Warren Buffett and his crew at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) have been almost synonymous with Apple (NASDAQ: AAPL) since taking a place within the inventory in 2014. The funding (and all of the inventory they purchased alongside the best way) turned out to be sensible and made Berkshire a considerable revenue.

Nonetheless, Berkshire has began to promote Apple inventory regardless of voicing its perception within the enterprise. At one level, Apple made up greater than half of Berkshire’s funding portfolio; now, it has retreated to lower than 40%.

So why is Berkshire decreasing its stake in considered one of Buffett’s favourite firms? The reply could shock you.

Berkshire’s unrealized beneficial properties in Apple are an enormous motive for its gross sales

Buffett is a worth investor, however he is additionally one to carry on to a inventory if it is successful. This is a superb technique, and it is one which many ought to emulate. Nonetheless, there’s one downside: taxes.

If an investor has held a inventory for greater than a yr, any revenue they make is taxed on the long-term capital beneficial properties charge. For particular person traders, this maxes out at 20%, relying in your earnings. For companies, it is a flat 21%. Which means for each greenback in revenue that Berkshire makes from Apple inventory, $0.21 goes to the U.S. authorities.

In Berkshire Hathaway’s annual assembly in 2024, Buffett talked about that they do not thoughts paying taxes, however it sees the writing on the wall. Buffett talked about that the speed was 35% not way back and as excessive as 52% earlier in his profession. After wanting on the present political surroundings, he would not see these taxes lowering, and most certainly they may enhance.

In the newest State of the Union Handle, President Joe Biden known as for elevating the company earnings tax charge to twenty-eight%, so Buffett’s evaluation appears legitimate.

In consequence, Berkshire is taking motion and capturing a few of these beneficial properties earlier than it is pressured to pay increased taxes.

Throughout the assembly, Buffett reiterated just a few instances that Apple would stay its largest holding even when it continued to promote inventory. Nonetheless, I do not assume promoting Apple inventory is a foul concept, particularly after the quarter it simply posted.

Buffett could also be promoting for taxes, however chances are you’ll wish to promote for a unique motive

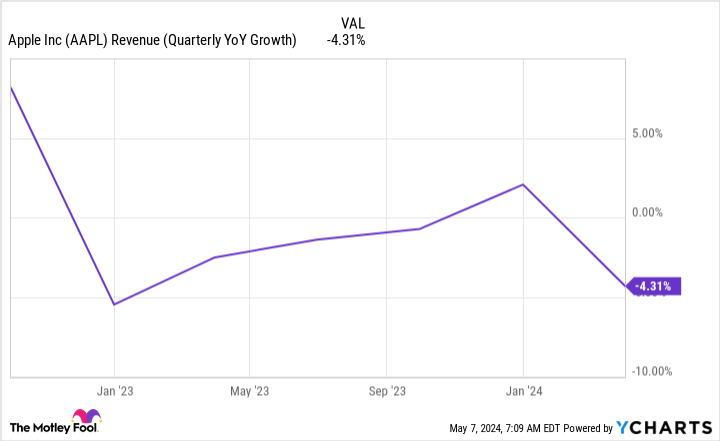

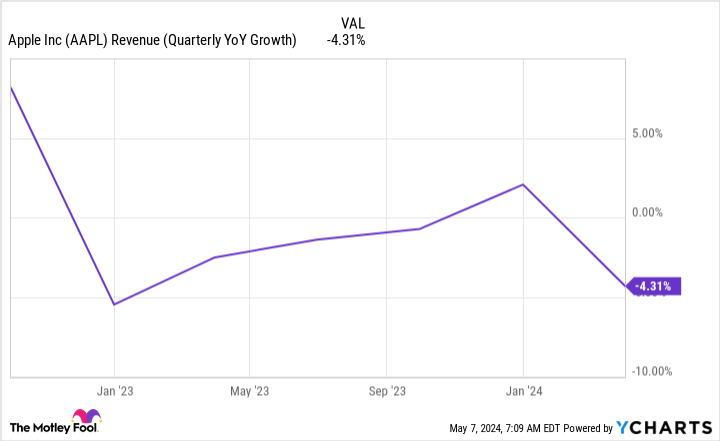

Apple’s enterprise isn’t what it as soon as was. Customers aren’t upgrading their merchandise as typically, and Apple has struggled to launch a brand new hit product. The Apple Imaginative and prescient Professional digital actuality headset, for instance, is not flying off the Apple Retailer cabinets. iPhone gross sales are sliding, too. In consequence, Apple’s income fell from $94.8 billion within the second quarter of fiscal yr 2023 to $90.8 billion (ending March 30) in FY 2024. This decline is only a continuation of a sample that has been current for the reason that begin of 2023.

Regardless of that, Apple has managed to enhance its gross revenue, which trickled all the way down to the underside line, and has saved earnings per share (EPS) flat in comparison with final yr.

It is clear that Apple’s core enterprise (in addition to its providers division) is struggling, however Apple’s administration is a world-class crew, so the enterprise’ income do not replicate these struggles.

Regardless of that, Apple’s inventory nonetheless trades for a premium valuation: 28 instances ahead earnings.

With the S&P 500 index buying and selling at a a lot much less dear 21 instances ahead earnings, it is clear the market nonetheless holds Apple in excessive esteem.

I am much less satisfied, and till Apple’s core enterprise begins enhancing, I do not wish to be anyplace close to the inventory.

Do you have to make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Apple wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $543,758!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 6, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple and Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

Buffett Is Promoting Apple Inventory. The Purpose Why Is Eye-Opening. was initially printed by The Motley Idiot