After some current losses, markets turned up throughout Wednesday’s after-hours buying and selling session. This upturn coincided with Federal Reserve Chair Jay Powell’s announcement confirming that there can be no additional fee hikes for the foreseeable future.

The upward flip within the markets highlights the volatility in present circumstances – however that’s not a foul factor in any respect, for not less than one market knowledgeable.

John Stoltzfus, chief funding strategist at Oppenheimer, offers a transparent clarification of the place the market stands now: “Some near-term profit-taking within the day after day motion of the market, significantly in progress segments which have had distinctive run-ups since final 12 months into this 12 months, continues to seem to us fairly regular. Such exercise mixed with a means of rebalancing and rotation into different segments of the inventory market in our view will be wholesome and contribute to the broadening of the markets’ progress from final 12 months by this 12 months.”

Stoltzfus goes on to clarify why that is good for risk-tolerant traders, including, “Close to-term volatility may in our view proceed to current alternative for traders to ‘catch infants that get thrown out with the tub water’ in durations of market down drafts because the market digests ranges of uncertainty that aren’t unusual to occasions of transition like these and in durations of rising geopolitical danger.”

The inventory analysts at Oppenheimer are taking this view ahead and are predicting robust rallies – over 100% – for 2 healthcare shares specifically. We ran them by the TipRanks database to see what makes them stand out. Let’s take a better look.

Avalo Therapeutics (AVTX)

We’ll begin on the planet of biopharmaceuticals, with Avalo Therapeutics. This agency’s work is targeted on treating immune system ailments, particularly these attributable to immune system dysregulation. The corporate has a pipeline of energetic analysis initiatives, concentrating on a wide range of autoimmune and/or inflammatory ailments. It is a wealthy subject for a biotech, as these circumstances regularly are troublesome to deal with successfully and have consequent excessive ranges of unmet medical wants.

The corporate’s main drug candidate, AVTX-009, was acquired by Avalo in March of this 12 months, by an acquisition of AlmataBio. The drug candidate is an anti-IL-1β mAb, thought-about prepared for Part 2 testing. A Part 2 trial is deliberate for the drug candidate within the remedy of hidradenitis suppurativa with topline information anticipated for readout in 2026. The corporate sees excessive potential in AVTX-009 and has plans to develop the drug candidate in not less than yet one more, to-be-determined, persistent inflammatory indication.

Advancing medical analysis into late-stage trials doesn’t come low cost, however Avalo is in a sound place to pay for its analysis packages. In March of this 12 months, the corporate carried out a non-public placement financing transfer that was anticipated to yield roughly $185 million in gross proceeds and netted $105 million in up-front web proceeds. The corporate estimates its money runway as adequate to fund operations into 2027.

