There are many methods to generate passive earnings, from risk-free property to bonds to earnings from rental properties. However one of many easiest and handiest technique of producing earnings is to put money into dividend shares, whereas present passive earnings with out the necessity to promote an asset, whereas additionally permitting you to take part within the inventory market.

Discovering an organization that may develop in worth whereas distributing dividend funds is a dream come true for long-term buyers. And that is precisely what Microsoft (NASDAQ: MSFT) and Air Merchandise and Chemical compounds (NYSE: APD) are.

In the meantime, the J.P. Morgan Fairness Premium Revenue ETF (NYSEMKT: JEPI) yields a whopping 7.6% and consists of publicity to prime corporations from Amazon to ExxonMobil. Here is what makes Microsoft, Air Merchandise, and the J.P. Morgan Fairness Premium Revenue ETF value shopping for now.

Microsoft’s dividend is one a part of an impeccable funding thesis

Daniel Foelber (Microsoft): Microsoft’s mere 0.7% dividend yield outcomes from its outperforming inventory value, not an absence of raises. Over the past 5 years, the inventory is up 223%, however the dividend has elevated by 63%. Zoom out over the past decade, and Microsoft is up a jaw-dropping 906%, whereas the dividend is up 168%.

Given the inventory’s robust efficiency, Microsoft buyers certainly do not thoughts the low yield. However buyers who do not personal Microsoft and are contemplating shopping for the inventory might marvel why the 0.7% yield is value it, not to mention grounds for a lifetime of passive earnings.

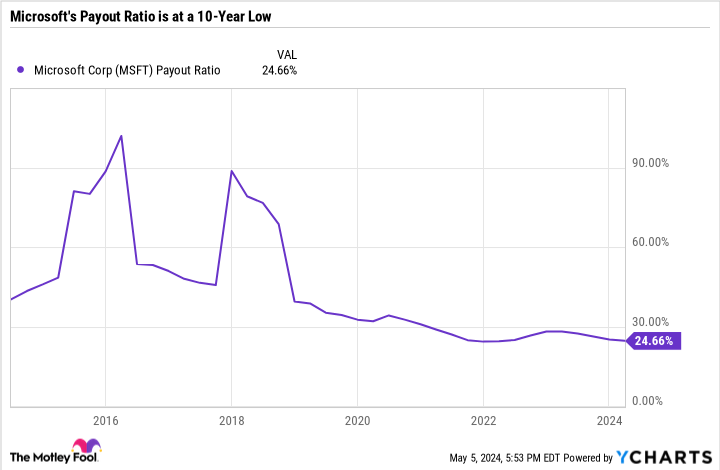

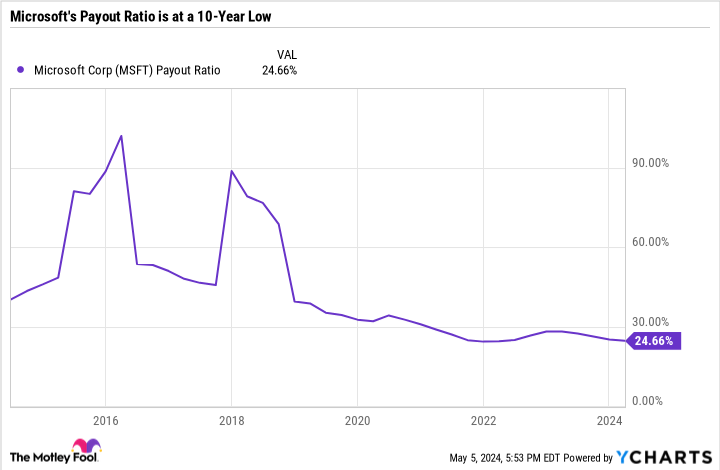

The reason being that Microsoft can simply afford to make sizable will increase to its dividend yearly. Earnings have grown at a quicker charge than dividend raises, which is why the payout ratio is now at a 10-year low of lower than 25%.

A payout ratio underneath 75% is nice for a dependable firm, however under 50% is even higher if an organization has cyclical earnings. A part of the explanation for Microsoft’s low payout ratio is that it rewards its shareholders with inventory repurchases and dividends. Microsoft has diminished its share depend regardless of its sizable stock-based compensation expense. Buybacks are an essential technique of stopping dilution, and we are able to count on buybacks to proceed to speed up and the excellent share depend to meaningfully lower over the approaching years.

