Markets once more begin the day with uncertainty and lack of course, as buyers digested Netflix’s earnings and cryptocurrency merchants gear up for the bitcoin halving.

Netflix Inc. reported earnings after the bell Thursday, and whereas the tech and media large reported sturdy subscriber numbers, buyers had been left pessimistic after the corporate gave a weaker than anticipated forecast for its Q2 earnings. Netflix dropped round 8% midmorning Friday, dragging down with it the tech-heavy Nasdaq.

Netflix was among the many first of the megacap tech firms to report earnings, and stumbling out the gate with the weaker forecast hasn’t offered buyers with the enhance wanted to shake off current pullbacks out there.

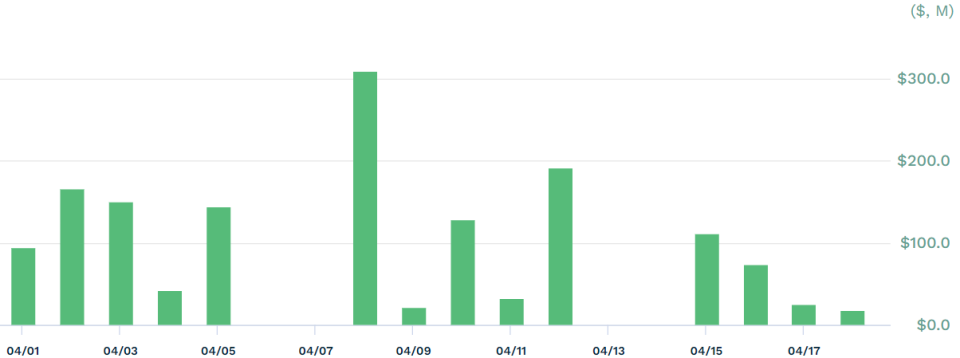

QQQ, the Invesco QQQ Belief which tracks the Nasdaq, slipped Friday, dropping 1%. In accordance with etf.com knowledge, QQQ noticed outflows topping $425M on Thursday.

QQQ April Flows

Supply: etf.com

XLK, the Know-how Choose Sector SPDR Fund equally struggled Friday. The fund does not maintain Netflix, however is a broad take a look at the tech sector, as buyers thought of the potential for disappointing tech earnings. Subsequent week buyers will flip their consideration to Meta, Alphabet (Google), and Microsoft.

SPY, the SPDR S&P 500 ETF Belief was within the crimson Friday morning because the S&P 500 teetered. DIA, the SPDR Dow Jones Industrial Common ETF Belief was the one index within the inexperienced Friday as buyers missed ratcheting tensions between Iran and Israel.

Crypto ETFs Rise as Bitcoin Halving Approaches

And cryptocurrency ETFs had been choosing up steam on Friday. The rise comes as buyers look ahead to the long-anticipated bitcoin halving. BTOP, the Bitwise Bitcoin and Ether Equal Weight Technique ETF was one of many high gainers Friday in response to etf.com knowledge. The GraniteShares 2x Lengthy COIN Day by day ETF (CONL), and the First Belief SkyBridge Crypto Business and Digital Economic system ETF (CRPT) had been additionally within the inexperienced.

The occasion, is, merely put, a time when the reward for bitcoin miners to create new bitcoin is minimize in half. Halvings happen each 4 years and keep the shortage of bitcoin. Traditionally, the occasions precede a rally in bitcoin costs. It isn’t sure precisely when a halving will happen, however merchants are anticipating the occasion may occur anytime between Friday and Sunday morning.

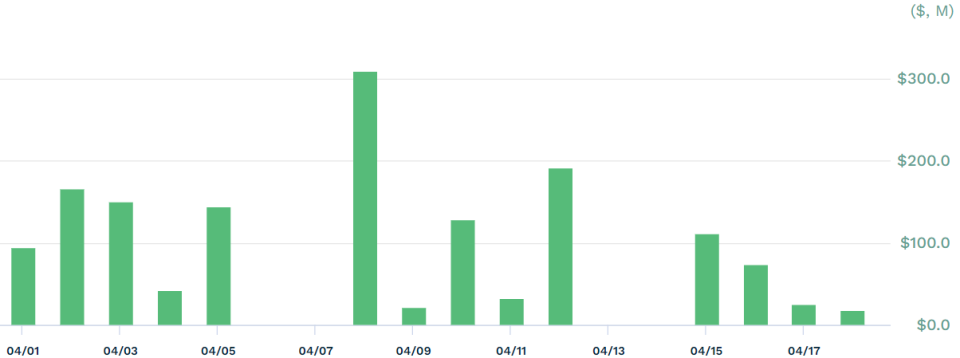

And the most important spot bitcoin ETF, IBIT, the iShares Bitcoin Belief rose almost 2% forward of the halving. In accordance with etf.com knowledge, flows into the ETF have been on the rise for the reason that begin of April, topping $1B within the final two weeks.

IBIT April Flows

Supply: etf.com

Many buyers want to the halving as a possible purchase alternative, hoping for a possible pop in bitcoin costs. But it surely’s unclear if this 12 months’s halving could have the identical impact for the reason that launch of spot bitcoin ETFs which have already fueled an increase in bitcoin costs.

Permalink | © Copyright 2024 etf.com. All rights reserved