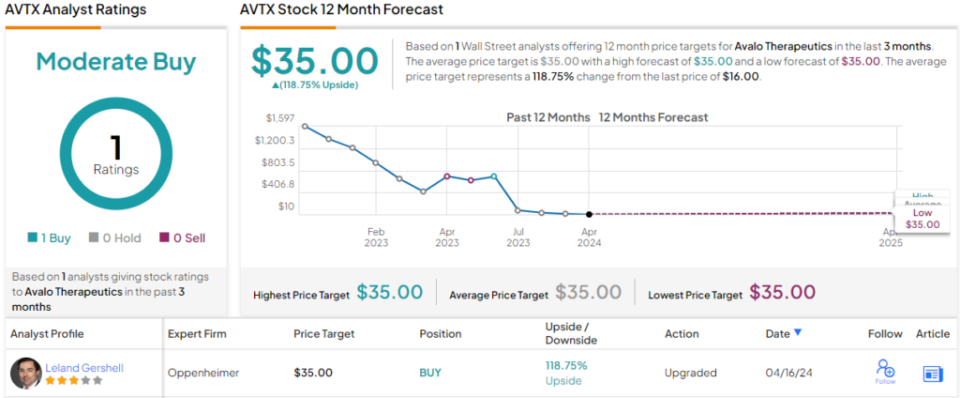

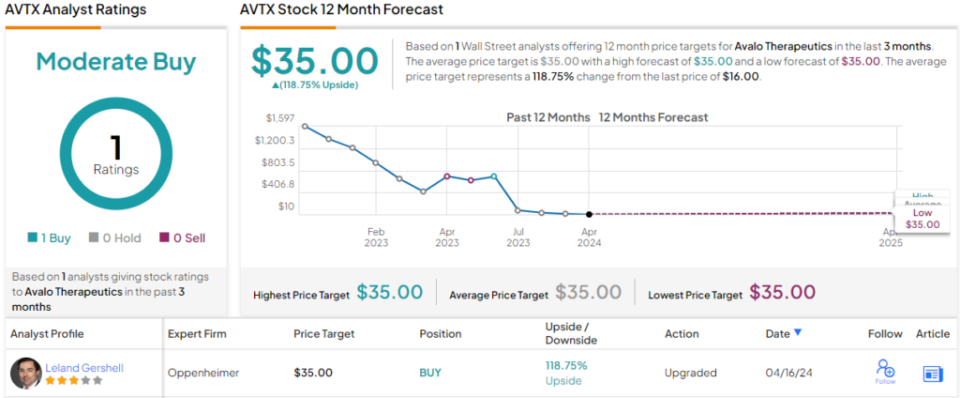

Wanting into this inventory for Oppenheimer, analyst Leland Gershell takes the measure of the corporate’s potential earnings, assuming success with AVTX-009. Gershell writes, “We view AVTX-009 as a promising drug candidate with the potential to deal with giant unmet wants in inflammatory illness. We fee shares Outperform as we look ahead to a Part 2 topline reveal in 2026 in HS and extra updates in one other essential autoimmune situation… We’re optimistic the Part 2 will pave the best way to registrational growth, to include a pen autoinjector for the business market. We venture peak penetration of 15% and assume $75,000 launch pricing in 2029, according to authorised biologics… We see ~$400M peak US gross sales in HS alone.”

The analyst’s Outperform (i.e. Purchase) score is complemented by a $35 worth goal that suggests a sturdy 119% upside for the approaching 12 months. (To observe Gershell’s monitor report, click on right here)

Micro-cap biopharmas don’t all the time get lots of analyst consideration, and at present Gershell’s is the only real AVTX evaluate on report.

AngioDynamics (ANGO)

Subsequent on our record of Oppenheimer picks is AngioDynamics, one other tech-oriented firm within the medical subject, however one centered on medical gadgets quite than therapeutic medication.

AngioDynamics acquired its begin in 1988, and its revolutionary merchandise are geared toward a number of medical specialties, together with interventional radiologists, interventional cardiologists, and surgeons. The corporate’s gadgets are used within the prognosis of most cancers and peripheral vascular illness, with a minimally invasive mode of operation.

AngioDynamics has an intensive product record, utilized in a variety of purposes. A number of the notable gadgets are the AlphaVac, utilized in endovascular therapies; the NanoKnife, utilized in localized oncological remedies; and the Auryon, utilized in endovascular remedies for peripheral atherectomy know-how. The corporate makes these gadgets, and lots of others, out there in over 50 markets worldwide – within the US, in Europe, in Asia, and in Latin America. AngioDynamics works by a community of direct gross sales and distributors, and frequently works to enhance and adapt its product strains.

Earlier this month, the corporate launched its monetary outcomes for its fiscal 3Q24. On the high line, the corporate reported a complete of $66 million in revenues, a consequence that was up 8% year-over-year, whereas the underside line determine got here to a web lack of 16 cents per share by non-GAAP measures.

Of the corporate’s income whole, $25.7 million was attributed to MedTech, whereas $40.3 million was attributed to Medical Gadgets. Throughout the quarter, AngioDynamics efficiently carried out a divestment of a number of product portfolios, significantly its PICC and Midline merchandise.

