The Nasdaq-100 Expertise Sector index has been in fantastic type previously 12 months, clocking spectacular beneficial properties of fifty%, as among the key elements of this index have witnessed a red-hot rally due to the proliferation of synthetic intelligence (AI).

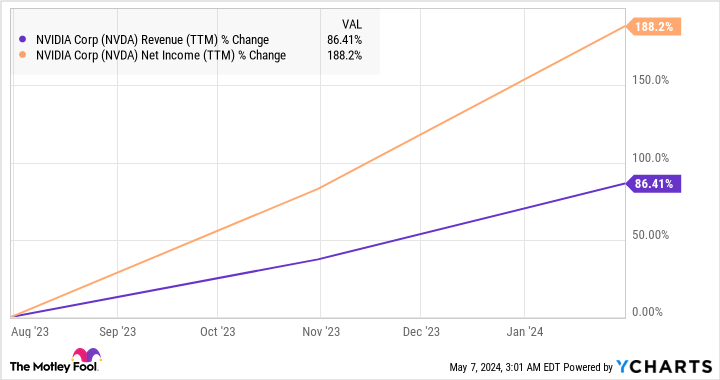

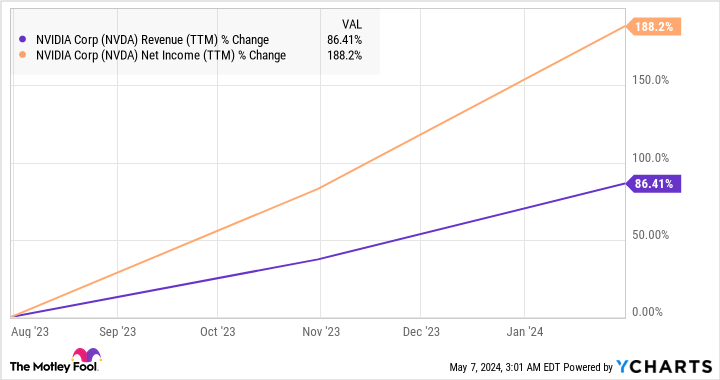

Shares of Nasdaq-100 part Nvidia (NASDAQ: NVDA), as an example, have shot up 221% previously 12 months. The chipmaker’s terrific rally is justified by its excellent development. Nvidia’s monopoly-like place available in the market for AI chips — the place it holds 95%-plus market share in line with some estimates — has supercharged the corporate’s high and backside traces, which is obvious from the chart under.

What’s extra, analysts predict Nvidia’s earnings to extend at a wholesome annual price of 38% over the subsequent 5 years. Based mostly on Nvidia’s earnings of $12.96 per share within the not too long ago concluded fiscal 2024, its backside line may bounce to virtually $65 per share after 5 years, in line with analyst estimates.

Even when Nvidia trades at 30 instances earnings after 5 years, in keeping with the Nasdaq-100’s earnings a number of, its inventory value may bounce to $1,950. That might be a 112% bounce from present ranges.

Nevertheless, Nvidia is not the one inventory that is successful huge from the fast adoption of AI. There are two different Nasdaq shares which might be profiting from the AI alternative and so they may ship extra upside than Nvidia over the subsequent 5 years.

1. Tremendous Micro Pc

Tremendous Micro Pc (NASDAQ: SMCI) inventory has outperformed Nvidia previously 12 months with beautiful beneficial properties of 505%. Supermicro, which is thought for manufacturing AI server options, can proceed to outperform Nvidia over the subsequent 5 years, due to the fast-growing promote it operates in.

Supermicro’s servers are deployed by knowledge middle operators to mount chips from the likes of Nvidia and different chipmakers, which retains their working prices in test. Supermicro’s modular server options intention to decrease electrical energy and cooling prices in knowledge facilities.

As an illustration, Supermicro launched liquid-cooled server options for deploying Nvidia’s massively in style H100 chips in Might final 12 months, claiming that they’ll cut back electrical energy prices in knowledge facilities by 40%. Moreover, Supermicro claims that its liquid-cooled H100 servers may cut back cooling prices by 86% when in comparison with current knowledge facilities.

