Shopping for and holding nice firms for a really very long time is a confirmed technique for earning profits within the inventory market. This permits traders to not solely benefit from secular progress traits but in addition helps compound their investments over time.

As an illustration, an funding price $10,000 in shares of Nvidia (NASDAQ: NVDA) a decade in the past is now price $1.9 million. That interprets right into a whopping annual return of just about 70% over the previous 10 years. Throughout this time, Nvidia traders have benefited from the rising adoption of the corporate’s graphics playing cards within the gaming, automotive, and information middle markets, illustrating simply why holding a strong firm for a very long time may very well be a rewarding factor to do — even serving to you change into a millionaire.

Nonetheless, a inventory leaping 100x and turning $10,000 into almost $2 million {dollars} is a uncommon incidence. However on the similar time, you probably have that a lot money obtainable after paying off your payments, saving for robust occasions, and clearing high-interest debt, it could be a smart factor to place that cash into an undervalued inventory with terrific long-term potential.

Doing so won’t solely enable you profit from the facility of compounding and secular progress alternatives but in addition help you assemble a diversified portfolio.

Let us take a look at the the explanation why shopping for Nvidia proper now as part of a diversified portfolio may assist traders change into millionaires in the long term.

Here is why Nvidia inventory is undervalued

You might be questioning why I am calling Nvidia an undervalued inventory following gorgeous good points of greater than 500% because the starting of 2023. In spite of everything, the shares are buying and selling at 36 occasions gross sales and 74 occasions trailing earnings. Each figures are considerably greater than the corporate’s five-year common gross sales a number of of 18 and trailing earnings a number of of 65.

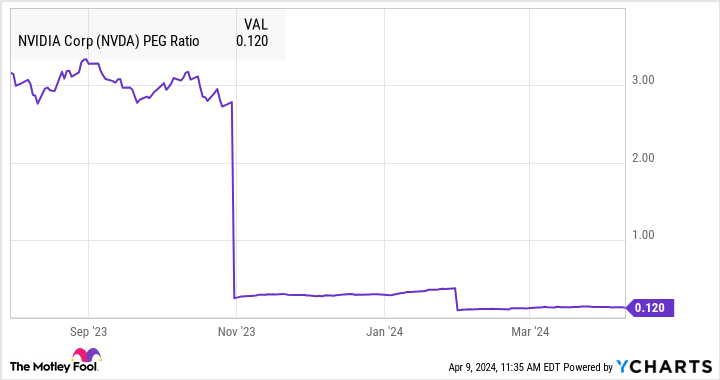

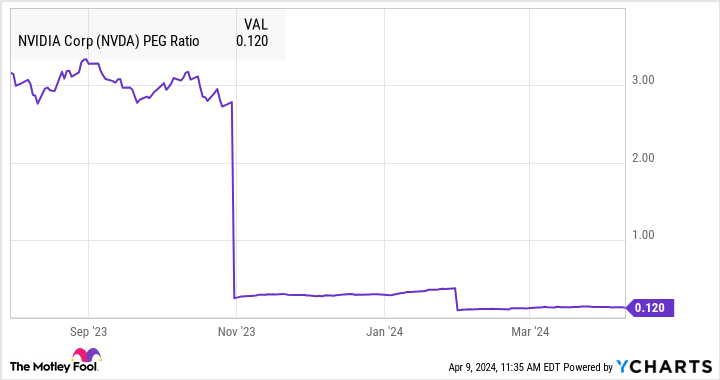

Nonetheless, Nvidia inventory is undervalued based mostly on the potential progress it’s forecast to ship. That is evident from the inventory’s ahead price-to-earnings (P/E) ratio of 36, which is decrease than the five-year common ahead earnings a number of of 39. In the meantime, Nvidia’s worth/earnings-to-growth ratio (PEG ratio) is one other clear indication of the inventory’s undervaluation.

The PEG ratio is set by dividing a inventory’s P/E ratio by the projected annual earnings progress it’s anticipated to ship. In less complicated phrases, the PEG ratio helps traders perceive how costly a inventory is with respect to the expansion it may ship. A PEG ratio of lower than 1 signifies that the inventory is undervalued. As the next chart tells us, Nvidia is considerably undervalued based mostly on the PEG ratio is anxious.

