Know-how shares have been in fantastic kind up to now 12 months, which is clear from the 50% good points clocked by the Nasdaq-100 Know-how Sector index throughout this era. However not all tech shares have benefited from the broader market’s surge. Fortinet (NASDAQ: FTNT) is considered one of them.

Shares of the cybersecurity firm are down 11% up to now 12 months, and the newest quarterly outcomes (for the primary quarter of 2024) have not helped issues, both. Let’s have a look at why that was so, earlier than taking a better take a look at the catalysts that would assist Fortinet regain its mojo.

Fortinet traders are fearful about its tepid progress

First-quarter income elevated simply 7% 12 months over 12 months to $1.35 billion, whereas its adjusted web revenue was up 26% to $0.43 per share. The numbers exceeded Wall Avenue’s outlook as analysts had been anticipating Fortinet to ship $0.38 per share in earnings on income of $1.34 billion. The issue, nonetheless, was with Fortinet’s billings throughout the quarter.

Billings fell simply over 6% from the year-ago interval to $1.41 billion final quarter, lacking the $1.43 billion consensus estimate. Administration identified that “billings drive present and future income” and that the metric is “an necessary indicator of the well being and viability of our enterprise.” So, the contraction within the firm’s billings does not bode nicely, and this explains why Fortinet inventory fell after the outcomes had been launched.

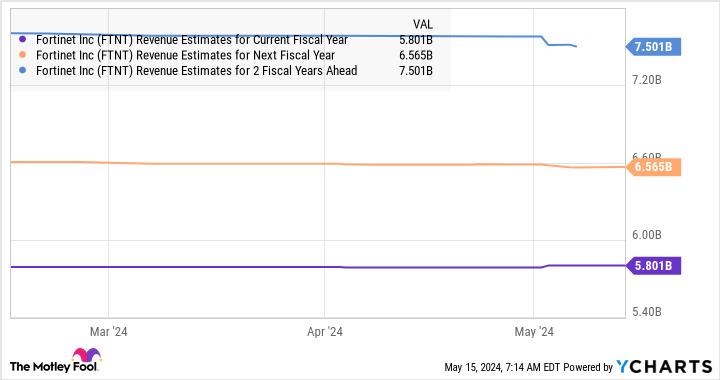

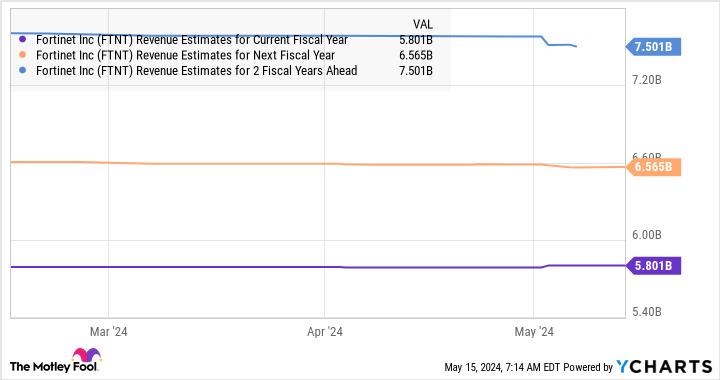

Furthermore, Fortinet’s steering for flat billings in 2024 versus the 14% progress it registered final 12 months has additional added to the unfavourable investor sentiment. This explains why the corporate’s top-line progress is anticipated to decelerate remarkably this 12 months. Fortinet’s income steering of $5.8 billion for this 12 months factors towards a rise of simply 9% from final 12 months. For comparability, the corporate’s prime line jumped 20% in 2023 to $5.3 billion.

In all, it’s simple to see why traders have pressed the panic button and the inventory has been underperforming. Nonetheless, there have been a couple of optimistic takeaways final quarter that would assist speed up progress as soon as once more. Let’s take a better take a look at them.

A give attention to generative AI may give the corporate’s progress a lift

The appearance of generative synthetic intelligence (AI) goes to have an enormous influence on the cybersecurity trade in the long term. In accordance with Bloomberg Intelligence, generative AI cybersecurity spending is anticipated to develop from simply $9 million in 2022 to $3.2 billion in 2027. By 2032, the dimensions of that market may soar to nearly $14 billion.

Firms which can be already providing generative AI-based cybersecurity have been rising at a terrific tempo. The market is at present in its early phases of progress, and it’s anticipated to clock an annual progress fee of 109% by means of 2032. So, it isn’t too late for Fortinet to leap into this market.

The corporate launched its FortiAI generative AI cybersecurity assistant final 12 months, and not too long ago added a number of updates to the platform to assist safety analysts bolster the cyber defenses of their organizations and speed up risk detection and evaluation.

Administration says that FortiAI is “being deployed throughout each networking and safety merchandise,” and the corporate’s companions and prospects have expressed their curiosity in its generative AI.

As Fortinet continues to roll out these instruments throughout its platform and extra prospects begin adopting them, the corporate may witness an acceleration in progress. This in all probability explains why analysts expect income progress to enhance over the subsequent couple of years following this 12 months’s flat efficiency.

The inventory is at present buying and selling at 8.6 instances gross sales, which is a reduction to its five-year common gross sales a number of of 10.5. Assuming its progress accelerates, it will not be shocking to see the inventory approaching its five-year common gross sales a number of sooner or later. So if Fortinet’s prime line certainly hits $7.5 billion in 2026 and its gross sales a number of hits 10, the corporate’s market cap may soar to $75 billion.

That may be a 63% enhance from present ranges, indicating that this cybersecurity inventory may ship wholesome good points over the subsequent three years because of catalysts akin to AI. Contemplating that it’s buying and selling at a comparatively cheaper stage proper now than the place it was earlier than, traders would do nicely to purchase Fortinet whereas it’s overwhelmed down because it appears able to flying greater in the long term.

Must you make investments $1,000 in Fortinet proper now?

Before you purchase inventory in Fortinet, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Fortinet wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $566,624!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 13, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Fortinet. The Motley Idiot has a disclosure coverage.

1 Inventory Down 11% to Purchase Earlier than Synthetic Intelligence (AI) Might Supercharge Its Development and Ship It Hovering was initially printed by The Motley Idiot