Contemplating the numerous quantity of electrical energy that AI knowledge facilities eat, the demand for Supermicro’s servers is booming. This explains why the corporate’s income and earnings grew remarkably within the earlier quarter. Tremendous Micro’s fiscal 2024 third-quarter income (for the three months ended March 31) tripled 12 months over 12 months to $3.85 billion. Its earnings jumped fourfold to $6.65 per share.

Supermicro’s full-year steering now requires income to extend 110% 12 months over 12 months to $14.9 billion on the midpoint. Earnings are anticipated to leap to $23.69 per share from $11.81 per share in the identical interval final 12 months. Even higher, analysts predict its earnings to extend at an annual price of 62% for the subsequent 5 years.

That will not be stunning as the marketplace for AI servers is predicted to clock annual development of 30% over the subsequent decade. Supermicro is rising sooner than the promote it serves, which explains why analysts predict its earnings development to stay strong. Assuming the corporate’s backside line does develop at 60% a 12 months for the subsequent 5 years, its earnings may hit $124 per share after 5 years.

Multiplying the projected earnings with the Nasdaq-100’s earnings a number of of 30 factors towards a inventory value of $3,720 after 5 years, a 348% bounce from present ranges. Even when development charges taper off, Supermicro nonetheless has a greater development likelihood than Nvidia. So, Supermicro seems like a strong various to Nvidia for buyers seeking to purchase an AI inventory proper now, provided that it appears able to outperforming the latter over the subsequent 5 years.

2. Meta Platforms

Meta Platforms (NASDAQ: META) is one other tech large that is capitalizing on the adoption of AI. The social media bellwether has been integrating AI instruments into its totally different platforms and can be leveraging the expertise to assist advertisers enhance returns on their spending.

CEO Mark Zuckerberg defined Meta’s AI initiatives intimately on the corporate’s first-quarter earnings convention name final month. He claimed that the corporate’s generative AI assistant, Meta AI, has been tried by “tens of tens of millions of individuals,” and it is going to be rolled out in additional nations and languages sooner or later.

Meta AI is being built-in into WhatsApp, Fb, Messenger, and Instagram. From permitting creators to generate high-quality photos to enabling companies to counsel merchandise for patrons, Meta Platforms is setting itself as much as monetize its AI choices in the long term. In line with Zuckerberg:

On the upside, as soon as our new AI providers attain scale, we have now a robust monitor report of monetizing them successfully. There are a number of methods to construct a large enterprise right here, together with scaling enterprise messaging, introducing advertisements or paid content material into AI interactions, and enabling individuals to pay to make use of greater AI fashions and entry extra compute. And on high of these, AI is already serving to us enhance app engagement which naturally results in seeing extra advertisements, and enhancing advertisements on to ship extra worth.

The excellent news for buyers is that Meta’s AI choices are giving the corporate’s development a pleasant increase. Its income elevated 27% 12 months over 12 months within the first quarter of 2024 to $36.4 billion. Earnings, in the meantime, shot up a powerful 114% 12 months over 12 months to $4.71 per share. Meta ought to have the ability to maintain a wholesome earnings development price in the long term because it begins monetizing extra of its AI choices.

Analysts are presently anticipating the corporate’s earnings to extend at an annual price of 28% over the subsequent 5 years, which might be a pleasant bounce over the 11% annual earnings development it has clocked previously 5 years. Utilizing its 2023 earnings of $14.87 per share as the bottom, Meta’s backside line may bounce to $51 per share in 5 years based mostly on the potential earnings development that analysts anticipate it to ship.

Multiplying that with the Nasdaq-100’s earnings a number of of 30 factors towards a inventory value of $1,530 after 5 years, a 229% bounce from present ranges. On condition that the inventory is buying and selling at 27 instances earnings proper now, buyers are getting a great deal on this Nasdaq inventory that appears able to outperforming Nvidia in the long term.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $550,688!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 6, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Meta Platforms and Nvidia. The Motley Idiot has a disclosure coverage.

2 Nasdaq Shares That Might Crush Nvidia and Ship Larger Positive aspects, Because of Synthetic Intelligence (AI) was initially printed by The Motley Idiot