Shopping for Nvidia at this a number of appears just like the good factor to do contemplating that it’s sitting on profitable secular progress alternatives in a number of markets. Let’s check out them.

These strong alternatives may also help Nvidia keep its eye-popping progress

Synthetic intelligence (AI) is the explanation why Nvidia inventory has surged so impressively up to now yr or so. The great half is that the corporate’s share-price surge is backed by strong progress in its income and earnings.

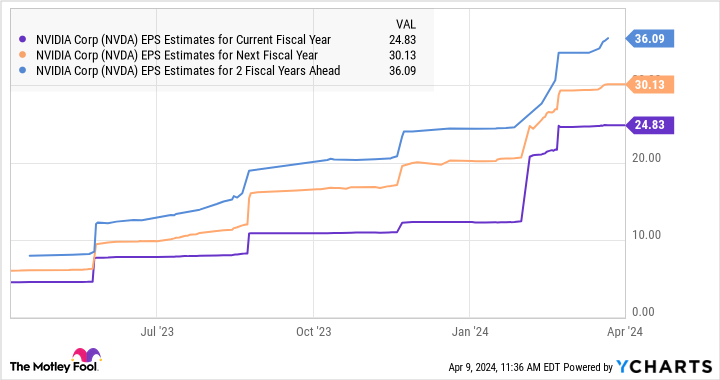

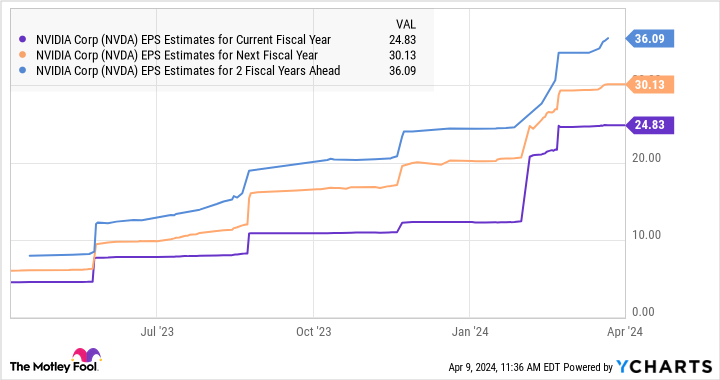

After ending fiscal 2024 with a 126% enhance in income to $60.9 billion and a 288% soar in adjusted earnings to $12.96 per share, analysts predict Nvidia to maintain its excellent progress over the following three fiscal years.

Extra importantly, Wall Road is bullish about Nvidia’s long-term prospects. As an illustration, analyst Vijay Rakesh of Japanese funding financial institution Mizuho is anticipating Nvidia’s information middle income to extend to $89 billion in fiscal 2025 from final yr’s $47.5 billion. By fiscal 2028, Rakesh is estimating that Nvidia may generate $280 billion from its information middle enterprise alone because of the terrific progress alternative out there for AI chips.

That will not be shocking for a few causes. First, the worldwide AI chip market is predicted to generate $400 billion in income in 2027, in keeping with Superior Micro Units. Second, Nvidia is main the AI chip market by an enormous margin, with an estimated market share of over 95%. The great half is that Nvidia has been taking steps to make sure that it stays the highest participant on this area.

From launching new AI graphics playing cards which might be far more highly effective than the prevailing ones at aggressive costs to creating a reported transfer into the marketplace for customized AI chips, there’s a good likelihood that the corporate will proceed to dominate this market in the long term. In the meantime, Nvidia can be set to capitalize on new niches comparable to digital twins and AI private computer systems (PCs).

These are multibillion-dollar alternatives for the corporate. For instance, Nvidia administration is forecasting a $150 billion addressable marketplace for its Omniverse enterprise software program, and it has began making headway. Equally, the potential income alternative for Nvidia within the AI PC market means that its annual gaming gross sales may soar by 5 occasions over the following 4 years.

All this exhibits that Nvidia may certainly stay a high progress inventory in the long term as a result of the market is prone to reward its wholesome progress with extra good points. That is why traders trying to assemble a million-dollar portfolio can take into account shopping for it whereas it stays undervalued.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 8, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units and Nvidia. The Motley Idiot has a disclosure coverage.

Might This Undervalued Inventory Make You a Millionaire One Day? was initially printed by The Motley Idiot