi-decade progress.

Apple appears to be like out of step, so it is exhausting to fault traders for hitting the promote button. To make issues worse, the Division of Justice filed a civil antitrust lawsuit in opposition to Apple for monetizing smartphone markets.

The silver lining is that Apple has a mere 26.1 price-to-earnings (P/E) ratio — making it far cheaper than the tech sector’s 38.7 P/E ratio. Apple generates loads of money, permitting it to repurchase inventory and lift the dividend even throughout slowing progress.

One have a look at Apple’s meager 0.6% dividend yield might lead you to consider the corporate has a weak capital return program. The truth is, it merely chooses to distribute the overwhelming majority of funds via buybacks slightly than the dividend. Apple’s buybacks have been a superb funding, contemplating the inventory’s efficiency. Buybacks will be significantly efficient when a inventory is beaten-down, and the corporate can swoop in and repurchase shares on a budget.

Counting Apple out has been a shedding wager up to now. The corporate’s model and vertical integration are nonetheless sturdy, so worth traders might need to step in and think about the inventory now.

It is time to transfer previous Nike’s short-term earnings spike

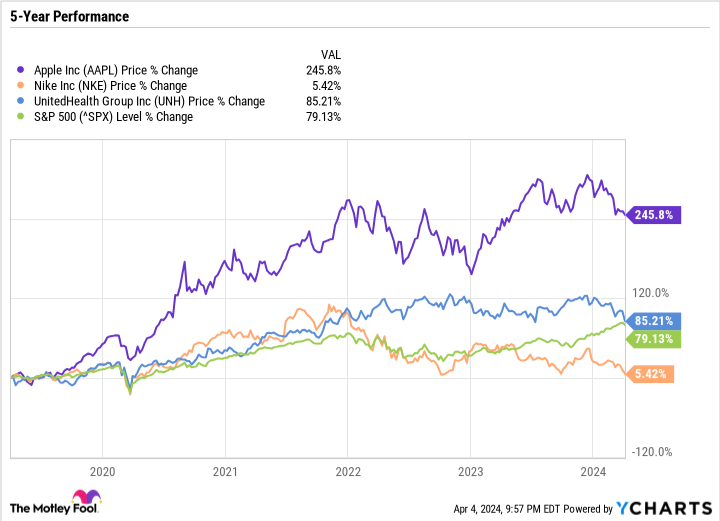

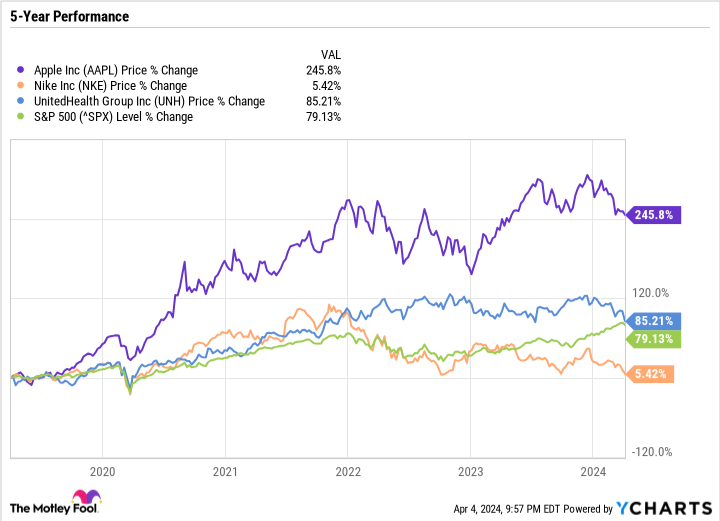

Regardless of its underperformance, Apple has nonetheless produced market-beating good points over the past 5 years. The identical cannot be mentioned about Nike. Regardless of placing up monster good points in 2020 and 2021, Nike inventory has round-tripped and is now about the place it was 5 years in the past.

Nike is an effective instance of why it’s dangerous to anchor a inventory to a value it most likely ought to have by no means reached within the first place. Throughout the top of the pandemic, individuals had restricted choices to spend on providers, in order that they flocked to items spending. Nike benefited significantly from that. Nonetheless, the expansion proved to be short-lived.

