The market is off to a scorching begin up to now in 2024, with the S&P 500 and Nasdaq Composite buying and selling close to report ranges, and maybe the largest affect proper now could be synthetic intelligence (AI).

The tech stalwarts within the “Magnificent Seven” are certainly making waves in AI and continually discover their names within the highlight. However exterior of huge tech, there are different disruptive forces in AI. Palantir Applied sciences (NYSE: PLTR) is one such participant, with numerous AI-powered enterprise software program platforms for the private and non-private sectors.

Final yr was a milestone for Palantir, and I feel one of the best is but to return. This is why it is my high choose for traders in a extremely contested AI enviornment.

Buyer acquisition is rising

A number of large tech firms have partnered with main AI start-ups. For instance, Microsoft has invested billions into OpenAI, the developer of ChatGPT. Amazon and Alphabet are each traders in OpenAI competitor Anthropic and Nvidia is an investor in Databricks.

Palantir has found out a solution to make inroads on this AI panorama. A yr in the past, the corporate launched the Palantir Synthetic Intelligence Platform (AIP).

To fend off the competitors, the corporate started internet hosting seminars referred to as “boot camps,” the place potential prospects might demo its AIP software program. The purpose was to assist potential prospects establish a use for it.

This lead-generating technique seems to be working. In 2023, Palantir elevated its buyer rely by 35% yr over yr. Furthermore, the corporate is accelerating its enlargement past its legacy government-contractor enterprise.

It grew its private-sector buyer rely by 44% final yr. Within the fourth quarter, U.S. income from these purchasers grew 70% yr over yr.

Income, margins, and income are up

Wanting on the firm’s funds sheds some gentle on how AIP helps Palantir. The corporate was based in 2003 and took 17 years to achieve $1 billion in income. Simply three years later, it eclipsed $2 billion in gross sales.

In 2023, Palantir’s income elevated 17% yr over yr to $2.2 billion, underlining how shortly breakthroughs in AI are unlocking new progress for software program firms.

Even higher, the corporate is witnessing a surge on the underside line as properly. Final yr, free money circulate grew greater than threefold to $730 million, and working margin expanded 6 proportion factors yr over yr.

The most effective is but to return

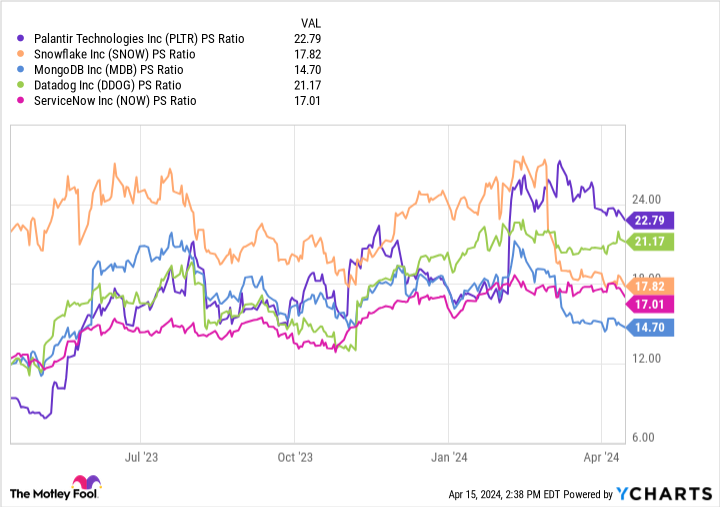

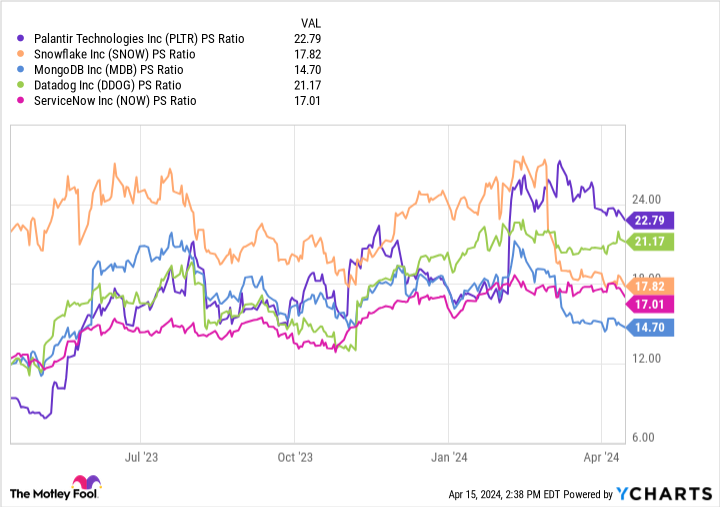

The chart beneath benchmarks Palantir in opposition to peer high-growth software-as-a-service (SaaS) builders in AI. The corporate’s price-to-sales (P/S) ratio of 23 is the very best amongst this cohort, narrowly above Datadog.

Whereas the inventory has turn into a bit expensive, it is essential to notice that Palantir’s valuation multiples actually started to increase in February following the corporate’s sturdy fourth-quarter earnings report. Since that report, optimistic shopping for exercise has fueled newfound momentum within the share worth.

Regardless of its premium worth, Palantir inventory nonetheless appears engaging to me. It’s buying and selling 43% beneath its all-time excessive.

Furthermore, one in all Wall Road’s most esteemed expertise analysts, Dan Ives of Wedbush Securities, is looking for enormous upside within the inventory. He set a worth goal of $35, practically 59% above present buying and selling ranges. Analysts do not at all times get issues proper, however I am in settlement with Ives’ optimism.

My take is that Palantir is properly definitely worth the premium. The mixture of top-line progress and strong money circulate makes it stick out among the many competitors as a result of many high-growth SaaS companies aren’t but constantly worthwhile. In This autumn, Palantir reported its fifth consecuve quarter of GAAP (unadjusted) profitability.

Moreover, the monetary and working outcomes talked about above drive dwelling the concept the corporate’s many years of investing in AI present a aggressive benefit. This has led to a brand new wave of progress, with constantly sturdy gross sales and income.

The progress thus far is encouraging, however I feel Palantir’s long-term journey to disrupt large tech is simply getting began. Now appears like a profitable alternative to make use of dollar-cost averaging to assist construct a place or add to an current one. Buyers with very long time horizons will not need to miss out on the corporate’s potential in AI.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Palantir Applied sciences wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $466,882!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 15, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Amazon, Datadog, Microsoft, MongoDB, Nvidia, Palantir Applied sciences, ServiceNow, and Snowflake. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

This Is Palms-Down My Choose for the Greatest Synthetic Intelligence Inventory to Purchase Now. (And It is Not Nvidia.) was initially printed by The Motley Idiot