If Microsoft retains outperforming the S&P 500, then the dividend will merely be a cherry on prime of a successful place. But when Microsoft languishes, count on the yield to noticeably improve due to robust dividend development and room for the payout ratio to go up if wanted. Both means, Microsoft has what it takes to reward shareholders.

Air Merchandise is a stalwart inventory that would ship many years of dividends

Scott Levine (Air Merchandise): It could be not possible to look into the long run and see which shares will present buyers with years of passive earnings, however it’s definitely useful to show your consideration to the previous. With a peak at an organization’s earlier efficiency, you’ll be able to acquire perception into how robust a candidate it’s to attain years of returning capital to shareholders. Air Merchandise is a chief choice.

Over its 80-year historical past, Air Merchandise has emerged as a number one supplier of commercial gases and associated tools to companies working in quite a lot of industries, together with vitality, aerospace, and healthcare, to call a number of. For forward-looking buyers, immediately’s a good time to fuel up on Air Merchandise inventory, which at present has a 2.9% forward-yielding dividend and is hanging on the low cost rack.

Rising its dividend for 42 consecutive years, Air Merchandise has demonstrated a steadfast dedication to rewarding shareholders. With respect to the more moderen previous, it is value noting the corporate’s dedication to its payout. From 2014 via 2024, Air Merchandise has hiked its dividend at a 9% compound annual development charge, whereas averaging a payout ratio of 62.3% over the previous 10 years.

As a result of the corporate serves all kinds of industries, it is unlikely a downturn in anybody would wreak havoc with the corporate’s financials, thus jeopardizing the dividend. Furthermore, the corporate has a powerful aggressive benefit. Working over 750 manufacturing services and over 1,800 miles of commercial fuel pipeline, Air Merchandise has developed a sturdy infrastructure that would hardly be disrupted by upstart industrial fuel corporations. Add to this the corporate’s commanding place as a hydrogen provider, and the attract of Air Merchandise turns into much more apparent.

With shares of Air Merchandise valued at about 15.2 occasions working money movement — a reduction to their five-year common money movement a number of of 17.4 — now looks like a fantastic alternative to begin of place on this industrial fuel powerhouse.

This ETF’s 7.6% yield is engaging for income-seeking buyers

Lee Samaha (J.P. Morgan Fairness Premium Revenue ETF): If you’re on the lookout for a month-to-month earnings ETF with equities publicity and a technique to generate comparatively low returns in comparison with the S&P 500 index, then this ETF might be for you. I’ve coated it in additional element as an ETF to purchase elsewhere, however I am going to run via the important thing factors right here for brevity.

In a nutshell, the ETF invests at the very least 80% of its property in actively managed U.S. equities and as much as 20% in a technique of promoting name choices on the S&P 500 index. A name choice on the index is the appropriate to purchase the index at a particular value, known as the strike value, as much as an expiration date. Traders in name choices should pay a premium for that proper.

As such, when this ETF sells a name choice, it is seeking to decide up the premium by the index not rising above the strike value, so buyers do not understand the choice. You can summarize the technique as follows:

-

When the S&P 500 rises sharply within the month, the ETF will lose cash on promoting name choices however make cash resulting from its fairness publicity.

-

When the S&P 500 falls sharply within the month, the ETF will most likely lose cash on its equities publicity however make cash selecting up premiums.

-

In low-volatility months, the ETF ought to earn cash by selecting up premiums and will make or lose cash on equities.

The ETF’s complete return (generated by reinvesting dividends) since inception in 2020 is an unbelievable 59.2%, and the utmost drawdown in a month was 6.4% in September 2020. General, it is a good file, and the month-to-month earnings will go well with buyers seeking to reside off of passive earnings.

The place to take a position $1,000 proper now

When our analyst crew has a inventory tip, it might pay to hear. In any case, the publication they’ve run for 20 years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they imagine are the 10 greatest shares for buyers to purchase proper now… and Microsoft made the checklist — however there are 9 different shares chances are you’ll be overlooking.

See the ten shares

*Inventory Advisor returns as of Could 6, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Daniel Foelber has no place in any of the shares talked about. Lee Samaha has no place in any of the shares talked about. Scott Levine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

3 Dividend Shares That Are Coiled Springs for a Lifetime of Passive Revenue was initially printed by The Motley Idiot