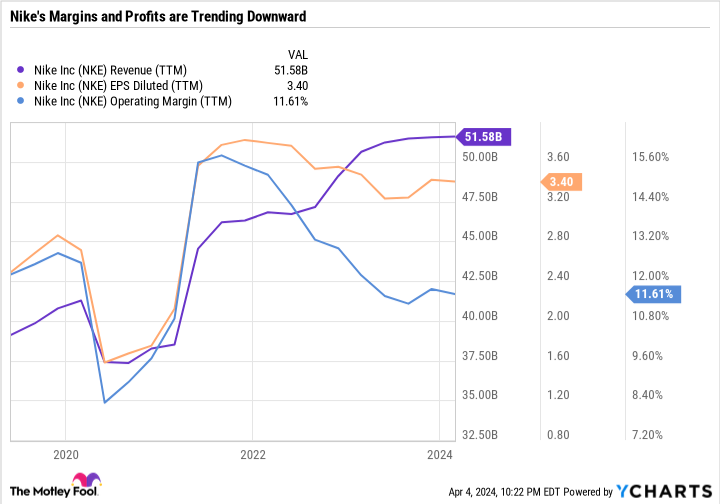

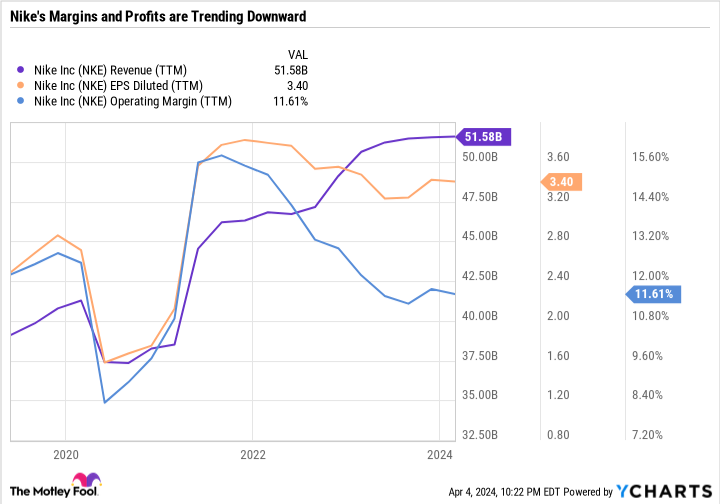

As you’ll be able to see within the chart, Nike’s earnings per share and working margin initially plummeted on the onset of the COVID-19 pandemic, however then shot up in 2021 — corresponding with the inventory’s file excessive. Gross sales have ticked up, however on the expense of decrease earnings and margins. The enterprise is nearer to the place it was pre-pandemic than the place it was in 2021, so it is comprehensible why the inventory value has retraced.

To its credit score, Nike has prioritized its capital return program amid slowing progress. It’s shopping for again inventory and its dividend is up 68% in simply 5 years.Granted, the inventory yields simply 1.6%, however Nike is popping right into a worthy dividend candidate, slightly than relying purely on progress because it did up to now.

Like Apple, Nike is among the most influential manufacturers on the earth. Nike now has only a 26.2 price-to-earnings ratio — under the S&P 500’s 27.9 P/E. The short-term outlook is not nice, however affected person traders are getting the possibility to purchase Nike at a compelling value.

Dip your toes into the healthcare sector with UnitedHeatlh

Like Apple, medical insurance supplier UnitedHealth nonetheless outperformed the market over the past 5 years. However the inventory has offered off just lately, primarily on account of a lower-than-expected cost fee enhance for the 2025 calendar yr.

UnitedHealth’s progress is closely depending on its Medicare enterprise, so the sell-off is sensible. To make issues worse, UnitedHealth was additionally the sufferer of a cyberattack, which prompted the corporate to fall behind on claims funds.

Quick-term challenges apart, it could be a mistake to underestimate UnitedHealth’s function within the healthcare sector. Drugmakers push the boundaries of innovation, however insurance coverage is the glue that holds the U.S. healthcare system collectively. The sector has ballooned to turn out to be the nation’s third-largest sector, behind solely financials and tech.

UnitedHealth is an effective selection for traders who need to put money into the healthcare sector, however not via a high-flying drugmaker like Eli Lilly. UnitedHealth lies on the stodgier finish of the healthcare sector and is extra centered on reasonable progress and elevating its dividend — which is up 400% over the past decade. It has a 19.1 P/E ratio, making it a great worth for these in search of cheaper shares to purchase now.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Apple wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 8, 2024

Daniel Foelber has the next choices: lengthy July 2024 $95 calls on Nike. The Motley Idiot has positions in and recommends Apple, Microsoft, Nike, and Nvidia. The Motley Idiot recommends UnitedHealth Group and recommends the next choices: lengthy January 2025 $47.50 calls on Nike, lengthy January 2026 $395 calls on Microsoft, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Dow Jones Dividend Shares That Are Inside 6% of Their 52-Week Lows to Purchase Now was initially printed by The Motley Idiot