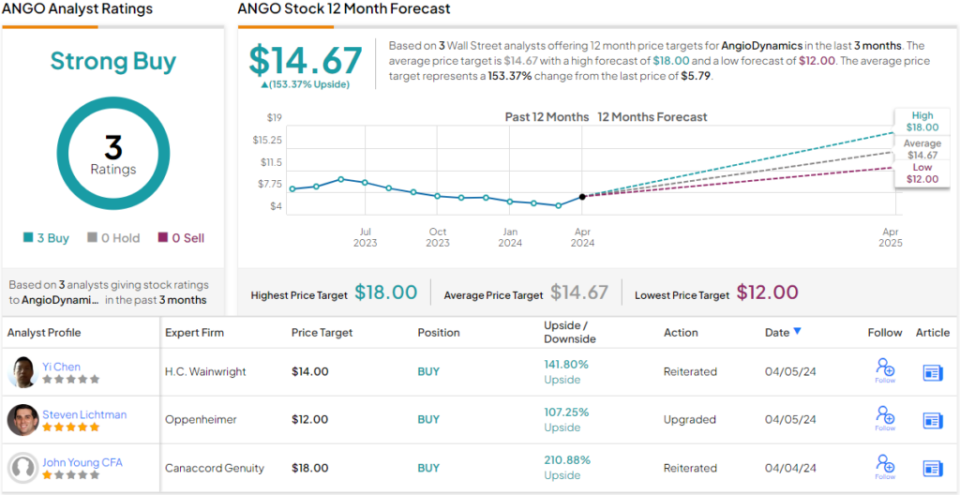

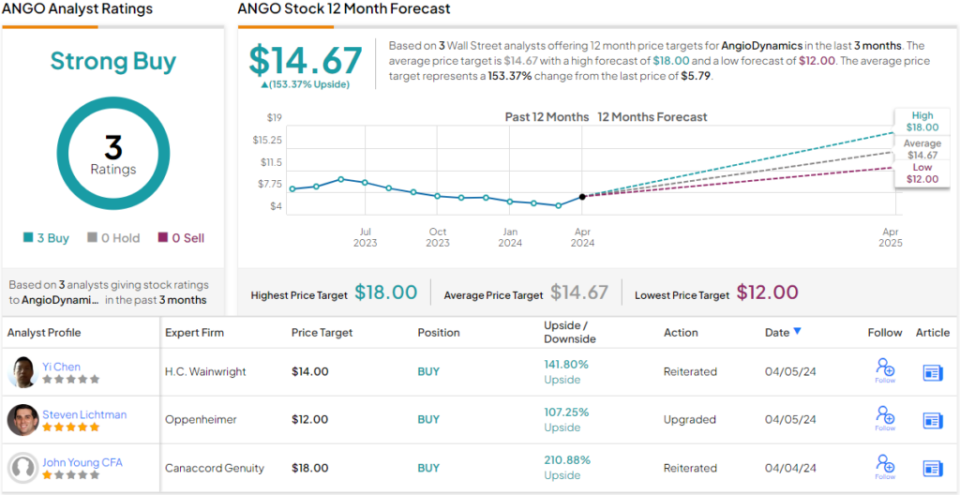

Regardless of a 26% decline in ANGO shares this 12 months, Oppenheimer analyst Steven Lichtman, who holds a 5-star score from TipRanks, stays bullish on the corporate’s progress prospects

“ANGO is targeted on accelerating progress by focusing its investments on its higher-margin Med Tech product strains— Auryon, AngioVac/AlphaVac, and NanoKnife. The corporate has a number of pipeline alternatives forward together with AlphaVac growth into PE, Auryon into DVT, and NanoKnife indication growth. Whereas competitors in ANGO’s core market stays stiff, new pipeline merchandise are near contributing, the corporate has strengthened its steadiness sheet, and the shares commerce at lower than 1x FY25E EV/gross sales,” Lichtman opined.

Quantifying his stance on ANGO, Lichtman offers the inventory an Outperform (i.e. Purchase) score, with a $12 worth goal that factors towards a 107% acquire within the subsequent 12 months. (To observe Lichtman’s monitor report, click on right here)

Whereas there are solely 3 current analyst evaluations on file for this inventory, they’re all in settlement that these are shares to purchase – making for a unanimous Robust Purchase consensus score. The inventory is priced at $5.79 and its $14.67 common worth goal implies an upside of a sturdy 153% for the 12 months forward. (See ANGO inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally essential to do your personal evaluation earlier than making any funding.